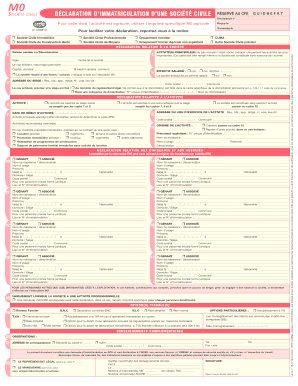

Get the free assets less than $2,500,000 at the end of the year may use this

Show details

T ! T Form Short Form Return of Organization Exempt From Income Tax 990EZ OMB No 15451150 2008 Under section 501×c), 527, or 4947×a)(1) of the Internal Revenue Code (except black lung benefit trust

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign assets less than 2500000

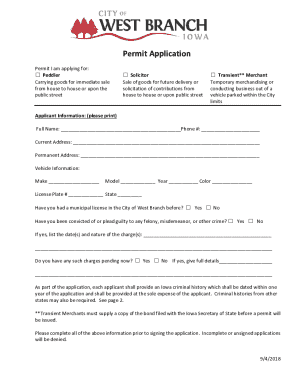

Edit your assets less than 2500000 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your assets less than 2500000 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit assets less than 2500000 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit assets less than 2500000. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out assets less than 2500000

How to fill out assets less than 2500000:

01

Start by gathering all relevant information about your assets, including their value and type. This can include bank accounts, investments, real estate, vehicles, and personal belongings.

02

Organize the information in a clear and systematic manner. Create a list or spreadsheet to keep track of each asset along with its value. Make sure to include any debts or liabilities associated with these assets as well.

03

Determine the total value of your assets. Add up the value of each individual asset to get an accurate assessment of your total assets. Ensure that you have accounted for any outstanding debts or liabilities that may affect the overall value.

04

Consider consulting with a financial advisor or accountant if you are unsure about calculating the value of your assets. They can provide guidance and ensure that you accurately assess the worth of each asset.

05

If required, prepare any necessary documentation to support the valuation of your assets. This can include bank statements, property deeds, investment statements, vehicle titles, or any other official documents that validate the value you have assigned to each asset.

06

When filling out any forms or applications that require disclosure of your assets, provide the accurate value for each asset as calculated. Be truthful and transparent about your assets to avoid any legal or financial consequences.

07

Regularly update your asset valuation as needed. As your financial situation changes, such as through additional acquisitions or sales, make sure to adjust your asset valuation accordingly.

Who needs assets less than 2500000:

01

Individuals who are in the early stages of their career and have not yet amassed significant wealth may have assets that are valued less than 2500000. They may have limited savings, a modest income, and minimal investments.

02

People who live in areas with a lower cost of living may have assets less than 2500000. In regions where property values are lower or where the average income is below the national average, individuals may have fewer assets in total.

03

Individuals who have recently experienced a significant financial loss, such as through bankruptcy or foreclosure, might have assets that are valued less than 2500000. These individuals may be working towards rebuilding their financial stability and thus have a lower net worth.

04

Young adults who are just starting their financial journey or are still in school may have assets less than 2500000. They may have limited income or resources and are still in the process of building their wealth.

05

Individuals who have recently retired and have spent a significant portion of their savings or assets may have a net worth less than 2500000. Retirement can often involve a decrease in income and a higher reliance on savings, leading to a decrease in total assets.

06

People facing significant debts or financial obligations may have assets that fall below 2500000. These individuals may prioritize paying off their debts rather than accumulating assets, resulting in a lower net worth.

Overall, individuals with assets less than 2500000 can be from various walks of life and financial situations. It is essential to consider personal circumstances, geographic location, and socioeconomic factors when assessing the value of assets.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find assets less than 2500000?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific assets less than 2500000 and other forms. Find the template you want and tweak it with powerful editing tools.

How can I edit assets less than 2500000 on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing assets less than 2500000 right away.

Can I edit assets less than 2500000 on an iOS device?

Create, edit, and share assets less than 2500000 from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is assets less than 2500000?

Assets less than 2500000 refer to the total value of possessions or resources that are below 2500000.

Who is required to file assets less than 2500000?

Individuals or entities whose assets are less than 2500000 are required to file their asset information.

How to fill out assets less than 2500000?

To fill out assets less than 2500000, individuals or entities need to list all their possessions or resources that fall below the 2500000 threshold.

What is the purpose of assets less than 2500000?

The purpose of assets less than 2500000 is to provide a clear record of the value of possessions or resources that are under the specified amount.

What information must be reported on assets less than 2500000?

The information required to be reported on assets less than 2500000 includes a detailed list of all possessions or resources along with their corresponding values.

Fill out your assets less than 2500000 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Assets Less Than 2500000 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.