Get the free U.S. CUSTOMS IMPORT POWER OF ATTORNEY

Show details

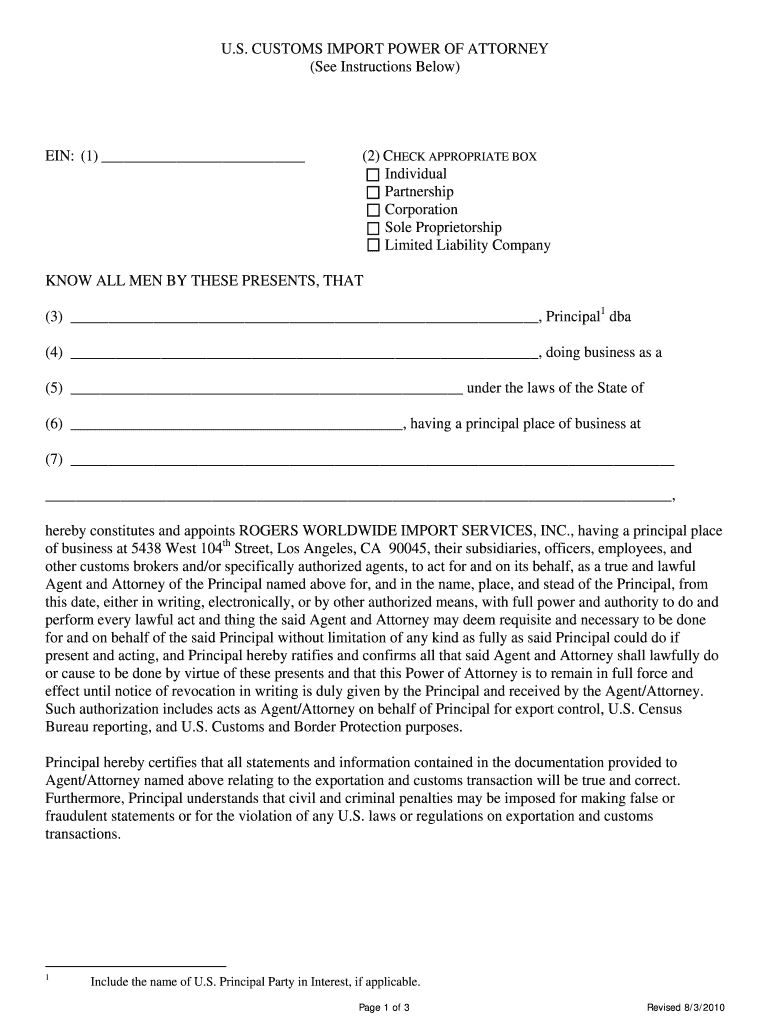

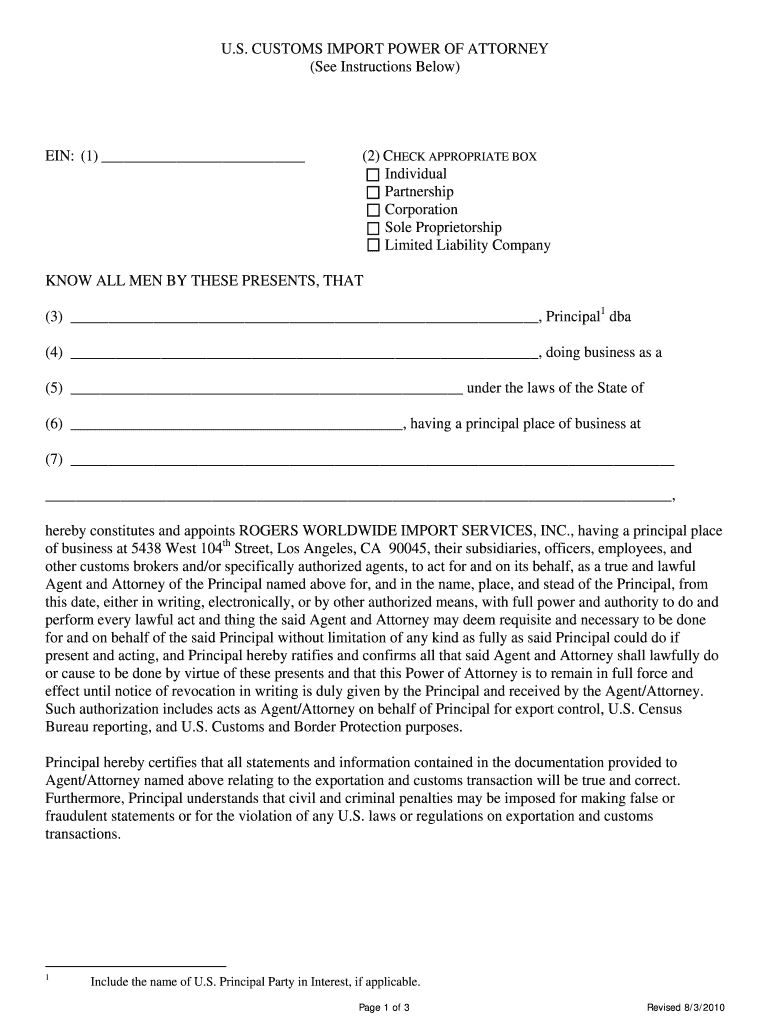

This document authorizes a customs broker to act on behalf of the Principal for customs transactions, including importation and exportation of goods, while outlining the obligations and powers granted

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign us customs import power

Edit your us customs import power form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your us customs import power form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing us customs import power online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit us customs import power. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out us customs import power

How to fill out U.S. CUSTOMS IMPORT POWER OF ATTORNEY

01

Obtain a U.S. Customs Import Power of Attorney form from the U.S. Customs and Border Protection website or your customs broker.

02

Fill in the name and address of the principal (the person or company granting the authority).

03

Provide the name and address of the customs broker who will act on your behalf.

04

Include the taxpayer identification number (TIN) or social security number of the principal.

05

Indicate the specific powers granted to the customs broker, such as the ability to sign documents and clear shipments.

06

Sign and date the form in the designated area.

07

Ensure the form is notarized if required by your customs broker.

08

Submit the completed form to your customs broker.

Who needs U.S. CUSTOMS IMPORT POWER OF ATTORNEY?

01

Any individual or business importing goods into the U.S. who requires assistance with customs clearance.

02

Importers who prefer to authorize a customs broker to act on their behalf for efficient processing of customs documentation.

03

Companies that regularly import goods and need to comply with U.S. Customs regulations.

Fill

form

: Try Risk Free

People Also Ask about

Why is POA needed for customs?

In shipping, a power of attorney is often needed during the clearance process for imports and exports. A sender or receiver fills in a power of attorney to authorize their carrier to act on their behalf when dealing with customs clearance.

Who signs a customs power of attorney?

POAs must be signed by an officer of the company since they have the authority to sign a POA that would bind the company legally.

How to give power of attorney to someone in the USA?

Here's how to make someone your power of attorney. Decide which type of power of attorney to make. Choose your agent. Decide how much authority to give your agent. Fill out a power of attorney form. Execute your POA according to the laws in your state.

Is a foreign power of attorney valid in the USA?

Your POA must be notarized first. This verifies the signer's identity and the authenticity of the document. You'll then apply for an apostille from the appropriate authority in your home country. In the United States, this is usually a Secretary of State or a similar government agency.

Who can act as the importer of records?

“Importer of Record” is defined as the owner or purchaser of the goods, or when designated by the owner, purchaser, or consignee, a licensed Customs broker. 5.1. 3 A nominal consignee may designate a Customs broker to make entry on his behalf but may not make entry on his own behalf.

What is a power of attorney for importing?

A power of attorney (POA) is a legal document used in shipping to grant a customs broker the authority to process Customs clearance on your behalf. A signed POA is necessary in order to clear your goods through US Customs.

What are the 4 types of power of attorney?

In California, there are four main types of POAs, each offering a specific scope of decision-making power: general, durable, limited, and medical. Understanding these distinctions is crucial for selecting the POA that best suits your individual needs: General Power of Attorney.

What is a power of attorney for import USA?

A power of attorney (POA) is a legal document used in shipping to grant a customs broker the authority to process Customs clearance on your behalf. A signed POA is necessary in order to clear your goods through US Customs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is U.S. CUSTOMS IMPORT POWER OF ATTORNEY?

U.S. Customs Import Power of Attorney is a legal document that authorizes a customs broker to act on behalf of the principal (importer) in customs dealings with the U.S. Customs and Border Protection (CBP).

Who is required to file U.S. CUSTOMS IMPORT POWER OF ATTORNEY?

Importers who wish to appoint a customs broker to handle their customs clearance activities are required to file a U.S. Customs Import Power of Attorney.

How to fill out U.S. CUSTOMS IMPORT POWER OF ATTORNEY?

To fill out the U.S. Customs Import Power of Attorney, one must provide details such as the importer's name, address, and Customs Identification number, as well as the name and details of the customs broker being authorized.

What is the purpose of U.S. CUSTOMS IMPORT POWER OF ATTORNEY?

The purpose of U.S. Customs Import Power of Attorney is to grant financial and legal authority to a customs broker to facilitate and expedite the import process on behalf of the importer.

What information must be reported on U.S. CUSTOMS IMPORT POWER OF ATTORNEY?

The information that must be reported includes the name and address of the importer, the name and address of the customs broker, the type of business of the importer, and any specific authorizations being granted.

Fill out your us customs import power online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Us Customs Import Power is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.