Get the free Drawback Certificate of Sale for Exportation

Show details

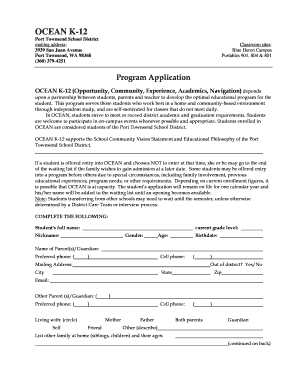

This document serves as a certificate for the drawback of goods sold for exportation, detailing exporter information and invoice data.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign drawback certificate of sale

Edit your drawback certificate of sale form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your drawback certificate of sale form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit drawback certificate of sale online

In order to make advantage of the professional PDF editor, follow these steps:

1

Check your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit drawback certificate of sale. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out drawback certificate of sale

How to fill out Drawback Certificate of Sale for Exportation

01

Obtain the Drawback Certificate of Sale for Exportation form from the relevant authority or website.

02

Fill in the required details such as exporter information, description of goods, and export destination.

03

Provide the original invoices related to the exported goods as supporting documents.

04

Include any applicable duty drawback claims associated with the exported item.

05

Review the completed form for accuracy and completeness.

06

Submit the form along with all supporting documents to the relevant customs authority.

Who needs Drawback Certificate of Sale for Exportation?

01

Exporters who have paid duties on imported goods that are subsequently exported.

02

Businesses that are looking to reclaim duties paid on goods that are not consumed domestically.

Fill

form

: Try Risk Free

People Also Ask about

What are the conditions for claiming duty drawback?

Customs Drawback for U.S. imports - Three Key Areas Manufacturing drawback (must be claimed within 5 years from the import date) Unused merchandise (must be claimed within 5 years from the import date) Rejected Merchandise (must be claimed within 5 years from the import date)

What is duty drawback in export?

Duty Drawback is a trusted and time-tested scheme administered by CBIC to promote exports. It rebates the incidence of Customs and Central Excise duties, chargeable on imported and excisable material respectively when used as inputs for goods to be exported.

Can a merchant exporter claim duty drawback?

Manufacturer selling the goods to merchant exporter need not charge duty. The procedure for procuring the goods by the merchant exporters is set out by the Board. Merchant exporter may also claim rebate or drawback benefits.

What is duty drawback on export sales?

Under Duty Drawback Scheme (DBK) relief of Customs and Central Excise Duties suffered on the inputs/components used in the manufacture of goods exported is allowed to Exporters. The admissible duty drawback amount is paid to exporters by depositing it into their nominated bank account.

How to submit duty drawback?

To file a claim complete Form K32, Drawback Claim, and submit it, together with supporting documentation, to the nearest Canada Border Services Agency office. The supporting documentation could include but is not exclusive to: a copy of export sales invoice. bill of landing or other shipping document.

What is the US export duty drawback?

Drawback is the refund of certain duties, internal revenue taxes and certain fees collected upon the importation of goods and refunded when the merchandise is exported or destroyed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Drawback Certificate of Sale for Exportation?

A Drawback Certificate of Sale for Exportation is a document issued by customs authorities that allows exporters to claim a refund of duties paid on imported goods that are subsequently exported.

Who is required to file Drawback Certificate of Sale for Exportation?

Exporters or businesses that have imported goods and wish to reclaim duties upon exporting those goods are required to file a Drawback Certificate of Sale for Exportation.

How to fill out Drawback Certificate of Sale for Exportation?

To fill out a Drawback Certificate of Sale for Exportation, the applicant must provide specific information including the importer's details, description of the goods, quantity, value, and relevant import duty amounts. It may also require signatures and dates.

What is the purpose of Drawback Certificate of Sale for Exportation?

The purpose of the Drawback Certificate of Sale for Exportation is to incentivize exports by allowing businesses to recover duties paid on imported materials that are incorporated into exported products.

What information must be reported on Drawback Certificate of Sale for Exportation?

The information that must be reported includes the importation details, exportation details, product descriptions, quantities, values, applicable duty rates, and any other relevant documentation to substantiate the claim.

Fill out your drawback certificate of sale online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Drawback Certificate Of Sale is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.