Get the free Wells Fargo Financing Program

Show details

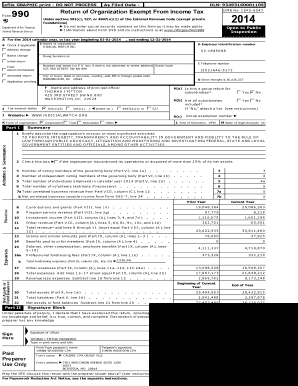

This document provides information about GAF's new financing program, the Home Projects Visa® credit card program, offered through Wells Fargo Retail Services for GAF dealers.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign wells fargo financing program

Edit your wells fargo financing program form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your wells fargo financing program form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit wells fargo financing program online

Follow the steps down below to take advantage of the professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit wells fargo financing program. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out wells fargo financing program

How to fill out Wells Fargo Financing Program

01

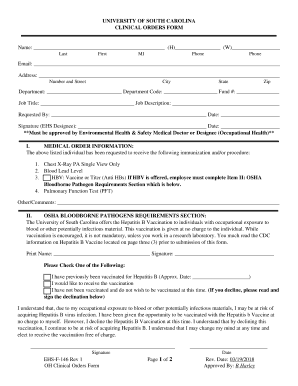

Gather necessary documents including income verification, credit history, and financial information.

02

Visit the Wells Fargo website or local branch to access the Financing Program application.

03

Complete the online application form or fill out a paper application, providing accurate and honest information.

04

Review the terms and conditions of the financing program before submitting your application.

05

Submit the application and await a decision from Wells Fargo regarding approval.

06

Upon approval, review your financing agreement and understand the repayment terms.

Who needs Wells Fargo Financing Program?

01

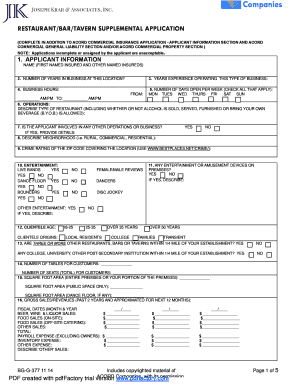

Individuals or families looking for financial assistance for home improvements, medical expenses, or other significant purchases.

02

Small business owners seeking funds for expansion, inventory, or operational costs.

03

Consumers needing flexible financing options for large purchases or unexpected expenses.

Fill

form

: Try Risk Free

People Also Ask about

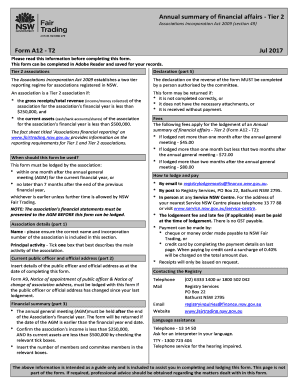

How hard is it to get a $30,000 personal loan?

As far as getting a loan it's going to hinge more on recent credit history, what your making yearly and what your debt to income ratio is. 30000 will be hard to get an unsecured loan with a credit score under 720, and even if you did you would have an interest rate over 20% most likely.

What credit score do I need for a $10,000 personal loan?

Those with a 640 or higher credit score are likely to find a number of options for a $10,000 personal loan; those with higher scores may have more options as well as more favorable terms.

Does Wells Fargo have a financial relief program?

If you find yourself struggling with credit card debt, hardship programs can help. Contact Wells Fargo Bank directly and let them know about your personal hardship. Provide as many details as possible about your financial situation. They will likely ask about your monthly income and expenses.

What is the minimum credit score for Wells Fargo financing?

You need a minimum credit score of 660 to get a personal loan from Wells Fargo, according to multiple third-party sources. That means a personal loan from Wells Fargo requires at least fair credit.

What is the lowest credit score for Wells Fargo?

Tip Exceptional (800 or better) You may generally be able to qualify for the best rates, depending on your debt-to-income (DTI) ratio and the amount of equity you have in any collateral. Very good (740 - 799) Good (670 - 739) Fair (580 - 669) Poor (300 - 579) No score -

What credit score is needed for a Wells Fargo loan?

Wells Fargo typically requires a credit score of at least 660 for personal loan approval, though higher scores may qualify for better rates.

Is Wells Fargo easy to get approved for?

Wells Fargo is known for easy approval and decent limits considering credit factors without having to bank there.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Wells Fargo Financing Program?

The Wells Fargo Financing Program provides financial services and solutions tailored for individuals and businesses, including loans and credit options designed to support various financial needs.

Who is required to file Wells Fargo Financing Program?

Individuals and businesses seeking financing options through Wells Fargo may be required to file applications and related documents to initiate the financing process.

How to fill out Wells Fargo Financing Program?

To fill out the Wells Fargo Financing Program, applicants should gather necessary financial documents, provide accurate personal and business information, and complete the application form, ensuring all required fields are filled.

What is the purpose of Wells Fargo Financing Program?

The purpose of the Wells Fargo Financing Program is to enable customers to access funding for personal or business needs, helping them manage cash flow, finance purchases, or invest in opportunities.

What information must be reported on Wells Fargo Financing Program?

Applicants must report personal identification information, financial details such as income and expenses, credit history, and the purpose of the financing request.

Fill out your wells fargo financing program online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Wells Fargo Financing Program is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.