Get the free CUSTOMS NOTICE 07-008

Show details

This notice advises parties involved in importing commercial shipments into Canada about changes to the import release process, specifically regarding the use of Electronic Data Interchange (EDI)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign customs notice 07-008

Edit your customs notice 07-008 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your customs notice 07-008 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing customs notice 07-008 online

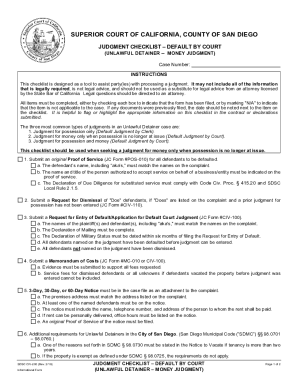

To use our professional PDF editor, follow these steps:

1

Log into your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit customs notice 07-008. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out customs notice 07-008

How to fill out CUSTOMS NOTICE 07-008

01

Download CUSTOMS NOTICE 07-008 from the official customs website.

02

Fill out the header section with your personal or business information.

03

Provide a detailed description of the goods related to your customs notice.

04

Indicate the value of the goods being declared.

05

Include any relevant reference numbers and dates.

06

Sign and date the form where indicated.

07

Make copies of the completed form for your records.

08

Submit the form to the appropriate customs authority.

Who needs CUSTOMS NOTICE 07-008?

01

Businesses or individuals importing goods that require customs clearance.

02

Anyone who needs to declare goods at customs when crossing borders.

03

Importers who are contacting customs for specific inquiries or information.

Fill

form

: Try Risk Free

People Also Ask about

What is the purpose of a customs form?

Customs Forms are important documents used by foreign customs authorities to clear mail for entry into their country and, when appropriate, to assess duty and taxes. When you mail a package to another country, the contents and value of an item must be declared on the customs form.

What is a customs notice?

Customs Notices are issued to inform clients about proposed changes to customs programs and procedures. They are not intended as an ongoing reference. Note: Customs Notices are maintained online for the current and previous year.

What is the customs notice 25 05 China surtax remission order?

The purpose of this Customs Notice is to advise of the China Surtax Remission Order (2024) , effective January 31, 2025 , which allows for the relief of surtaxes paid or payable under the China Surtax Order (2024) in respect of eligible goods. Remission is being granted pursuant to section 115 of the Customs Tariff .

How do I know if I have to pay customs in Canada?

Duty and taxes apply to all international goods imported by mail or purchased online that exceed the CAN$20 exemption. CBSA will assess duty and taxes on international packages (containing goods) arriving in Canada.

What is the purpose of customs?

The purpose of Customs Duty is to protect each country's economy, residents, jobs, environment, etc., by controlling the flow of goods, especially restrictive and prohibited goods, into and out of the country.

What does it mean if a package is at customs?

Shipments are held in customs to ensure they satisfy export or import customs regulations. A held shipment may have missing or incomplete paperwork, be waiting for clearance instructions or the authorities may need more information to clear the goods.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CUSTOMS NOTICE 07-008?

CUSTOMS NOTICE 07-008 is a document issued by customs authorities to provide guidance and regulations concerning specific customs processes and requirements.

Who is required to file CUSTOMS NOTICE 07-008?

Entities engaged in importing or exporting goods that fall under the purview of the regulations specified in CUSTOMS NOTICE 07-008 are required to file this notice.

How to fill out CUSTOMS NOTICE 07-008?

To fill out CUSTOMS NOTICE 07-008, individuals or businesses should follow the instructions provided in the notice, ensuring that all required fields are completed accurately and that any necessary supporting documents are attached.

What is the purpose of CUSTOMS NOTICE 07-008?

The purpose of CUSTOMS NOTICE 07-008 is to clarify customs procedures and requirements, ensuring compliance with regulations and facilitating the import/export process.

What information must be reported on CUSTOMS NOTICE 07-008?

The information required on CUSTOMS NOTICE 07-008 typically includes details about the importer/exporter, descriptions of the goods, values, quantities, and any relevant compliance details as specified in the notice.

Fill out your customs notice 07-008 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Customs Notice 07-008 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.