Get the free Commercial Surety Application

Show details

This document serves as an application for obtaining a commercial surety bond, detailing required information, instructions for completion, and the indemnity agreement guidelines.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign commercial surety application

Edit your commercial surety application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your commercial surety application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit commercial surety application online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit commercial surety application. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

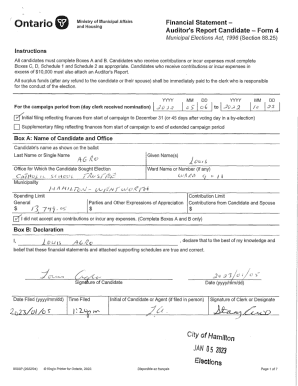

How to fill out commercial surety application

How to fill out Commercial Surety Application

01

Gather all necessary information, including business name, address, and contact details.

02

Provide the applicant's legal structure (e.g., corporation, partnership, sole proprietorship).

03

Detail the type of surety bond required and the purpose for which it is needed.

04

Include financial information such as balance sheets and income statements.

05

List any previous surety bonds and provide details on claims history.

06

Complete any additional sections required by the surety company, such as personal statements or references.

07

Review the application for accuracy and completeness before submission.

08

Submit the application along with any required fees to the surety provider.

Who needs Commercial Surety Application?

01

Businesses that require a surety bond to comply with legal or contractual obligations.

02

Contractors needing a performance or payment bond for construction projects.

03

Individuals or companies applying for licenses that require a surety bond.

04

Companies seeking to guarantee compliance with laws or regulations.

Fill

form

: Try Risk Free

People Also Ask about

How do I get a commercial surety bond?

You'll need to find an independent insurance broker or agent near you to purchase a surety bond from these insurance companies. The Small Business Administration also guarantees some types of surety bonds. This way, the SBA will reduce the risk for a surety company so that it can offer bonds to more small businesses.

What is the purpose of the surety?

The surety bond protects the obligee by guaranteeing performance to the obligee if the principal does not fulfill their obligation. Obligated to be liable for the performance of a contract, debt or failure of a duty of another party.

How do I fill out a surety bond application?

How to Fill Out a Surety Bond Form Bond Number. The bond number is the unique identification number assigned to your bond. Bond Premium. This is the cost of your bond, typically calculated as a percentage of your bond coverage. Principal Name. Surety Name. State of Incorporation. Obligee Name. Bond Amount. Bond Obligation.

What is an example of a surety?

License and permit bonds are typically required before you can get your business license to operate. These bond types are also referred to as “commercial bonds" or “business bonds." Examples of license and permit surety bonds include auto dealer bonds, mortgage broker bonds, and collection agency bonds.

What is an example of a commercial surety bond?

Different Types of Commercial Surety Bonds. Commercial surety bonds come in many different forms but a few are more popular than others: license and permit bonds, court bonds, fiduciary bonds, and public official bonds.

What is commercial surety?

A term generally used to refer to a person who undertakes to satisfy a payment or performance obligation owed by another person to a third party. A surety may give security over some or all of its assets in support of the undertaking in favour of the third party.

What is the difference between commercial surety and contract surety?

The main difference between commercial surety and contract surety bonds is the intended purpose. Commercial surety bonds are to ensure a business complies with all state regulations while contract surety bonds provide a financial guarantee for construction projects.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Commercial Surety Application?

A Commercial Surety Application is a formal request submitted to obtain a surety bond that guarantees the obligations of a business or individual in commercial activities.

Who is required to file Commercial Surety Application?

Individuals or businesses that wish to obtain a surety bond as a guarantee for fulfilling contractual obligations or legal requirements are required to file a Commercial Surety Application.

How to fill out Commercial Surety Application?

To fill out a Commercial Surety Application, you must provide detailed information about the applicant, the type of bond required, the purpose of the bond, financial information, and any relevant personal or business history.

What is the purpose of Commercial Surety Application?

The purpose of the Commercial Surety Application is to initiate the bonding process for individuals or businesses to secure financial guarantees to comply with laws and contractual obligations.

What information must be reported on Commercial Surety Application?

Information that must be reported includes the applicant's name, contact details, business structure, financial statements, a description of the obligations to be secured, and any prior bonding history.

Fill out your commercial surety application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Commercial Surety Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.