Get the free FTB 3800

Show details

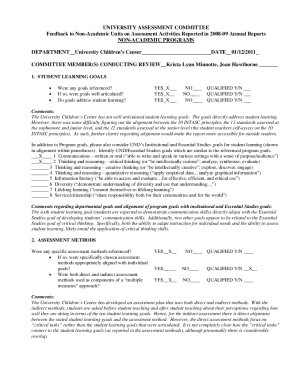

This form is used to calculate the tax for children under age 14 who have investment income exceeding $1,900, which is taxed at the parent's tax rate.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ftb 3800

Edit your ftb 3800 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ftb 3800 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ftb 3800 online

To use the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit ftb 3800. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ftb 3800

How to fill out FTB 3800

01

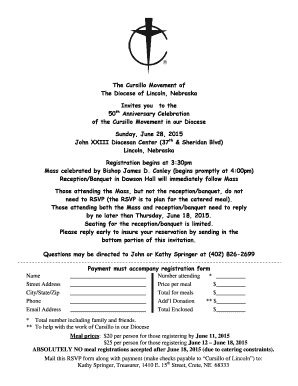

Obtain a copy of FTB 3800 form from the California Franchise Tax Board website.

02

Fill in your personal information, including your name and Social Security number.

03

Indicate the tax year for which you are filing the form.

04

Complete the sections regarding your business information and any relevant income details.

05

Follow the instructions for calculating any credits you may be eligible for.

06

Review the information you have filled out for accuracy.

07

Sign and date the form before submitting it.

Who needs FTB 3800?

01

Individuals or businesses claiming California state tax credits related to certain economic activities or investments.

02

Taxpayers seeking to report claims for the California Competes Tax Credit or other related incentives.

Fill

form

: Try Risk Free

People Also Ask about

How much is California franchise tax payment?

California LLC Annual Franchise Tax A California LLC, like all entities in California, must pay the state's annual Franchise Tax. This tax is $800 for all California LLCs. The annual Franchise Tax is due the 15th day of the fourth month after the beginning of the tax year. You must file Form 3522 (LLC Tax Voucher).

How much is the California LLC filing fee?

Starting an LLC in California – fees to file You'll pay two filing fees with your LLC application in California: $70 fee to file articles of organization with the California Secretary of State's office. $20 fee to file a Statement of Information, Form LLC-12, with the California Secretary of State.

What would require a taxpayer's child to have to file FTB form 3800?

Complete form FTB 3800 if all of the following apply: The child is under 19 or a full time student under the age of 24 at the end of 2024. The child had investment income taxable by California of more than $2,600. At least one of the child's parents was alive at the end of 2024.

How much is the IRS filing fee for 501c3?

The filing fee for Form 1024 is $600 with a processing time of 7-10 months. Taking these costs into account, you'll either pay $275 or $600. Let's go back to our graph and add these costs. For more information about each form check out our article on how to start a nonprofit.

What is California Form 3800 used for?

California Form 3800 is the Tax Computation for Certain Children with Unearned Income. For certain children, unearned income over $2,300 is taxed at the parent's rate if the parent's rate is higher. Based on the information you provided, your child does not have unearned income in California, just a summer internship.

What is the filing fee?

Filing fee is a charge by a state or federal government agency for processing documents and requests. Filing fees help cover the cost of reviewing the documents, storing them, and discourage unnecessary paper filings.

How much is the filing fee for the FTB 3500?

Application and Filing Fees for Exempt Organizations Beginning January 1, 2021, exempt organizations are no longer required to pay the $25 fee when submitting form FTB 3500 or the $10 annual information return filing fee for form FTB 199, California Exempt Organization Annual Information Return.

What is Form 3800 Turbotax?

Form 3800 is used to calculate the General Business Credit, which is a combination of over 30 “component” tax credits that have their own eligibility requirements and rules. Form 3800 is a complex form that's broken down into six separate parts.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is FTB 3800?

FTB 3800 is a form used by California taxpayers to claim the California Child and Dependent Care Expenses Credit and report the credit on their state income tax returns.

Who is required to file FTB 3800?

Taxpayers who claim the Child and Dependent Care Expenses Credit are required to file FTB 3800.

How to fill out FTB 3800?

To fill out FTB 3800, gather necessary information about your qualifying child or dependent care expenses, follow the instructions provided with the form, and input relevant data such as the amount of expenses incurred and the applicable credit calculation.

What is the purpose of FTB 3800?

The purpose of FTB 3800 is to facilitate the claiming of the Child and Dependent Care Expenses Credit, allowing taxpayers to reduce their taxable income based on qualifying care expenses.

What information must be reported on FTB 3800?

FTB 3800 requires the reporting of personal information, details about qualifying expenses, the number of qualifying individuals, and the calculated credit amount.

Fill out your ftb 3800 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ftb 3800 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.