Get the free Planned Giving Group of Connecticut c/o CAMI 411 Waverly Oaks Road Suite 331 B Walth...

Show details

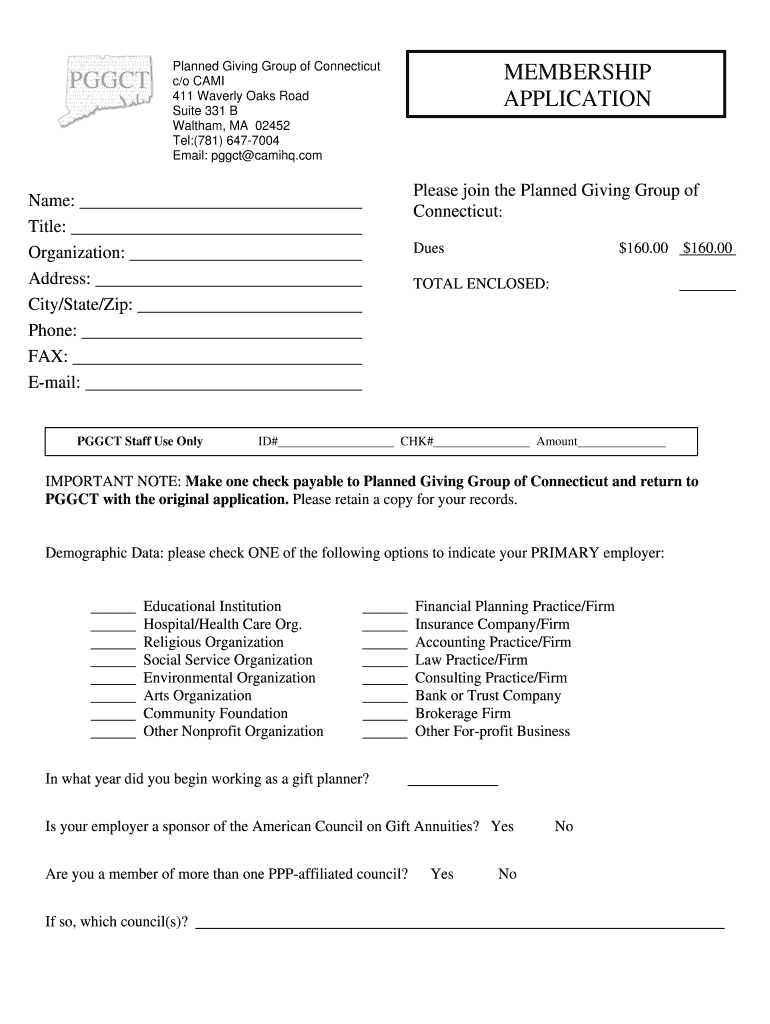

Planned Giving Group of Connecticut c×o CAME 411 Waverley Oaks Road Suite 331 B Waltham, MA 02452 Tel:(781× 6477004 Email: pact camihq.com MEMBERSHIP APPLICATION Please join the Planned Giving Group

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign planned giving group of

Edit your planned giving group of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your planned giving group of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing planned giving group of online

Follow the steps below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit planned giving group of. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out planned giving group of

How to fill out a planned giving group:

01

Start by gathering all relevant information about your planned giving intentions. This includes details about your assets, financial goals, and any specific organizations or causes you wish to support.

02

Research different planned giving options that align with your goals. There are several ways you can make a planned gift, such as a bequest in your will, a charitable trust, or a gift annuity. Understand the tax implications and benefits associated with each option.

03

Consider consulting with a financial advisor or an attorney who specializes in estate planning. They can provide valuable guidance and help you navigate through the complexities of planned giving.

04

Contact the organizations or institutions that you intend to support through your planned giving. They may have specific forms or guidelines to follow when making a planned gift. Request any necessary information or documentation from them.

05

Fill out the required forms accurately and completely. Make sure to include all the necessary information, such as your personal details, the type of gift you are making, and any specific instructions or restrictions you may have. Provide any supporting documents or legal instruments as required.

06

Review and double-check your completed forms for any errors or omissions. It is crucial to ensure the accuracy of your planned giving documentation to avoid any complications or misunderstandings in the future.

07

If applicable, submit your completed forms to the relevant organizations or institutions. Follow their instructions regarding submission methods and any additional steps required.

08

Keep copies of all the documents related to your planned giving group for your records. It's essential to have a clear paper trail of your intentions and any agreements made.

09

Periodically review your planned giving group and update it as necessary. Life circumstances and financial goals may change over time, so it's important to reassess your planned giving strategy to ensure it aligns with your current wishes.

10

Consider communicating your planned giving intentions with your loved ones and professional advisors. This can help ensure that your wishes are understood and properly executed when the time comes.

Who needs a planned giving group:

01

Individuals who have a desire to support specific organizations or causes through their estate planning.

02

Those who want to leave a lasting legacy by making a significant charitable contribution after their lifetime.

03

People who seek to maximize the impact of their charitable giving while also taking advantage of potential tax benefits.

04

Individuals who want to align their personal values and philanthropic goals with their overall financial and estate planning strategies.

05

Those who wish to provide ongoing support to organizations or institutions they care about even after they are no longer able to actively contribute.

06

People who want to ensure that their hard-earned assets are used according to their wishes and help make a difference in areas they are passionate about.

07

Individuals who want to explore different giving options and financial planning strategies that can benefit both themselves and their chosen charitable beneficiaries.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the planned giving group of electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your planned giving group of in minutes.

Can I edit planned giving group of on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share planned giving group of on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

How do I complete planned giving group of on an Android device?

On an Android device, use the pdfFiller mobile app to finish your planned giving group of. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is planned giving group of?

Planned giving group refers to a group of donors who have committed to leaving a gift to a non-profit organization in their will or estate plan.

Who is required to file planned giving group of?

Non-profit organizations are required to maintain records of planned giving group donors and report this information to the IRS.

How to fill out planned giving group of?

To fill out planned giving group information, non-profit organizations should collect data on donors who have pledged to leave a gift in their will or estate plan.

What is the purpose of planned giving group of?

The purpose of planned giving group is to acknowledge and honor donors who have made a commitment to support the organization in the future.

What information must be reported on planned giving group of?

Non-profit organizations must report the names of planned giving group donors, the amount of the planned gift, and any specific conditions attached to the gift.

Fill out your planned giving group of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Planned Giving Group Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.