Get the free MIP Valuation Requirements - Checklist - Genworth Australia

Show details

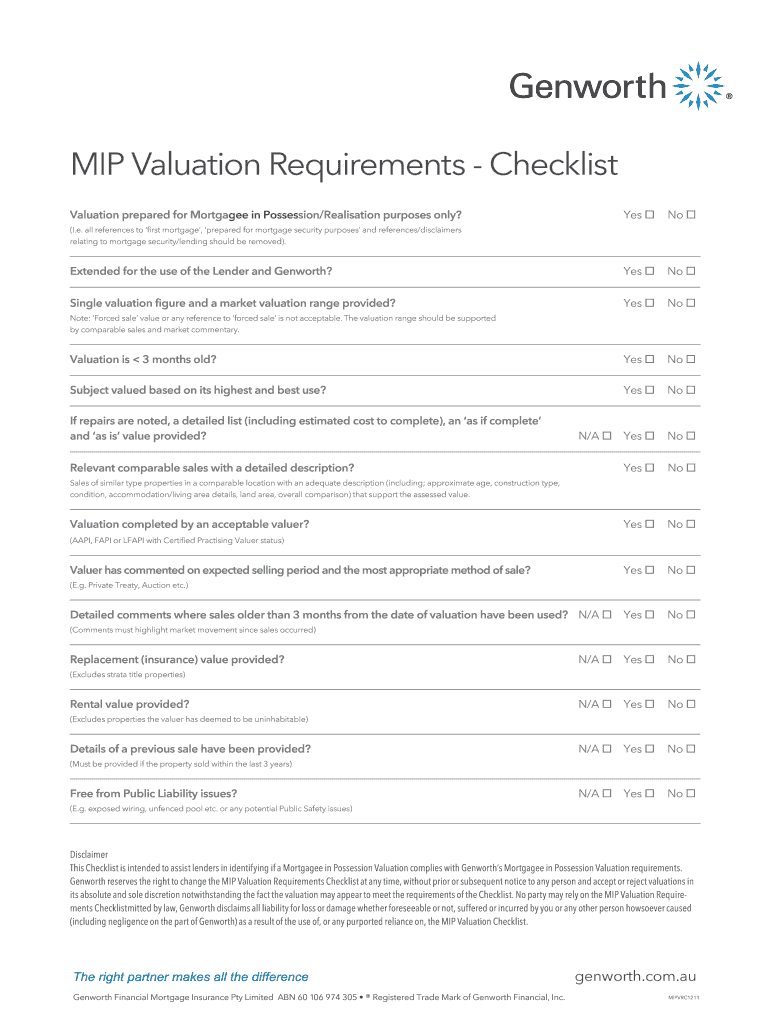

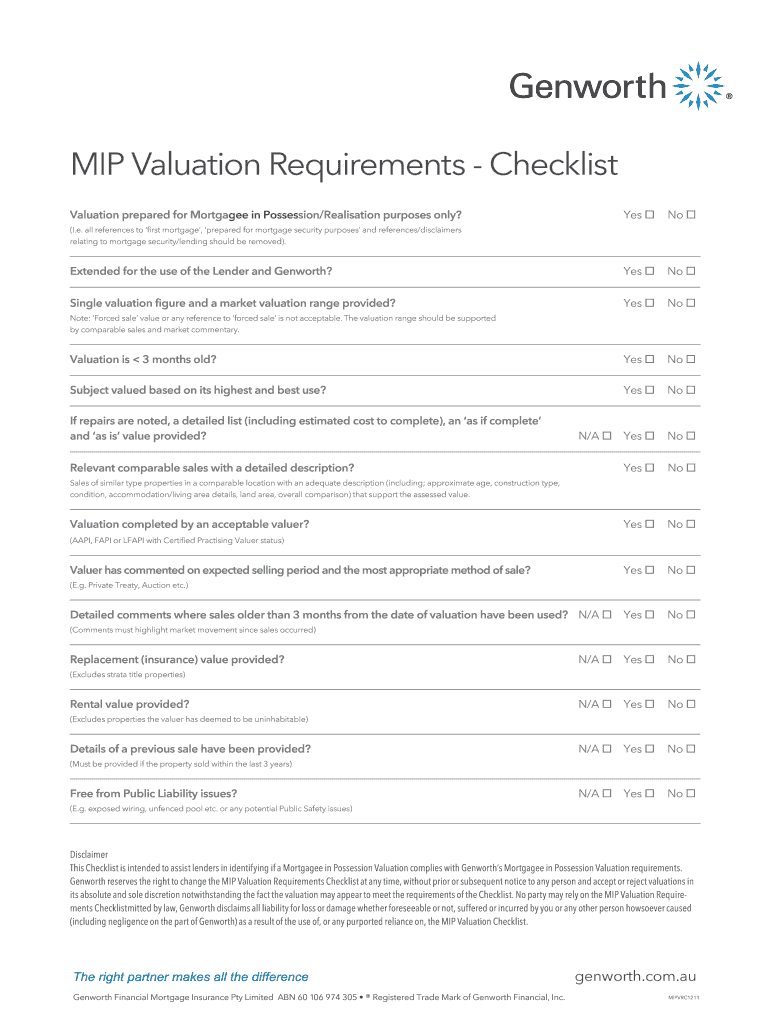

MIP Valuation Requirements Checklist Valuation prepared for Mortgagee in Possession×Realization purposes only? Yes No (I.e. all references to first mortgage, prepared for mortgage security purposes

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mip valuation requirements

Edit your mip valuation requirements form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mip valuation requirements form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mip valuation requirements online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit mip valuation requirements. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mip valuation requirements

How to fill out mip valuation requirements:

01

Start by gathering all necessary information and documentation related to the property that requires valuation. This can include property details, purchase agreements, previous appraisal reports, and any documents related to recent renovations or additions.

02

Familiarize yourself with the specific mip valuation requirements set by your jurisdiction or lending institution. These requirements may vary, so it is essential to have a clear understanding of what is expected during the valuation process.

03

Choose a qualified and certified appraiser who is experienced in conducting mip valuations. This is important to ensure that the appraisal report meets all the necessary standards and requirements set by the relevant authorities or lenders.

04

Schedule a valuation appointment with the selected appraiser. During the inspection, provide the appraiser with access to the property and answer any questions they may have regarding the property's features, condition, or recent renovations.

05

Provide the appraiser with any additional documentation or information that may be required, such as property tax records, floor plans, or photographs. This will help the appraiser in conducting a thorough and accurate valuation.

06

After the valuation inspection, the appraiser will analyze the gathered data, compare it with similar properties in the area, and apply relevant valuation methodologies to determine an accurate value for the property.

07

Once the appraisal report is finalized, review it carefully to ensure that all the necessary information has been included correctly. If any discrepancies or errors are found, contact the appraiser for corrections or clarifications.

Who needs mip valuation requirements?

01

Homebuyers applying for a mortgage loan insured by the Federal Housing Administration (FHA) are required to fulfill mip valuation requirements. This applies to those purchasing residential properties with an FHA loan.

02

Lenders who provide FHA-insured mortgage loans also need to adhere to the mip valuation requirements. They must ensure that the property being financed meets the necessary valuation standards set by the FHA.

03

Real estate professionals, such as real estate agents and brokers, may also need to be aware of mip valuation requirements to effectively guide and assist their clients who are purchasing a property with an FHA loan. Understanding these requirements can help them provide accurate information and advice to their clients throughout the homebuying process.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute mip valuation requirements online?

pdfFiller makes it easy to finish and sign mip valuation requirements online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

Can I sign the mip valuation requirements electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your mip valuation requirements in minutes.

How do I edit mip valuation requirements on an iOS device?

Create, edit, and share mip valuation requirements from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is mip valuation requirements?

The MIP valuation requirements refer to the guidelines set by the government for evaluating the value of collateral pledged for a Mortgage Insurance Premium (MIP) in certain loan programs.

Who is required to file mip valuation requirements?

Lenders and borrowers are typically required to file MIP valuation requirements when applying for certain loan programs that require mortgage insurance.

How to fill out mip valuation requirements?

MIP valuation requirements can be filled out by providing detailed information about the collateral being pledged for the mortgage insurance premium, including appraisals, property condition reports, and other relevant documents.

What is the purpose of mip valuation requirements?

The purpose of mip valuation requirements is to ensure that the collateral being pledged for the mortgage insurance premium is accurately valued to protect the lender in case of default on the loan.

What information must be reported on mip valuation requirements?

The information that must be reported on MIP valuation requirements includes property appraisals, property condition reports, and any other documentation related to the value of the collateral.

Fill out your mip valuation requirements online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mip Valuation Requirements is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.