Get the free 2011 Form IL-1040

Show details

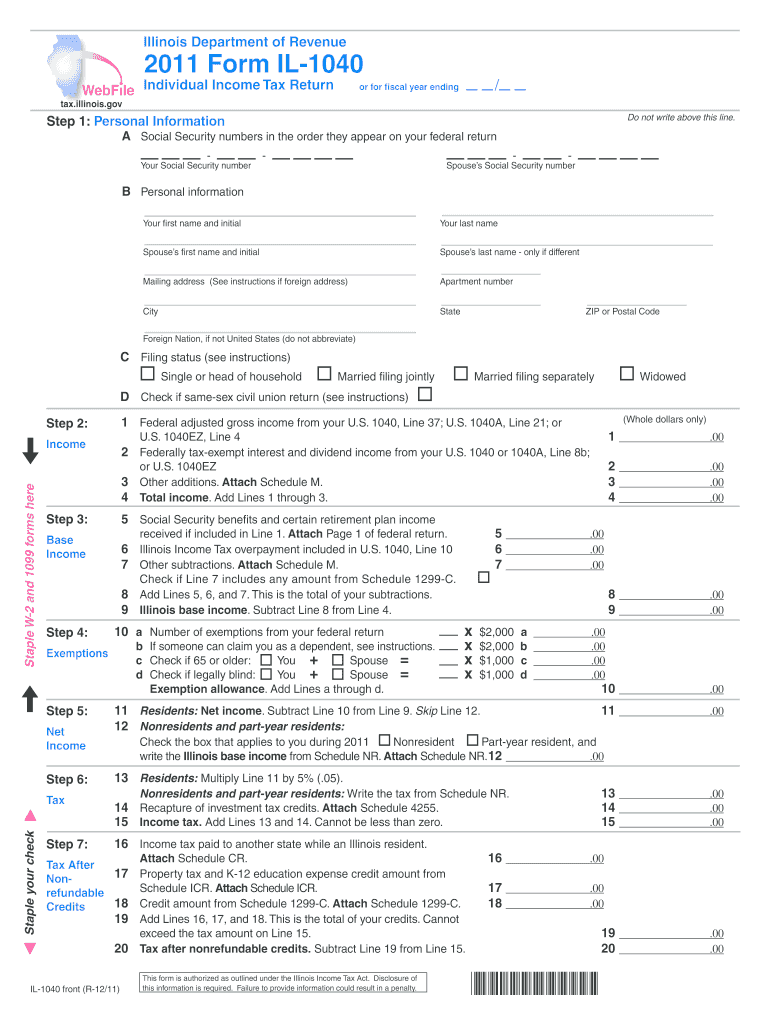

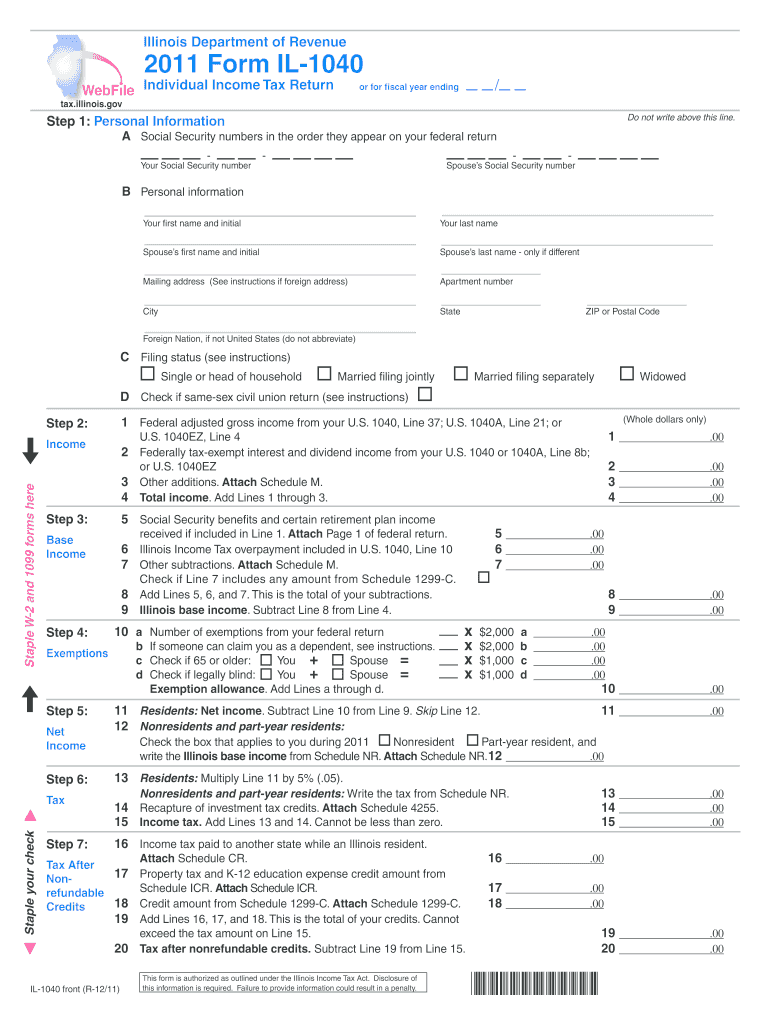

This form is used by individuals to file their income tax return in the state of Illinois for the year 2011.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2011 form il-1040

Edit your 2011 form il-1040 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2011 form il-1040 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2011 form il-1040 online

Follow the steps below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 2011 form il-1040. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2011 form il-1040

How to fill out 2011 Form IL-1040

01

Gather all necessary documents such as W-2s, 1099s, and any other income statements.

02

Download and print the 2011 Form IL-1040 from the Illinois Department of Revenue website.

03

Fill in your name, address, and Social Security number at the top of the form.

04

Enter your filing status, choosing from options like single, married filing jointly, etc.

05

Report your total income on the designated line.

06

Deduct any allowable exemptions and adjustments to calculate your taxable income.

07

Fill out the lines for your tax calculations, including any credits and payments.

08

Review the form for accuracy, ensuring all calculations are correct.

09

Sign and date the form before submission.

10

Mail the completed form to the appropriate address as indicated in the instructions.

Who needs 2011 Form IL-1040?

01

Individuals who are residents of Illinois and earned income during the tax year 2011.

02

Anyone who needs to report state income taxes for the year 2011.

03

People who are claiming refunds for overpayment or requesting credits applicable to their tax situation.

Fill

form

: Try Risk Free

People Also Ask about

Does Illinois allow itemized deductions?

Illinois does not use standard or itemized deductions in arriving at your taxable income. Instead, an exemption of $2,775 is allowed for Single, Head of Household, Widowed and Married Filing Separately filers; and $5,550 for those who are Married Filing Jointly.

Where can I file my Illinois tax return for free?

You can now use the IRS Direct File Program. Eligible Illinois taxpayers can file their 2024 federal returns directly with the IRS for free. Federal return information can then be transferred into MyTax Illinois, to free file Illinois individual income taxes.

Can you write off gambling losses in Illinois?

Unemployment compensation included in your federal adjusted gross income, except railroad unemployment, is fully taxable to Illinois. gambling losses. Illinois does not allow a deduction for gambling losses. your federal itemized deductions from U.S. 1040 Schedule A, Itemized Deductions.

Who needs to file an Illinois tax return?

If you lived in Iowa, Kentucky, Wisconsin, or Michigan and worked in Illinois you must file an Illinois tax return if: You received income from sources other than wages, salaries and tips. You want a refund of any Illinois tax withheld.

What is the tax on gambling in Illinois?

Tax on online sports betting Starting July 1, Illinois sportsbooks will pay $0.25 on the first 20 million online bets statewide annually, and then $0.50 on every bet after that.

How do I get an IL-1040?

If you have created a MyTax Illinois account, login to your account to view and print your return. If you filed your IL-1040 without creating a MyTax Illinois account, go to the MyTax Illinois home screen. Click the "Retrieve a return, application, or payment" button.

What is the Illinois exemption allowance?

This is different from a standard deduction, which is a fixed amount that reduces taxable income, available to all taxpayers regardless of dependents. For the 2024 tax year, Illinois offers a personal exemption allowance of $2,775 per individual, totaling $5,550 for married couples filing jointly.

What tax credits are available in Illinois?

These credits are usually claimed on Schedule 1299-C. Education Expense Credit. Invest in Kids Credit - Note: No new Invest in Kids credits may be awarded after December 31, 2023. Property Tax Credit. Volunteer Emergency Worker Credit. Credits that can be carried forward.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2011 Form IL-1040?

The 2011 Form IL-1040 is the individual income tax return form used by residents of Illinois to report their income and calculate their state income tax obligation for the tax year 2011.

Who is required to file 2011 Form IL-1040?

Individuals who were residents of Illinois during the tax year 2011 and had taxable income, as well as certain non-residents who earned income sourced from Illinois, are required to file the 2011 Form IL-1040.

How to fill out 2011 Form IL-1040?

To fill out the 2011 Form IL-1040, taxpayers should gather their income documents, such as W-2s and 1099s, complete the personal information section, report their total income, calculate deductions and credits applicable, and finally determine the tax owed or refund due.

What is the purpose of 2011 Form IL-1040?

The purpose of the 2011 Form IL-1040 is to allow individuals to report their income, calculate their tax liability, and ensure compliance with state tax laws in Illinois for the year 2011.

What information must be reported on 2011 Form IL-1040?

The information that must be reported on the 2011 Form IL-1040 includes personal identification details, income sources, deductions, exemptions, tax credits, and the calculation of the tax owed or refund due.

Fill out your 2011 form il-1040 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2011 Form Il-1040 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.