Get the free Form 3919

Show details

This document outlines the terms and conditions of a Collateral Mortgage for real property under the Real Property Act (P.E.I.), detailing the obligations of the mortgagor and mortgagee regarding

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 3919

Edit your form 3919 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 3919 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 3919 online

To use the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form 3919. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 3919

How to fill out Form 3919

01

Obtain Form 3919 from the official IRS website or your local IRS office.

02

Read the instructions carefully to understand the purpose of the form.

03

Fill in your personal information, including your name, address, and Social Security number.

04

Indicate the type of account you are inquiring about by checking the appropriate box.

05

Provide any relevant details regarding the inquiry you are making.

06

Review your completed form for accuracy and completeness.

07

Sign and date the form at the designated area.

08

Send the completed Form 3919 to the appropriate address as specified in the instructions.

Who needs Form 3919?

01

Individuals who are seeking information regarding a decedent's tax liabilities.

02

Executors or administrators of an estate needing to report tax obligations.

03

Taxpayers who need clarification on prior IRS correspondence related to accrued tax debt.

Fill

form

: Try Risk Free

People Also Ask about

What is the IRS form to request a refund?

Use Form 843 to claim a refund or request an abatement of certain taxes, interest, penalties, fees, and additions to tax.

What are the types of refunds?

Types of Refunds Beyond tax refunds, there are also refunds for goods or services that businesses issue. Companies may issue refunds to customers based on their return policy.

What is form 145 in English?

Form 145 is a form that workers must submit to their company to communicate their personal and family situation, which is used to calculate the Personal Income Tax (IRPF) withholding rate.

What does form refer to in English?

Form is the shape, visual appearance, or configuration of an object. In a wider sense, the form is the way something happens. Form may also refer to: Form (document), a document (printed or electronic) with spaces in which to write or enter data.

What is a form 3911 taxpayer statement regarding refund?

Form 3911 is completed by the taxpayer to provide the Service with information needed to trace the nonreceipt or loss of the already issued refund check.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

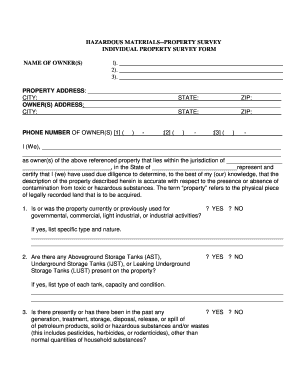

What is Form 3919?

Form 3919 is a form used by individuals to report their health coverage information to the Internal Revenue Service (IRS) for the purpose of claiming the Premium Tax Credit and for reconciling advance premium tax credit payments.

Who is required to file Form 3919?

Individuals who received advance premium tax credits through the Health Insurance Marketplace and need to reconcile those credits on their tax return are required to file Form 3919.

How to fill out Form 3919?

To fill out Form 3919, you will need to provide personal information such as your name, address, and Social Security number, as well as details about your health coverage, including the months you were covered and any advance premium tax credits you received.

What is the purpose of Form 3919?

The purpose of Form 3919 is to help the IRS verify that individuals are accurately reporting their health insurance coverage and calculating their Premium Tax Credit or reconciling any advance payments received.

What information must be reported on Form 3919?

Information that must be reported on Form 3919 includes your personal identification details, months of coverage, the amount of premium tax credits received, and any additional information required by the IRS related to your health insurance status.

Fill out your form 3919 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 3919 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.