Get the free CUSTOMER IDENTIFICATION POLICY - NRI/PIO

Show details

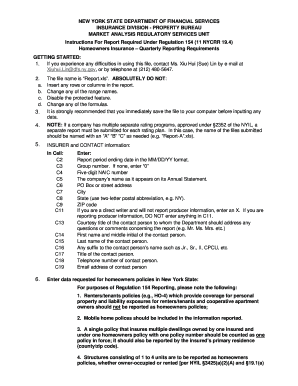

This document outlines the customer identification policy for Non-Resident Indians (NRI) and Persons of Indian Origin (PIO) at AXIS Bank, detailing the required documentation to establish identity,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign customer identification policy

Edit your customer identification policy form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your customer identification policy form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit customer identification policy online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit customer identification policy. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

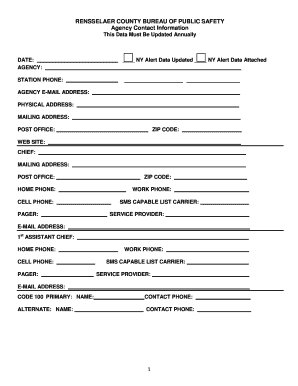

How to fill out customer identification policy

How to fill out CUSTOMER IDENTIFICATION POLICY - NRI/PIO

01

Gather required identification documents for the customer, such as passports, visa, and proof of address.

02

Ensure that the customer fills out the Customer Identification Form accurately.

03

Verify the authenticity of the identification documents provided by the customer.

04

Check the customer's background and status (NRI or PIO) according to relevant laws.

05

Store the completed Customer Identification Form and supporting documents securely and in compliance with applicable regulations.

06

Regularly update and review the information as necessary to ensure continued compliance.

Who needs CUSTOMER IDENTIFICATION POLICY - NRI/PIO?

01

Non-Resident Indians (NRI) looking to open bank accounts or invest in India.

02

Persons of Indian Origin (PIO) who wish to avail banking services in India.

03

Financial institutions that provide services to NRIs and PIOs to comply with regulations.

Fill

form

: Try Risk Free

People Also Ask about

What is Pio in RBI?

'Person of Indian Origin' (PIO) means a citizen of any country other than Bangladesh or Pakistan, if: He at any time held an Indian passport; He or either his parents or any of his grandparents was a citizen of India by virtue of the Constitution of India or the Citizenship Act, 1955.

Who gets Pio?

(i) the person at any time held an Indian passport; or (ii) the person or either of his/her parents or grand parents or great grand parents was born in, and was permanently resident in India, provided further that neither was at any time a citizen of any of the aforesaid excluded countries; or (iii) the person is the

Who are NRI and Poi?

NRIs are people who are citizens of India who live abroad whereas PIOs are people who have Indian parents, grandparents or an Indian spouse. An individual who spent 182 days in India for one year will be known as an Indian resident whereas PIO cardholders can visit India at any time and stay for 180 days in India.

What is NRI and poi?

Persons of Indian Origin (PIOs) refers to foreign citizens who have ancestral ties to India. Unlike non-resident Indians (NRIs), PIOs hold the citizenship and passport of their country of residence, not India. As foreign nationals, PIOs require a valid Indian visa for visiting the country.

Is OCI better than Pio?

An Overseas Citizen of India (OCI) is a foreign citizen of Indian origin who holds an OCI card. This category offers more long-term privileges compared to the previous PIO scheme. OCI status is not equivalent to dual citizenship, but it provides many benefits akin to those of Indian citizens.

What are KYC documents for NRI?

Documents needed to complete a KYC procedure include a recent photograph, documents to prove NRI/PIO status, PAN card copy, Aadhaar card copy, Indian and overseas address proof. For proof of NRI/PIO status, you can submit: Copy of passport. Copy of visa or work/residence permit.

What is the customer identification policy?

The purpose of CIPs is to establish a reasonable belief that the institution knows the identity of the customer, thereby preventing identity theft and fraud.

What is the meaning of poi in passport?

PERSON OF INDIAN ORIGIN (PIO) CARD. A Person of Indian Origin (PIO) means a foreign citizen (except a national of. Pakistan, Afghanistan Bangladesh, China, Iran, Bhutan, Sri Lanka and Nepal) who at any time held an Indian passport.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CUSTOMER IDENTIFICATION POLICY - NRI/PIO?

The CUSTOMER IDENTIFICATION POLICY - NRI/PIO is a framework designed to verify the identity of Non-Resident Indians (NRI) and Persons of Indian Origin (PIO) opening accounts or conducting financial transactions. It ensures compliance with regulatory requirements to prevent fraud and money laundering.

Who is required to file CUSTOMER IDENTIFICATION POLICY - NRI/PIO?

Financial institutions, banks, and other entities that engage with NRIs and PIOs must file the CUSTOMER IDENTIFICATION POLICY - NRI/PIO when they begin a business relationship with these customers.

How to fill out CUSTOMER IDENTIFICATION POLICY - NRI/PIO?

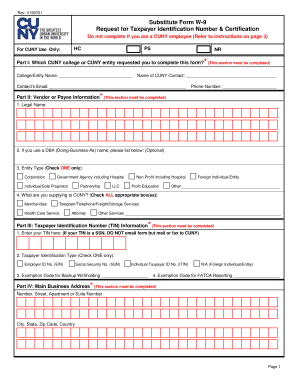

To fill out the CUSTOMER IDENTIFICATION POLICY - NRI/PIO, individuals need to provide personal information such as name, date of birth, nationality, passport details, present address, and permanent address in India, along with relevant identification documents for verification.

What is the purpose of CUSTOMER IDENTIFICATION POLICY - NRI/PIO?

The purpose of the CUSTOMER IDENTIFICATION POLICY - NRI/PIO is to ensure transparency in the identification process of NRIs and PIOs, to mitigate risks related to money laundering and financial fraud, and to comply with international and local laws.

What information must be reported on CUSTOMER IDENTIFICATION POLICY - NRI/PIO?

The information that must be reported includes the individual's full name, date of birth, nationality, passport number, date of issue and expiry of the passport, addresses (both residential and permanent), contact information, and any other relevant identification documents.

Fill out your customer identification policy online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Customer Identification Policy is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.