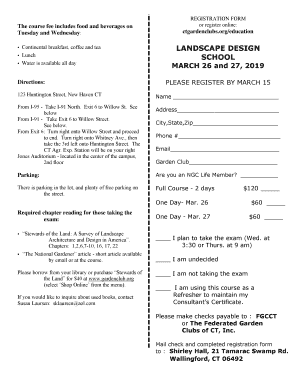

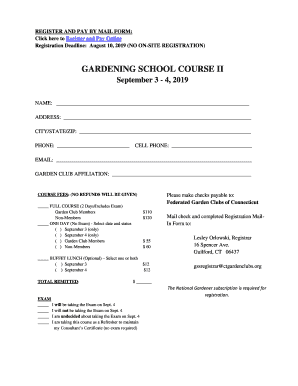

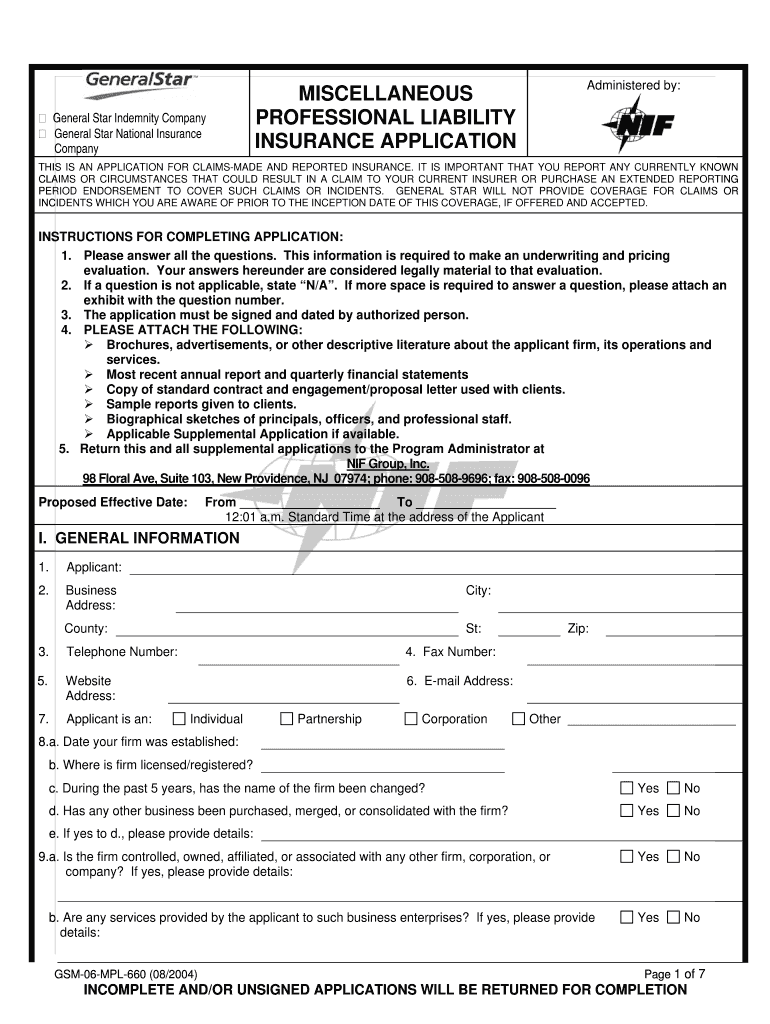

Get the free MISCELLANEOUS PROFESSIONAL LIABILITY INSURANCE APPLICATION

Show details

This document serves as an application for claims-made and reported insurance, requiring the reporting of known claims or circumstances that could result in a claim. It includes instructions for completing

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign miscellaneous professional liability insurance

Edit your miscellaneous professional liability insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your miscellaneous professional liability insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit miscellaneous professional liability insurance online

Follow the steps below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit miscellaneous professional liability insurance. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out miscellaneous professional liability insurance

How to fill out MISCELLANEOUS PROFESSIONAL LIABILITY INSURANCE APPLICATION

01

Gather necessary information about your business, including your business name, address, and contact details.

02

Identify the type of services you provide as a professional and describe them clearly in the application.

03

Provide details about your professional experience and qualifications relevant to the services you offer.

04

Disclose any prior claims or lawsuits against you regarding professional liability.

05

Indicate the number of years you have been in business and your estimated annual revenue.

06

Outline any risk management practices you have in place to minimize potential claims.

07

Review your application thoroughly for accuracy and completeness before submission.

08

Submit the application to the insurance provider along with any required documentation.

Who needs MISCELLANEOUS PROFESSIONAL LIABILITY INSURANCE APPLICATION?

01

Professionals offering services such as consultants, architects, engineers, and healthcare providers who may be exposed to risks of negligence or errors in their professional work.

02

Freelancers and independent contractors who provide specialized services to clients.

03

Any business entity that provides professional advice, recommendations, or services that could lead to lawsuits.

Fill

form

: Try Risk Free

People Also Ask about

How much would $1,000,000 liability insurance cost?

What's the average cost of a $1 million liability insurance policy? On average, Insureon customers pay $42 per month, or about $500 annually, for a $1 million general liability insurance policy. Additionally, 29% pay less than $30 per month, and 40% pay between $30 and $60 per month.

What is miscellaneous professional liability insurance?

Miscellaneous Professional Liability (MPL) is designed to equip service providers with comprehensive coverage and arm them with the knowledge needed to navigate common allegations, such as errors, omissions, and failure to meet customer expectations.

How much does a $1,000,000 liability insurance policy cost?

On average, a $1 million liability insurance policy costs $69 a month, or $824 a year, for our small business owners. ** Keep in mind that every business is different, so the $1 million liability insurance cost will vary.

What are the two types of professional liability insurance?

The two basic types of malpractice insurance are "claims-made" and "occurrence-made." "Claims-made" insurance protects you from malpractice claims only if the company that insured you at the time of the alleged "occurrence" is the same company at the time the claim is filed in court.

How much is $100,000 in liability insurance?

Here are some typical premiums for different amounts of coverage: $250,000 per occurrence/$250,000 aggregate range from $500 to $1,000 on average. $1 million per occurrence $2 million aggregate range from $1,000 to $3,000. $2 million per occurrence $2 million aggregate range from $2,000 to $3500.

What is the difference between MPL and E&O?

While tech E&O insurance focuses specifically on the businesses that provide technology services, MPL insurance is designed to protect businesses that perform a wide range of services such as consultants, real estate agents, and advertising agencies.

How much does a $1 million dollar umbrella policy cost?

On average, a renters insurance policy with $100,000 in liability coverage and a $500 deductible costs $22 per month, or $268 a year. With a higher deductible of $1,000, a renters insurance policy costs an average of $20 per month, or $246 a year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is MISCELLANEOUS PROFESSIONAL LIABILITY INSURANCE APPLICATION?

MISCELLANEOUS PROFESSIONAL LIABILITY INSURANCE APPLICATION is a form used by professionals to apply for insurance coverage that protects against claims of negligence, errors, or omissions in the performance of their professional services.

Who is required to file MISCELLANEOUS PROFESSIONAL LIABILITY INSURANCE APPLICATION?

Individuals or businesses that provide professional services such as consultants, architects, or engineers are typically required to file this application to obtain professional liability insurance.

How to fill out MISCELLANEOUS PROFESSIONAL LIABILITY INSURANCE APPLICATION?

To fill out the application, applicants need to provide detailed information about their business and services, including their professional qualifications, previous claims history, and specified coverage limits they wish to acquire.

What is the purpose of MISCELLANEOUS PROFESSIONAL LIABILITY INSURANCE APPLICATION?

The purpose of this application is to assess the risk involved in providing professional services and to determine the appropriate coverage and premium rates for the insurance policy.

What information must be reported on MISCELLANEOUS PROFESSIONAL LIABILITY INSURANCE APPLICATION?

The application typically requires information such as the applicant's business name and address, description of professional services offered, years in business, number of employees, and details about any prior claims or incidents related to professional liability.

Fill out your miscellaneous professional liability insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Miscellaneous Professional Liability Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.