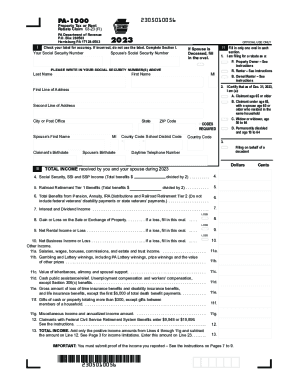

Get the free Limitation on Benefits (LOB)

Show details

This document serves as a certification for clients, allowing them to claim a reduced rate of withholding on U.S. source income under the Canada-U.S. Income Tax Convention, contingent on meeting specific

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign limitation on benefits lob

Edit your limitation on benefits lob form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your limitation on benefits lob form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing limitation on benefits lob online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit limitation on benefits lob. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out limitation on benefits lob

How to fill out Limitation on Benefits (LOB)

01

Obtain the Limitation on Benefits (LOB) form from the relevant tax authority or official website.

02

Review the instructions provided with the form carefully.

03

Fill out your entity's basic information, such as name, address, and tax identification number.

04

Specify the type of entity (e.g., corporation, partnership) and the country of residence.

05

Indicate the nature of income that is eligible for the benefits under the tax treaty.

06

Provide evidence of satisfying the LOB tests applicable to your situation, such as ownership and base erosion tests.

07

Review the completed form for accuracy and completeness.

08

Submit the LOB form along with any required documents to the corresponding tax authority.

Who needs Limitation on Benefits (LOB)?

01

Entities or individuals claiming tax treaty benefits to avoid double taxation.

02

Foreign businesses receiving income from U.S. sources or vice versa.

03

Taxpayers looking to comply with tax regulations to ensure they qualify for preferential tax rates.

Fill

form

: Try Risk Free

People Also Ask about

What is a simplified limitation on benefits?

The Simplified Limitation on Benefits Provision shall apply in place of or in the absence of provisions of a Covered Tax Agreement that would limit the benefits of the Covered Tax Agreement (or that would limit benefits other than a benefit under the provisions of the Covered Tax Agreement relating to residence,

Do treaty benefits expire?

Form 8233 & W-9 tax treaties apply for the calendar year, unless the treaty terms has an earlier expiration and you must renew each year.

What is the US UK tax treaty limitation on benefits?

The US-UK Treaty's Limitation on Benefits provision is in Article 23. It generally provides that an other- wise eligible US or UK tax resident will be unable to qualify for benefits under the US-UK Treaty if it can- not satisfy the Limitation on Benefits requirements. A specified charitable entity.

What does lob mean in tax?

LOB (Limitation on Benefits) clauses are provisions included in tax treaties between countries to prevent treaty shopping. Treaty shopping occurs when a person or entity from a third country attempts to benefit from a tax treaty between two other countries, often to avoid or reduce tax liabilities.

What is a limitation on benefits?

A Limitation on Benefits (LOB) clause is a provision commonly embedded in a tax treaty to curb treaty shopping by ensuring that only legitimate residents of the contracting states can enjoy the treaty's benefits.

How do I know if I qualify for US tax treaty benefits?

To qualify for treaty exemption, you must be a citizen or a permanent resident (generally, a noncitizen who files a resident income tax return) of the "treaty country," and the type of payment must be exempt under that specific treaty.

What is the limitation on benefits statement?

The Limitation on Benefits (“LOB”) Article, found in Section XXIX-A of the Treaty defines the clients who can sign the above statement. By signing the above statement, a client certifies that such client is a “qualifying person” as set forth in Article XXIX-A of the Treaty.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Limitation on Benefits (LOB)?

Limitation on Benefits (LOB) is a provision within tax treaties that aims to prevent entities from obtaining treaty benefits unless they meet certain requirements, specifically designed to limit the benefit of reductions in withholding tax rates to bona fide residents of a contracting country.

Who is required to file Limitation on Benefits (LOB)?

Entities and individuals who seek to claim reduced withholding tax rates under a tax treaty are required to file the Limitation on Benefits (LOB) provisions. Typically, this includes corporations, partnerships, and trusts, especially if they receive income from the other contracting country.

How to fill out Limitation on Benefits (LOB)?

To fill out the Limitation on Benefits (LOB), taxpayers must complete the relevant forms provided by tax authorities, detailing their eligibility for treaty benefits. This includes providing information about the residency, ownership, and structure of the entity claiming benefits, as well as any other required supporting documentation.

What is the purpose of Limitation on Benefits (LOB)?

The purpose of Limitation on Benefits (LOB) is to prevent tax avoidance and treaty abuse by ensuring that only genuine residents of the treaty countries can benefit from reduced withholding taxes and other favorable tax provisions.

What information must be reported on Limitation on Benefits (LOB)?

The information that must be reported on Limitation on Benefits (LOB) includes the entity's country of residency, types of income received, details about ownership and control, and evidence of substantial business operations or presence in the resident country, depending on the specific requirements of the applicable tax treaty.

Fill out your limitation on benefits lob online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Limitation On Benefits Lob is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.