CO DoR 104PN 2009 free printable template

Show details

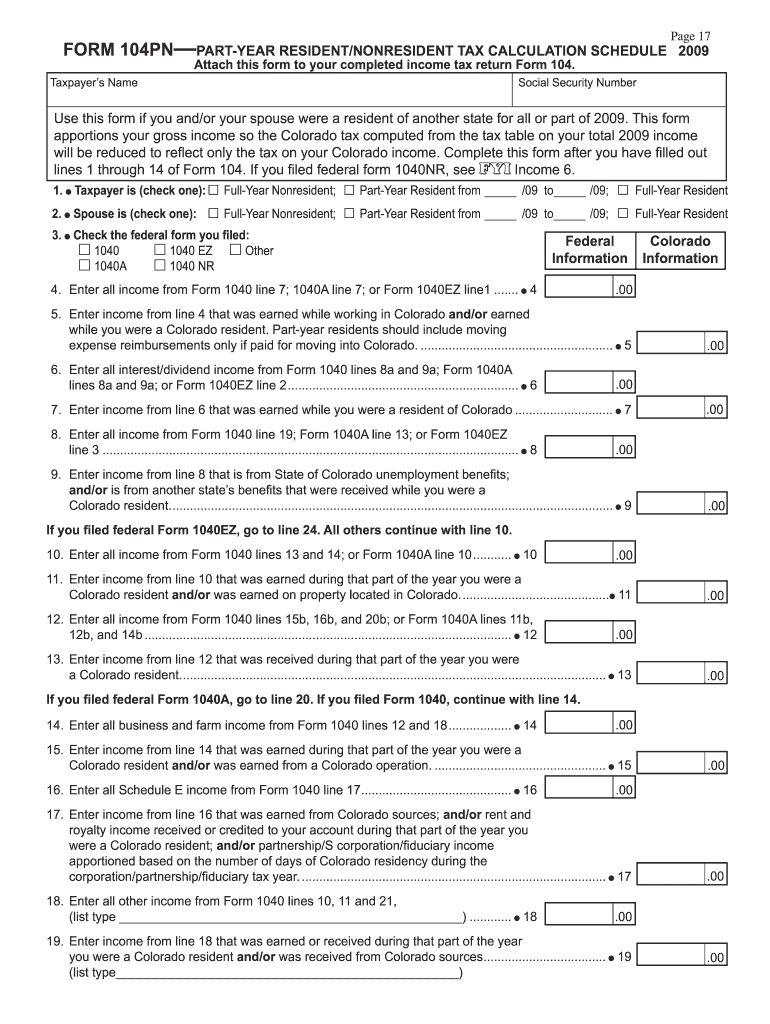

Page 17 FORM 104 IN?PART-YEAR RESIDENT/NONRESIDENT TAX Calculation SCHEDULE 2009 Attach this form to your completed income tax return Form 104. Taxpayer’s Name Social Security Number Use this form

pdfFiller is not affiliated with any government organization

Instructions and Help about CO DoR 104PN

How to edit CO DoR 104PN

How to fill out CO DoR 104PN

Instructions and Help about CO DoR 104PN

How to edit CO DoR 104PN

To edit the CO DoR 104PN Tax Form, you can utilize pdfFiller's tools that allow for easy editing and input of required information. First, upload the existing form to pdfFiller. You can then use the editing features to amend any sections as needed before saving the updated version. Make sure all changes are compliant with the requirements set forth by the Colorado Department of Revenue.

How to fill out CO DoR 104PN

Filling out the CO DoR 104PN Tax Form involves a series of steps. Begin by gathering necessary documents, such as income statements and identification numbers. Then, complete each section of the form accurately. If you are unsure about certain areas, refer to the instructions provided with the form or use pdfFiller's guidance tools. Double-check for accuracy before submitting.

About CO DoR 104PN 2009 previous version

What is CO DoR 104PN?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What payments and purchases are reported?

How many copies of the form should I complete?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About CO DoR 104PN 2009 previous version

What is CO DoR 104PN?

The CO DoR 104PN is a specific tax form used by the state of Colorado for reporting certain payments made to non-resident taxpayers. This form is significant for individuals or businesses based outside of Colorado who earn income within the state, as it ensures compliance with Colorado tax regulations.

What is the purpose of this form?

The primary purpose of the CO DoR 104PN Tax Form is to report specific income earned by non-residents. This includes payments for services performed or goods sold in Colorado. By submitting this form, non-residents can fulfill their tax obligations and provide the state with necessary financial information regarding their earnings.

Who needs the form?

The CO DoR 104PN form is required for non-resident individuals or entities that received specific types of payments in Colorado. This includes self-employed individuals, independent contractors, or businesses providing services that generate income subject to Colorado tax. If you are a non-resident earning income in Colorado, it is crucial to determine whether this form applies to you.

When am I exempt from filling out this form?

Individuals or businesses may be exempt from filing the CO DoR 104PN if they did not earn income in Colorado or if the income received falls below a specific threshold. For example, certain types of payments might be exempt based on the nature of the work performed or the amount received. It is important to verify your eligibility for exemption to avoid unnecessary filing.

Components of the form

The components of the CO DoR 104PN include fields for the taxpayer’s name, address, identification number, and detailed sections for reporting the type and amount of income earned. Each section is designed to capture specific information required by the Colorado Department of Revenue. Completing each component correctly is essential for accurate reporting.

Due date

The due date for submitting the CO DoR 104PN typically aligns with the filing deadlines for state income taxes. Generally, forms must be submitted by April 15 of the following year after income was earned. However, taxpayers should check current regulations as deadlines can be adjusted or extended under specific circumstances.

What payments and purchases are reported?

The CO DoR 104PN is used to report payments from various sources, including wages, contract work, rental income, and other service-related payments made to non-resident individuals or businesses. It is important to understand what qualifies under Colorado tax law to ensure all applicable income is reported accurately.

How many copies of the form should I complete?

Generally, you should complete one copy of the CO DoR 104PN for each tax year in which income was earned. However, if multiple income sources are reported, ensure each payment is documented on separate forms if required. Proper record-keeping is essential for compliance and potential audits.

What are the penalties for not issuing the form?

Not issuing the CO DoR 104PN can lead to penalties, including fines imposed by the Colorado Department of Revenue. Failure to report income accurately or missing the deadline may result in interest charges on unpaid taxes as well. It is advisable to file the form correctly to avoid these financial repercussions.

What information do you need when you file the form?

When filing the CO DoR 104PN, you will need your Social Security number or Employer Identification Number, details about the income earned in Colorado, and any withholding information relevant to the payments received. Collecting this information ahead of time facilitates a smoother filing process.

Is the form accompanied by other forms?

In some cases, the CO DoR 104PN may require accompanying documentation or additional forms related to income verification or withholding details. Review the instructions carefully to ensure you include any necessary supplementary forms to support your filing. This can prevent delays or rejections from the Colorado Department of Revenue.

Where do I send the form?

Once completed, the CO DoR 104PN should be sent to the Colorado Department of Revenue. Check the latest address on their website or the form instructions, as locations may change. Filing by mail or electronically is an option, depending on the state’s guidelines.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

It has been GREAT lots of forms to choose from and easy to fill out.

It works great, and here is all I neeed for my job. GOD BLESS YOU ALL. GOOD WOEK

See what our users say