Get the free Pinnacle Flexible Premium Variable Annuity Prospectus

Show details

This document is a prospectus for the Pinnacle Flexible Premium Variable Annuity, detailing the investment options, fees, charges, and other important information regarding the annuity.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pinnacle flexible premium variable

Edit your pinnacle flexible premium variable form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pinnacle flexible premium variable form via URL. You can also download, print, or export forms to your preferred cloud storage service.

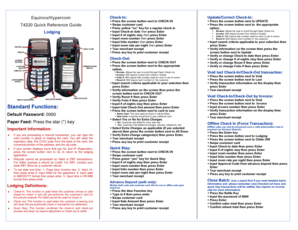

How to edit pinnacle flexible premium variable online

To use our professional PDF editor, follow these steps:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit pinnacle flexible premium variable. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pinnacle flexible premium variable

How to fill out Pinnacle Flexible Premium Variable Annuity Prospectus

01

Obtain a copy of the Pinnacle Flexible Premium Variable Annuity Prospectus.

02

Review the introduction section to understand the purpose of the annuity.

03

Fill out your personal information including name, address, and social security number in the application section.

04

Read about the investment options and select the funds that meet your financial goals.

05

Determine your premium payments, both initial and ongoing, and record the amounts.

06

Understand and select any additional riders or features you wish to include.

07

Review the fees and charges outlined in the prospectus to know the costs involved.

08

Sign and date the application form to complete the process.

Who needs Pinnacle Flexible Premium Variable Annuity Prospectus?

01

Individuals looking for tax-deferred savings options for retirement.

02

People seeking flexibility in their investment choices and the potential for growth.

03

Those who want to combine investment growth with a guaranteed income in retirement.

04

Individuals who may benefit from estate planning strategies to pass wealth to beneficiaries.

Fill

form

: Try Risk Free

People Also Ask about

What is a flexible variable annuity?

0:00 4:37 Hey John Stevenson here the guaranteed retirement. Guy and what is a flexible. Annuity. WellMoreHey John Stevenson here the guaranteed retirement. Guy and what is a flexible. Annuity. Well flexible annuities are just that they're flexible. Okay most annuities that I sell are not very flexible.

How does a flexible premium annuity work?

A flexible premium annuity allows you to fund your annuity with several payments. You can purchase this type of contract with payments of different amounts, paid at different times. Once you've put all the money you want into your annuity, you can determine when and how the annuity will disperse the money back to you.

What is the difference between a single premium and a flexible premium?

Single premium annuities are often funded by rollovers or from the sale of an appreciated asset. A flexible premium annuity is an annuity that is intended to be funded by a series of payments.

Are variable annuities ever a good idea?

There are many pros and cons to annuities and, more specifically, variable annuities. The biggest benefit of a variable annuity is the potential growth your money could earn. Compared to many other types of annuities, such as fixed annuities, a variable annuity potentially offers the best possible return.

What are the downsides of a variable annuity?

The benefits of a variable annuity include tax-deferred growth, guaranteed income in retirement, and a death benefit for beneficiaries. The downsides are complexity, layered fees, and withdrawal penalties.

What is the downside of a spia annuity?

Some of the advantages of SPIAs include simplicity, lower fees, and guaranteed income, but the tradeoff is loss of control over the money. Your age and other factors can influence the taxation of your annuity payments.

What is a prospectus for a variable annuity contract?

Variable annuities and their underlying fund investments are sold by prospectus only. The prospectuses contain the investment objectives, risks, fees, charges, expenses and other information regarding the contract and underlying funds, which should be considered carefully before investing.

What is a flexible premium variable annuity?

The two main options for annuity premiums are single, meaning you make a one-time lump-sum payment, or flexible, meaning you make several payments over time. So, a flexible premium deferred annuity is an annuity that you pay into incrementally over time and that you defer receiving payments from until a later date.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Pinnacle Flexible Premium Variable Annuity Prospectus?

The Pinnacle Flexible Premium Variable Annuity Prospectus is a legal document that provides detailed information about the Pinnacle Flexible Premium Variable Annuity product, including its features, benefits, risks, investment options, and fees.

Who is required to file Pinnacle Flexible Premium Variable Annuity Prospectus?

Insurance companies or financial institutions that offer the Pinnacle Flexible Premium Variable Annuity are required to file the prospectus with regulatory bodies to provide transparency and protect investors.

How to fill out Pinnacle Flexible Premium Variable Annuity Prospectus?

To fill out the Pinnacle Flexible Premium Variable Annuity Prospectus, individuals should follow the guidelines provided in the document, ensuring they provide accurate information regarding personal details, investment choices, and any other required disclosures.

What is the purpose of Pinnacle Flexible Premium Variable Annuity Prospectus?

The purpose of the Pinnacle Flexible Premium Variable Annuity Prospectus is to inform potential investors about the annuity’s features, investment options, risks, and costs, allowing them to make informed decisions.

What information must be reported on Pinnacle Flexible Premium Variable Annuity Prospectus?

The information that must be reported includes the annuity’s investment objectives, fees, surrender charges, performance history, tax implications, and risk factors associated with the investment.

Fill out your pinnacle flexible premium variable online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pinnacle Flexible Premium Variable is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.