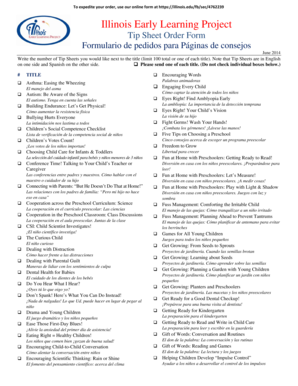

Get the free Brownfield/Grayfield Redevelopment Tax Credit Application

Show details

This document serves as an application for the Brownfield/Grayfield Redevelopment Tax Credit by the Iowa Economic Development Authority. It collects necessary information from applicants seeking tax

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign brownfieldgrayfield redevelopment tax credit

Edit your brownfieldgrayfield redevelopment tax credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your brownfieldgrayfield redevelopment tax credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit brownfieldgrayfield redevelopment tax credit online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit brownfieldgrayfield redevelopment tax credit. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out brownfieldgrayfield redevelopment tax credit

How to fill out Brownfield/Grayfield Redevelopment Tax Credit Application

01

Gather all necessary documentation related to the property, including environmental assessments and previous ownership records.

02

Download or request the Brownfield/Grayfield Redevelopment Tax Credit Application from the appropriate state agency.

03

Review the eligibility requirements outlined in the application instructions to ensure your property qualifies.

04

Complete all sections of the application form, providing concise and accurate information.

05

Attach any required supporting documents, such as a remediation plan, site maps, and photographs of the property.

06

Provide a detailed budget and timeline for the redevelopment project as requested in the application.

07

Review the application for completeness and accuracy before submission.

08

Submit the application along with any required fees to the designated agency by the specified deadline.

Who needs Brownfield/Grayfield Redevelopment Tax Credit Application?

01

Property owners or developers seeking financial incentives for the cleanup and redevelopment of contaminated or underutilized brownfield or grayfield sites.

02

Local governments looking to stimulate economic development by encouraging the revitalization of abandoned or underdeveloped areas.

03

Investors interested in funding redevelopment projects that can benefit from tax credits.

Fill

form

: Try Risk Free

People Also Ask about

What is the New York City biotech tax credit?

The NYC Biotechnology Tax Credit is designed to support investors and owners of qualified biotechnology companies. This tax credit can be applied against business corporation tax, general corporation tax, and unincorporated business tax.

What is the brownfield category?

Brownfield is previously-developed land that has been abandoned or underused, and which may carry pollution, or a risk of pollution, from industrial use. The specific definition of brownfield land varies and is decided by policy makers and land developers within different countries.

Who is eligible for the property tax credit in NY?

The real property tax credit may be available to New York State residents who have household gross incomes of $18,000 or less, and pay either real property taxes or rent for their residences. The amount of the credit for each household will vary depending on income and real property taxes paid (see table to the right).

What is the brownfield tax credit in NY?

The Brownfield Redevelopment Tax Credit (BRTC) is a fully-refundable tax credit available to businesses and individual taxpayers who have satisfactorily cleaned a brownfield site and have been issued a Certification of Completion by the New York State Department of Environmental Conservation.

What is the Brownfield Opportunity Area in NY?

The Brownfield Opportunity Area (BOA) Program is operated by the New York State Department of State and provides state planning funds to community-based organizations (CBOs) and municipalities to develop community plans for areas with multiple vacant properties or brownfields.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Brownfield/Grayfield Redevelopment Tax Credit Application?

The Brownfield/Grayfield Redevelopment Tax Credit Application is a formal request for tax credits aimed at encouraging the redevelopment of underutilized or contaminated properties (brownfields) and non-contaminated but potentially redevelopable sites (grayfields).

Who is required to file Brownfield/Grayfield Redevelopment Tax Credit Application?

Developers or property owners who are planning to undertake redevelopment projects on brownfield or grayfield sites must file this application to qualify for the associated tax credits.

How to fill out Brownfield/Grayfield Redevelopment Tax Credit Application?

To fill out the application, applicants need to provide detailed information regarding the property, including its location, project plans, estimated costs, and environmental assessments. Supporting documents should be attached as required by the application guidelines.

What is the purpose of Brownfield/Grayfield Redevelopment Tax Credit Application?

The purpose of the application is to facilitate the clean-up and redevelopment of contaminated or underutilized properties, thereby revitalizing communities, increasing property values, and promoting economic development.

What information must be reported on Brownfield/Grayfield Redevelopment Tax Credit Application?

The application must report information such as the property's eligibility status, project scope, estimated remediation costs, environmental assessments, and projected timelines for redevelopment.

Fill out your brownfieldgrayfield redevelopment tax credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Brownfieldgrayfield Redevelopment Tax Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.