Get the free Two investments in one Mutual fund growth potential and the

Show details

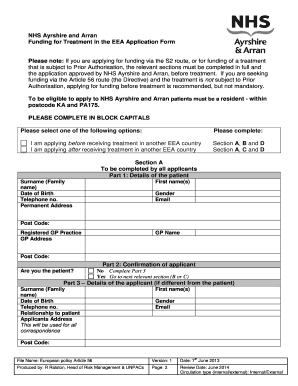

This document provides detailed information about the Scotia Dividend Fund GIC, including its investment structure, potential returns, terms, and conditions.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign two investments in one

Edit your two investments in one form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your two investments in one form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit two investments in one online

Follow the guidelines below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit two investments in one. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out two investments in one

How to fill out two investments in one:

01

Research and analyze the potential investments: Start by identifying two investment opportunities that align with your financial goals and risk tolerance. Conduct thorough research on each investment, examining factors such as historical performance, projected returns, and market trends. Utilize various resources such as financial publications and online investment platforms to gather information.

02

Determine your desired allocation: Decide how much capital you want to allocate to each investment. Consider factors such as expected returns, risk levels, and your overall investment strategy. Assess whether you want to distribute the investments equally or assign a higher proportion to one over the other.

03

Consider diversification: Assess the correlation between the two investments. If they are highly correlated, their performance may move in tandem, minimizing the potential benefits of diversification. On the other hand, if they are uncorrelated or negatively correlated, combining them in one portfolio can help reduce overall risk. Evaluate how the inclusion of both investments affects the overall diversification of your portfolio.

04

Monitor and adjust: Once you have successfully filled out the two investments in one, it is essential to monitor their performance regularly. Stay informed about any news or developments that may impact the investments. Review and rebalance your portfolio periodically to ensure it remains aligned with your financial objectives.

Who needs two investments in one:

01

Investors seeking diversification: Combining two different investments in one can help reduce the risk associated with relying solely on a single asset. By diversifying their portfolio with multiple investments, investors can potentially lower the impact of market fluctuations and increase the chances of achieving their financial goals.

02

Investors with varying investment objectives: Sometimes, investors may have different investment objectives that are not met by a single investment. For example, one investment may aim for long-term growth, while the other may focus on generating regular income. By combining these investments, investors can align their portfolio with their diverse objectives, allowing for a more holistic investment strategy.

03

Experienced investors with a higher risk tolerance: Experienced investors who have a higher risk tolerance may consider combining multiple investments in one to maximize potential returns. They may be more comfortable managing a portfolio with different types of assets and have the knowledge and expertise to analyze and monitor multiple investments effectively.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit two investments in one from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including two investments in one, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I make changes in two investments in one?

With pdfFiller, it's easy to make changes. Open your two investments in one in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I complete two investments in one on an Android device?

Use the pdfFiller app for Android to finish your two investments in one. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is two investments in one?

Two investments in one refers to a financial strategy or product that combines two separate investments into a single offering, providing investors with the benefits of both investments in a streamlined manner.

Who is required to file two investments in one?

Individuals or entities who have chosen to invest in a financial product or strategy that combines two separate investments into one are required to file two investments in one.

How to fill out two investments in one?

To fill out two investments in one, you need to provide the necessary information regarding the two investments being combined, including investment amounts, types of investments, and any additional details required by the specific financial institution or regulatory body.

What is the purpose of two investments in one?

The purpose of two investments in one is to provide investors with a simplified approach to diversifying their portfolios and capturing the benefits of multiple investments in a single offering.

What information must be reported on two investments in one?

When filing two investments in one, you must report information such as the investment amounts, types of investments being combined, any associated fees or charges, and any other relevant details specified by the financial institution or regulatory body.

Fill out your two investments in one online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Two Investments In One is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.