Get the free INDEMNITY BOND

Show details

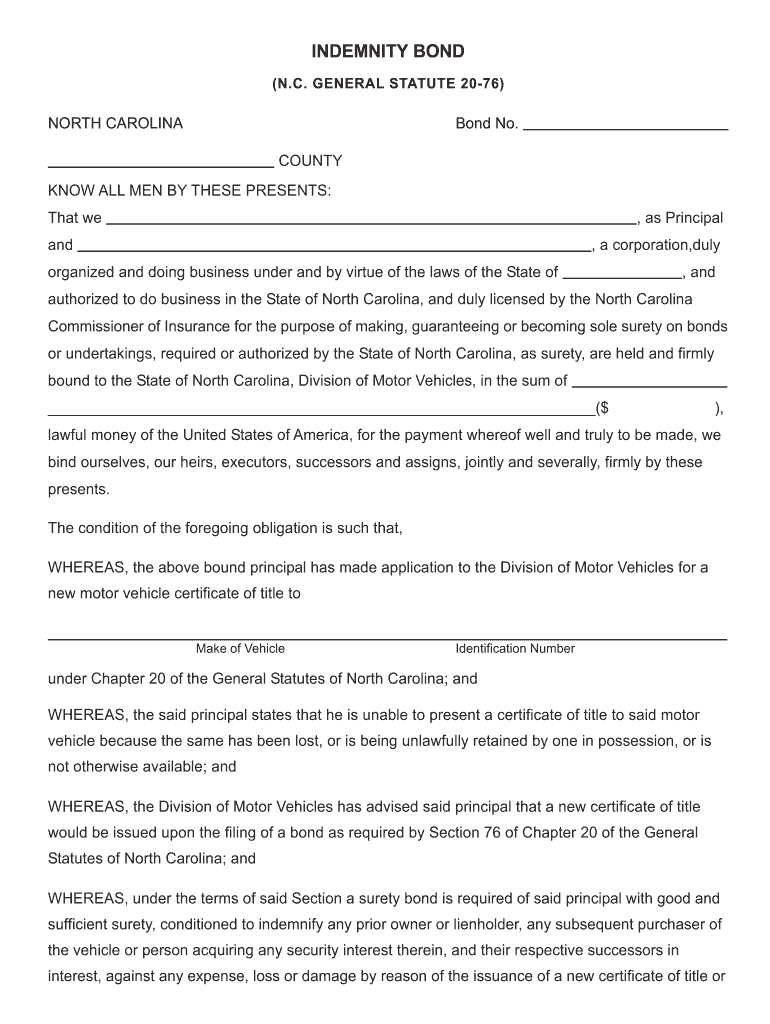

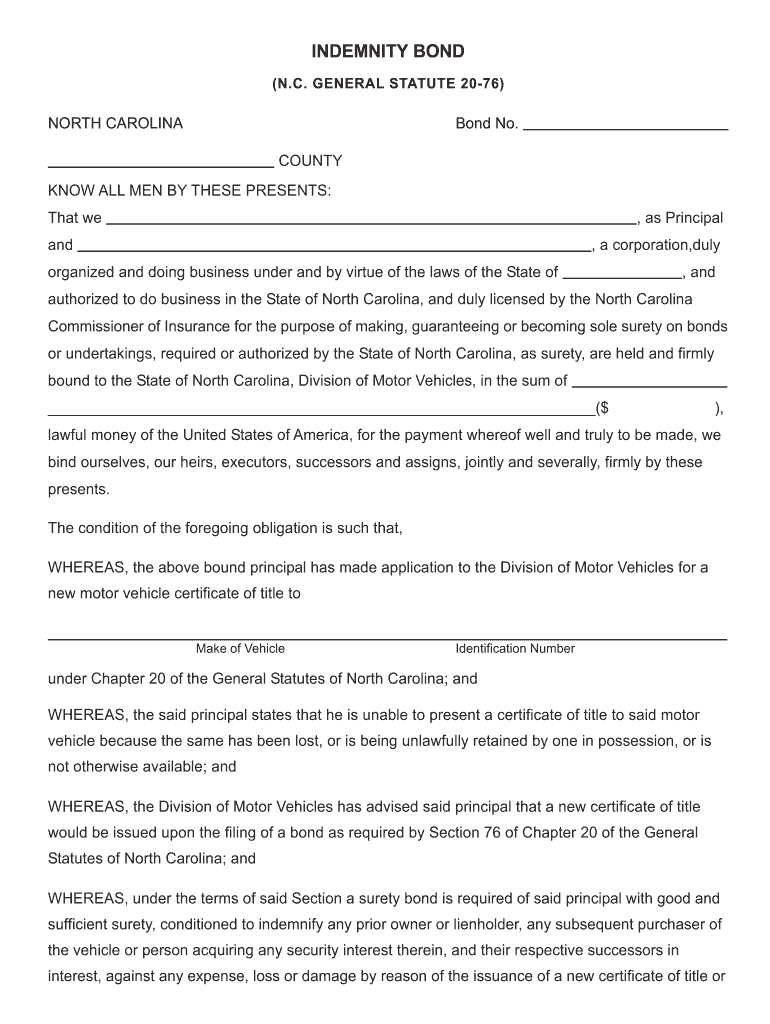

This document serves as a surety bond for obtaining a new motor vehicle certificate of title in North Carolina when the original title is lost or unavailable, ensuring indemnification against any

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign indemnity bond

Edit your indemnity bond form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your indemnity bond form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing indemnity bond online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit indemnity bond. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out indemnity bond

How to fill out INDEMNITY BOND

01

Title the document 'Indemnity Bond'.

02

Specify the date of the bond.

03

Enter the names and addresses of the indemnitor (the party providing the bond) and the indemnitee (the party receiving the bond).

04

Clearly state the obligation or the purpose of the bond.

05

Include the amount for which the bond is executed.

06

Outline the terms and conditions under which the indemnity applies.

07

Include a clause that confirms the indemnitor's agreement to indemnify the indemnitee against specific losses or claims.

08

Sign the document in the presence of a witness or a notary public if required.

09

Keep copies of the signed bond for all parties involved.

Who needs INDEMNITY BOND?

01

Individuals or businesses needing to provide assurance against certain risks or liabilities.

02

Contractors and service providers to protect clients from potential losses.

03

Parties involved in legal transactions requiring guarantees.

04

Those seeking to secure licenses or permits that require an indemnity bond.

Fill

form

: Try Risk Free

People Also Ask about

What is the translation of indemnity bond?

Indemnity bond meaning in Hindi (हिन्दी मे मीनिंग ) is क्षतिपूर्ति बंधपत्र. English definition of Indemnity bond : An indemnity bond is a legal document that guarantees compensation for any losses or damages incurred by one party due to the actions of another party.

What is an indemnity bond?

An indemnity bond assures the holder of the bond, that they will be duly compensated in case of a possible loss. This bond is an agreement that protects the lender from loss if the borrower defaults on a legally binding loan.

How do you get an indemnity bond?

You can purchase indemnity bonds through several insurance companies, however, they are often difficult to obtain. Contact your insurance broker for help. Be aware that even after you present an indemnity bond, a bank may require you to wait 30–90 days before it will issue a replacement check.

What is indemnity in easy words?

The word indemnity means security or protection against a financial liability. It typically occurs in the form of a contractual agreement made between parties in which one party agrees to pay for losses or damages suffered by the other party.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is INDEMNITY BOND?

An indemnity bond is a legally binding contract that ensures that one party will compensate another for any losses or damages incurred.

Who is required to file INDEMNITY BOND?

Individuals or entities that require assurance against potential losses, such as contractors, insurance agents, or individuals involved in legal proceedings, are typically required to file an indemnity bond.

How to fill out INDEMNITY BOND?

To fill out an indemnity bond, you need to provide the names of the parties involved, details of the obligation, the amount of indemnity, and any specific terms or conditions, then sign the document in the presence of a witness.

What is the purpose of INDEMNITY BOND?

The purpose of an indemnity bond is to protect one party from financial loss due to the actions or inactions of another party, ensuring that any compensation agreed upon is paid.

What information must be reported on INDEMNITY BOND?

The information that must be reported on an indemnity bond includes the names and addresses of the indemnitor and indemnitee, the amount of the bond, the circumstances under which the bond is effective, and any relevant dates.

Fill out your indemnity bond online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Indemnity Bond is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.