Get the free VEHICLE TITLE SURETY BOND

Show details

This document serves as a surety bond ensuring the protection of the State of Alaska against any defects in the title of a vehicle, providing a mechanism for indemnification in case of legal claims

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign vehicle title surety bond

Edit your vehicle title surety bond form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your vehicle title surety bond form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing vehicle title surety bond online

Follow the steps below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit vehicle title surety bond. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out vehicle title surety bond

How to fill out VEHICLE TITLE SURETY BOND

01

Obtain the Vehicle Title Surety Bond form from your local Department of Motor Vehicles (DMV) or an authorized bond provider.

02

Fill in your personal information, including your name, address, and contact details.

03

Provide details about the vehicle, including its make, model, year, and Vehicle Identification Number (VIN).

04

Indicate the amount of the bond, which is typically based on the vehicle's value.

05

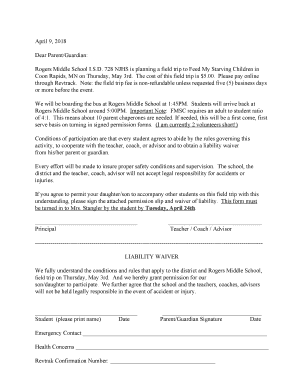

Sign the form to acknowledge the information provided is accurate and complete.

06

Submit the completed form along with any required documentation and payment to the bond provider or DMV.

Who needs VEHICLE TITLE SURETY BOND?

01

Individuals who are purchasing a vehicle without a title.

02

Those who are trying to obtain a title for a vehicle that has been lost or destroyed.

03

People who are involved in the transfer of vehicles that require proof of ownership.

Fill

form

: Try Risk Free

People Also Ask about

How to calculate a surety bond?

Surety bond premiums are mainly calculated based on the applicant's credit score and usually vary between 0.5%-10% of the total bond amount. Other influencing factors include: Industry Experience: More experience can lead to lower premiums. Financial Strength: Strong financials and liquid assets can reduce costs.

How much is a $35000 surety bond?

Surety Bond Cost Table Surety Bond AmountYearly Premium Excellent Credit (675 and above)Average Credit (600-675) $35,000 Surety Bond $350 - $1,050 $1,050 - $1,750 $40,000 Surety Bond $400 - $1,200 $1,200 - $2,000 $50,000 Surety Bond $500 - $1,500 $1,500 - $2,5009 more rows

How much does a $10 000 surety bond cost?

Surety bond premiums are calculated as a small percentage of the bond amount. $10,000 surety bonds typically cost 0.5–10% of the bond amount, or $50–$300.

Is it hard to sell a vehicle with a bonded title?

Bonded title process will make things about 4x more tedious for the seller so be prepared to drop the price to match the time you'll waste for them. And potentially a court summons when they sue you for the double taxes they'll have to pay because you didn't pay them to begin with.

How much does a $35000 surety bond cost?

Surety Bond Cost Table Surety Bond AmountYearly Premium Excellent Credit (675 and above)Average Credit (600-675) $35,000 Surety Bond $350 - $1,050 $1,050 - $1,750 $40,000 Surety Bond $400 - $1,200 $1,200 - $2,000 $50,000 Surety Bond $500 - $1,500 $1,500 - $2,5009 more rows

How much does a $25,000 surety bond cost?

Surety bond premiums are calculated as a small percentage of the bond amount. $25,000 surety bonds typically cost 0.5–10% of the bond amount, or $125–$2,500. Highly qualified applicants with strong credit might pay just $125 to $250, while an individual with poor credit will receive a higher rate.

What is the purpose of a surety bond?

Surety bonds help small businesses win contracts by providing the customer with a guarantee that the work will be completed. Many public and private contracts require surety bonds, which are offered by surety companies.

What is a typical surety bond rate?

The cost of a surety bond is calculated as a small percentage of the total bond coverage amount — typically 0.5–10%. This means a $10,000 bond policy may cost between $50 and $1,000. For applicants with strong credit, most bond rates are 0.5–4% of the bond amount.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is VEHICLE TITLE SURETY BOND?

A Vehicle Title Surety Bond is a legal contract that guarantees the payment of a specific amount to cover claims against a vehicle's title. It is typically required when the owner cannot provide a clear title for a vehicle.

Who is required to file VEHICLE TITLE SURETY BOND?

Individuals who are applying for a new title for a vehicle without a clear title, such as those who purchased a vehicle without receiving a title or those whose title has been lost or stolen, are required to file a Vehicle Title Surety Bond.

How to fill out VEHICLE TITLE SURETY BOND?

To fill out a Vehicle Title Surety Bond, the applicant must provide their personal information, vehicle details (VIN, make, model, year), the bond amount, and any other required declarations. It's essential to ensure accuracy to prevent delays in the title process.

What is the purpose of VEHICLE TITLE SURETY BOND?

The purpose of a Vehicle Title Surety Bond is to protect against losses from claims that may arise due to issues with the vehicle's title, ensuring that the rightful owner can obtain a title while providing a financial guarantee against potential disputes.

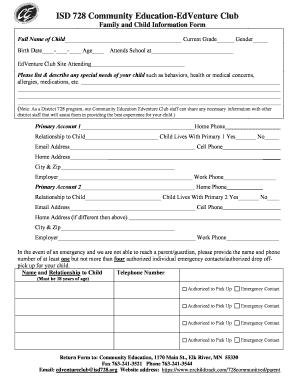

What information must be reported on VEHICLE TITLE SURETY BOND?

The information that must be reported on a Vehicle Title Surety Bond includes the bond number, the name and address of the principal (vehicle owner), the bond amount, details about the vehicle (VIN, make, model, year), and any applicable signatures.

Fill out your vehicle title surety bond online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Vehicle Title Surety Bond is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.