Get the free REQUEST FOR MORTGAGE FUNDS

Show details

This document is a request for disbursement of mortgage funds, detailing required information and instructions for the notary and the bank.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign request for mortgage funds

Edit your request for mortgage funds form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your request for mortgage funds form via URL. You can also download, print, or export forms to your preferred cloud storage service.

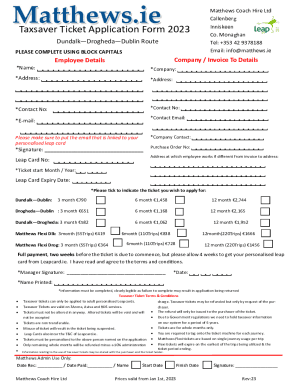

How to edit request for mortgage funds online

To use the services of a skilled PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit request for mortgage funds. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out request for mortgage funds

How to fill out REQUEST FOR MORTGAGE FUNDS

01

Begin by obtaining the REQUEST FOR MORTGAGE FUNDS form from your lender or financial institution.

02

Fill out the borrower's personal information, including name, address, and contact details.

03

Provide details about the property for which you are requesting mortgage funds, including the address and type of property.

04

Specify the loan amount you are requesting and any relevant loan numbers associated with the transaction.

05

Include any additional information required by the lender, such as income verification or credit history.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form, acknowledging that the information provided is truthful.

08

Submit the form to your lender according to their specified submission process, which may include online submission, email, or physical mail.

Who needs REQUEST FOR MORTGAGE FUNDS?

01

Homebuyers seeking financing to purchase property.

02

Property owners looking to refinance their mortgage.

03

Investors acquiring rental properties requiring mortgage funding.

04

Individuals needing funds for home improvements with a mortgage as collateral.

Fill

form

: Try Risk Free

People Also Ask about

How do I ask for a mortgage loan?

You'll need to select a lender and complete an application. Depending on the lender, you may be able to apply in person, by phone or online. All lenders require you to provide information about yourself and anyone else, such as a spouse or partner, who will be listed as a co-borrower on the mortgage.

What is the 2% rule for mortgage payoff?

The 2% rule for a mortgage payoff involves refinancing your mortgage. Refinancing is when you take out a new loan to pay off your existing loan — ideally at a lower interest rate. The 2% rule states that you should aim for a new refinanced rate that is 2% lower than your current rate on the existing mortgage.

When to request mortgage funds?

Solicitor Requesting Mortgage Funds: A solicitor typically requests mortgage funds from the lender a few days before the completion date of the property purchase, often around 5-7 working days in advance, to ensure the funds are available for the transaction.

Who requests mortgage funds?

Solicitor Requesting Mortgage Funds: A solicitor typically requests mortgage funds from the lender a few days before the completion date of the property purchase, often around 5-7 working days in advance, to ensure the funds are available for the transaction.

How do I write a letter for a mortgage?

How to Write a Letter of Explanation Choose a Business Letter Format. Write a Clear Subject Line. Explain Your Situation Clearly and Honestly. Provide Supporting Documents. Reaffirm Your Current Financial Stability. Thank the Lender for Their Consideration.

At what stage do solicitors ask for proof of funds?

Proof of funds must be provided and verified as part of the anti-money laundering checks. Your solicitor will conduct these checks at the beginning of the conveyancing process. This will prove that the funds you are using are safe and legitimate. It'll also confirm you can afford the property and how you can afford it.

How long does it take to request mortgage funds?

While the process and timeframe for releasing mortgage funds, plus what happens on the completion date, can vary, it's typical for the funds to take around 3 to 7 days to be released, especially if all paperwork necessary is ready and filed.

What is a mortgage request?

A mortgage application is a form requesting to borrow a loan to buy a home or refinance an existing mortgage, typically completed by the prospective borrower or the mortgage loan officer. This form covers all aspects of the borrower's finances, as well as the property attached to the loan.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

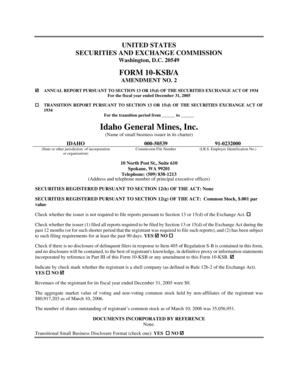

What is REQUEST FOR MORTGAGE FUNDS?

A Request for Mortgage Funds is a formal document used by borrowers to request the disbursement of funds for a mortgage loan, typically at closing.

Who is required to file REQUEST FOR MORTGAGE FUNDS?

Borrowers or their representatives, such as real estate agents or mortgage brokers, are typically required to file a Request for Mortgage Funds.

How to fill out REQUEST FOR MORTGAGE FUNDS?

To fill out a Request for Mortgage Funds, you need to complete the provided form with relevant details such as borrower information, property address, loan amount, and the lender's details, ensuring all sections are accurately filled.

What is the purpose of REQUEST FOR MORTGAGE FUNDS?

The purpose of a Request for Mortgage Funds is to initiate the release of mortgage loan proceeds for property purchase or refinancing, ensuring that funds are available for closing transactions.

What information must be reported on REQUEST FOR MORTGAGE FUNDS?

Key information that must be reported includes the borrower's name, property address, loan amount requested, closing date, lender's name, and any additional conditions as specified by the lender.

Fill out your request for mortgage funds online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Request For Mortgage Funds is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.