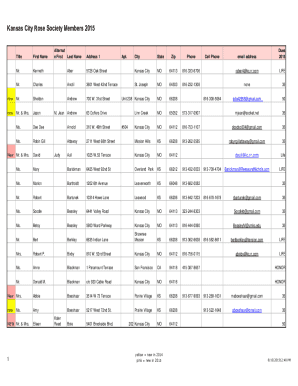

Get the free IMPORTANT U.S. TAX INFORMATION FOR AGILENT SPIN-OFF

Show details

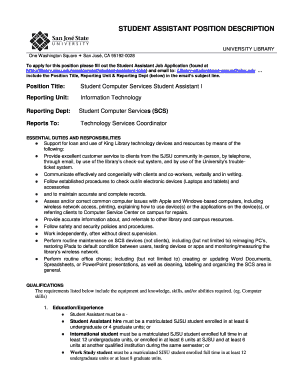

This document provides important tax information for shareholders of Hewlett-Packard regarding the distribution of shares in Agilent Technologies, including tax-free status and guidance on calculating

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign important us tax information

Edit your important us tax information form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your important us tax information form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit important us tax information online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit important us tax information. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out important us tax information

How to fill out IMPORTANT U.S. TAX INFORMATION FOR AGILENT SPIN-OFF

01

Gather all necessary financial documents related to the Agilent spin-off.

02

Identify your tax status and whether you are an individual or corporate taxpayer.

03

Review the IRS guidelines specific to spin-offs to understand the tax implications.

04

Fill out the forms required to report the spin-off income accurately.

05

Ensure you include any relevant information about the fair market value of the shares received.

06

Consult a tax professional for clarity if you have specific questions regarding your situation.

07

Submit the completed tax forms by the tax deadline.

Who needs IMPORTANT U.S. TAX INFORMATION FOR AGILENT SPIN-OFF?

01

Shareholders of Agilent Technologies who participated in the spin-off.

02

Individuals and corporations who received new shares as a result of the spin-off.

03

Tax professionals assisting clients with filings related to the spin-off.

04

Financial analysts reviewing the impacts of the spin-off on individual tax liabilities.

Fill

form

: Try Risk Free

People Also Ask about

When did Agilent spin-off Keysight?

When was Keysight spun off of Agilent? The Keysight distribution date was November 1, 2014.

Why did Agilent change to Keysight?

Agilent created Keysight to concentrate solely on the electronic measurement business, prioritizing electronic test equipment and measurement customers — leaving chemical and bio-analytical products to Agilent.

Why did Agilent stock drop?

Agilent Shares Fall After CFO Bob McMahon Steps Down. Agilent Technologies shares dropped after the company said Chief Financial Officer Bob McMahon will step down, effective July 31. Shares were down 6.3% at $112.56. The stock has been down 15.8% this year.

What is the Agilent Technologies scandal?

SAN FRANCISCO – Agilent Technologies, Inc. has agreed to pay the government $849,678 to resolve allegations that it submitted false claims to the United States in connection with the sale of electronic measurement instruments, United States Attorney Melinda Haag and Defense Criminal Investigative Service Special Agent

Why did Agilent spin off Keysight?

Agilent created Keysight to concentrate solely on the electronic measurement business, prioritizing electronic test equipment and measurement customers — leaving chemical and bio-analytical products to Agilent.

What is the new name for Agilent?

Keysight Technologies, Inc.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is IMPORTANT U.S. TAX INFORMATION FOR AGILENT SPIN-OFF?

The IMPORTANT U.S. TAX INFORMATION FOR AGILENT SPIN-OFF refers to tax implications and reporting requirements related to the spin-off of Agilent Technologies, which may affect shareholders and investors.

Who is required to file IMPORTANT U.S. TAX INFORMATION FOR AGILENT SPIN-OFF?

Shareholders who received shares in the Agilent spin-off and may have tax responsibilities or impacts due to the transaction are required to file the IMPORTANT U.S. TAX INFORMATION.

How to fill out IMPORTANT U.S. TAX INFORMATION FOR AGILENT SPIN-OFF?

To fill out the IMPORTANT U.S. TAX INFORMATION, shareholders should provide details such as the cost basis of the original shares, the fair market value of the distributed shares, and any relevant personal tax identification information.

What is the purpose of IMPORTANT U.S. TAX INFORMATION FOR AGILENT SPIN-OFF?

The purpose of the IMPORTANT U.S. TAX INFORMATION is to inform shareholders about their tax obligations and to assist them in accurately reporting their gains or losses from the spin-off on their tax returns.

What information must be reported on IMPORTANT U.S. TAX INFORMATION FOR AGILENT SPIN-OFF?

The information that must be reported includes the number of shares received, the date of the spin-off, the cost basis of the shares, and any necessary details related to tax calculations and reporting.

Fill out your important us tax information online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Important Us Tax Information is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.