Get the free Professional Gift Rate

Show details

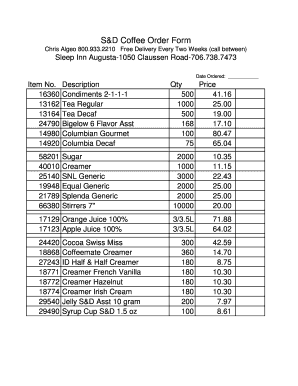

This document is an order form for a professional gift subscription that includes sending elegant gift cards and subscribing to a magazine for a year. It requires contact details, payment information,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign professional gift rate

Edit your professional gift rate form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your professional gift rate form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing professional gift rate online

To use the services of a skilled PDF editor, follow these steps below:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit professional gift rate. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out professional gift rate

01

To fill out the professional gift rate, you will need to gather the necessary information and follow a specific process. Here is a point-by-point guide:

1.1

Determine the purpose: Understand why you are filling out the professional gift rate. Is it for tax purposes, employee recognition, or promotional activities? Identifying the purpose will help you provide accurate information.

1.2

Identify the gift recipients: Make a list of individuals or organizations who will receive the professional gifts. Note down their names, addresses, and any other relevant details.

1.3

Specify the gift details: Describe the gifts you plan to give. Include the name or type of the gift, its value, and any special features or considerations that should be noted.

1.4

Research applicable regulations: Familiarize yourself with the laws and regulations governing professional gifting in your country or industry. This may include tax laws, limits on gift values, and any reporting requirements.

1.5

Determine the appropriate rate: Consider the guidelines or recommendations regarding professional gift rates. These rates can vary based on factors such as industry norms, business relationships, and the nature of the gifts. Consult with relevant authorities or professional associations if necessary.

1.6

Complete the documentation: Fill out the required forms or paperwork provided by your company or regulatory authorities. Ensure that all information is accurate, legible, and up to date. Double-check for any additional requirements specific to your situation.

1.7

Seek approval if needed: Some organizations or jurisdictions may require approval or review of the professional gift rate. If necessary, submit the completed documentation for review to the appropriate department or authorities.

02

The professional gift rate is relevant to various individuals and organizations, depending on their specific needs and circumstances. Here are some examples of who might require a professional gift rate:

2.1

Businesses: Companies often give professional gifts to clients, partners, or vendors as a way to strengthen relationships, express gratitude, or promote their products or services. Determining the appropriate gift rate ensures compliance with tax laws and regulatory requirements.

2.2

Employees: Employers may offer gifts to their employees as a form of recognition, appreciation, or incentives. Establishing a professional gift rate helps ensure fairness and consistency in gift-giving practices across the organization.

2.3

Tax authorities: Professional gift rates are important for tax authorities to ensure accurate reporting and taxation of gifts. By adhering to specified rates, individuals and organizations can avoid potential tax issues or penalties.

2.4

Professional associations: Certain industries or professional associations may have specific guidelines regarding professional gift rates. Adhering to these guidelines promotes ethical conduct and standardizes gift-giving practices within the industry.

2.5

Individuals: Depending on personal situations, individuals may need to determine a professional gift rate when giving gifts in a professional capacity. This can include self-employed individuals, freelancers, or consultants who want to ensure appropriate gift-giving practices.

Overall, anyone involved in professional gift-giving or receiving should be aware of the professional gift rate and follow the necessary steps to ensure compliance and ethical conduct.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get professional gift rate?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific professional gift rate and other forms. Find the template you want and tweak it with powerful editing tools.

How do I edit professional gift rate online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your professional gift rate to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

Can I edit professional gift rate on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign professional gift rate. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is professional gift rate?

Professional gift rate refers to the rate at which gifts are given in a professional setting.

Who is required to file professional gift rate?

Individuals and organizations involved in professional gift giving are required to file professional gift rate.

How to fill out professional gift rate?

To fill out professional gift rate, you need to provide relevant information such as the value of the gift, recipient details, and purpose of the gift.

What is the purpose of professional gift rate?

The purpose of professional gift rate is to monitor and regulate the exchange of gifts in professional settings to ensure transparency and prevent unethical practices.

What information must be reported on professional gift rate?

The information that must be reported on professional gift rate includes the value of the gift, recipient's name and contact information, nature of the professional relationship, and any additional details required by the regulating authority.

Fill out your professional gift rate online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Professional Gift Rate is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.