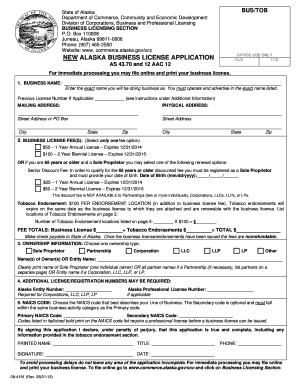

This state-specific form must be filed with the appropriate state agency in compliance with state law in order to create a new non-profit corporation. The form contains basic information concerning the corporation, normally including the corporate name, names of the incorporates, directors and/or officers, purpose of the corporation, corporate address, registered agent, and related information.

MT 35-2-213 MCA 2006-2025 free printable template

Get, Create, Make and Sign montana form 35 2 213 nonprofit

Editing mt 35 2 213 domestic online

Uncompromising security for your PDF editing and eSignature needs

How to fill out montana 35 2 213

How to fill out MT 35-2-213 MCA

Who needs MT 35-2-213 MCA?

Video instructions and help with filling out and completing montana 35 2 213 articles fillable

Instructions and Help about montana 35 2 213

Hey Tina Williams here and I'm going to give you the three things you must have in your forming documentation in order to be eligible to become a 501c3 tax-exempt nonprofit First, you have to have a purpose and the IRS defines an exempt purpose as anything that is charitable religious Educational Scientific literary testing for public safety fostering national or international amateur sports competition and or preventing cruelty to children or animals and charitable is not spread their defined as release for the poor the distressed or underprivileged... you can read the definition of an exempt purpose on the IRS website for our purpose yow want to copy and paste into your purpose section on your articles of incorporation something like this the purpose or purposes for which the corporation is organized are and then insert the company name and so your company name is organized exclusively for charitable and educational purposes under section 501 c3 of the Internal Revenue code or corresponding section any future federal tax coach then search your company name engage, and they provide this service that you are going to be providing to you your community in this case we're saying we will provide mentorship coaching in Human Services to you second thing you have to have I need three classes IRS requires in order for you to be eligible to be tax-exempt in New York warming documentation so in your articles of incorporation that you now would, you stay you have to have these declines there if you don't have been there the IRS will reject your application to become tech dept still clouds wind basically this class said that you are not going to carry on any activities not permitted by the coach an agency there some legalese here this is what you are happy in cut and paste into your for me documentation make sure that you in Syria your company name there class member to you basically that says that no part of the earnings are going to be for the benefit other founders and officers ex-senator an except for reasonable compensation, so you see their legally stare UPS in searcher company name in article number: they club and made three all assets are to go to charitable cause upon dissolution, so that has to be there because they want you to make sure that area if you close your use of the money that you raise for your exit clause there's the legalese there you get a copy and paste that put your name in there and lilac the anything that you need to have in your forming document AG order to be a tax-exempt organizations is a bit bored so uh get started board includes fight people that would include the executive director the executive director is the only person on the board that is that you get paid and this is used going to be the founder, or you left your starting that nap happy second person is chairperson or the president the board is person is important they need to be a mover in a shaker and okay we'll work with no pay at least at the beginning and then...

People Also Ask about

What does it mean to become a public benefit corporation?

What is the difference between a nonprofit and a public benefit corporation?

What is the difference between a B Corp and a public benefit corporation?

Why would a company become a public benefit corporation?

What are corporation bylaws in Montana?

What is a public benefit corporation Montana?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get montana 35 2 213?

How do I make edits in montana 35 2 213 without leaving Chrome?

How do I fill out montana 35 2 213 on an Android device?

What is MT 35-2-213 MCA?

Who is required to file MT 35-2-213 MCA?

How to fill out MT 35-2-213 MCA?

What is the purpose of MT 35-2-213 MCA?

What information must be reported on MT 35-2-213 MCA?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.