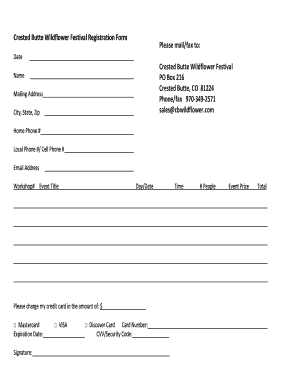

Get the free WHOLESALE LENDING APPLICATION

Show details

This document serves as an application form for companies seeking to engage in wholesale lending, providing essential company information, financial details, and certification requirements.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign wholesale lending application

Edit your wholesale lending application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your wholesale lending application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit wholesale lending application online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit wholesale lending application. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out wholesale lending application

How to fill out WHOLESALE LENDING APPLICATION

01

Gather necessary documents: Prepare financial statements, tax returns, and business licenses.

02

Fill out personal information: Provide your name, address, and contact information.

03

Business details: Include the name of your business, its structure, and its purpose.

04

Loan information: Specify the loan amount requested, the intended use of the funds, and the repayment terms you prefer.

05

Provide financial history: Include details about existing debts, credit history, and income sources.

06

Review and double-check: Ensure all information is accurate and complete before submission.

07

Submit the application: Send the completed application to the lender along with any required documentation.

Who needs WHOLESALE LENDING APPLICATION?

01

Small business owners looking for funding to expand their operations.

02

Startups seeking initial capital to launch their business.

03

Real estate investors needing financing for property investments.

04

Entrepreneurs requiring loans for equipment purchases or improvements.

05

Companies looking to consolidate existing debts under better terms.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between wholesale lending and warehouse lending?

Warehouse lenders are similar to wholesale lenders, but they lend the money directly to the institution that is originating the loan, not the customer. They provide short-term funding for intermediaries like mortgage bankers or small mortgage banks. Usually, the loans that warehouse lenders make are short-term.

What are the 5 Cs of lending?

One of the first things all lenders learn and use to make loan decisions are the “Five C's of Credit": Character, Conditions, Capital, Capacity, and Collateral.

What is a wholesale lender?

A wholesale mortgage lender is an institution that offers mortgages through third parties, such as a bank, credit union or mortgage broker.

What are the steps in the lending process?

By understanding the process, you will feel more at ease during the transaction. Step 1: Gathering and Submitting Application & Required Documentations. Step 2: Loan Underwriting. Step 3: Decision & Pre-Closing. Step 4: Closing. Step 5: Post Closing.

What is an example of a wholesale loan?

Examples of loan uses for your wholesale business may include: Purchasing, building or renovating a property with sufficient space to house your operations and room to expand as your business grows. Buying major equipment to stock goods, as well as equipment and technology to store, ship and track them.

What is the wholesale lending process?

Wholesale Lending refers to the process of offering loans to mortgage brokers or financial institutions, who then liaise with borrowers directly. This practice, also known as wholesale mortgage, involves the mortgage lender extending credit to a mortgage broker's financial institution.

What are the three main types of lending?

Three common types of loan facility are: overdrafts. term loans, and. revolving credit facilities (RCFs)

What is the lending application?

A 'Loan Application' is a formal request submitted by individuals or businesses to financial institutions seeking financial assistance, where AI algorithms are often used to process massive datasets and make decisions on whether to approve the loan.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is WHOLESALE LENDING APPLICATION?

A Wholesale Lending Application is a formal request submitted by lending institutions to seek approval for financing from wholesale lenders, typically involving the processing of loans at a larger scale.

Who is required to file WHOLESALE LENDING APPLICATION?

Entities such as mortgage brokers, lenders, and financial institutions that seek to engage in wholesale lending must file a Wholesale Lending Application.

How to fill out WHOLESALE LENDING APPLICATION?

To fill out a Wholesale Lending Application, gather necessary financial documents, provide accurate business and borrower information, and complete all required sections of the application form before submitting it to the wholesale lender.

What is the purpose of WHOLESALE LENDING APPLICATION?

The purpose of the Wholesale Lending Application is to facilitate the funding process for lenders by detailing their financial requirements and qualifications to wholesale lenders.

What information must be reported on WHOLESALE LENDING APPLICATION?

The information required typically includes details about the applicant's business, loan amount requested, financial statements, borrower qualifications, and any additional documentation as requested by the wholesale lender.

Fill out your wholesale lending application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Wholesale Lending Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.