Get the free Tax CollectorCity of Shelton

Show details

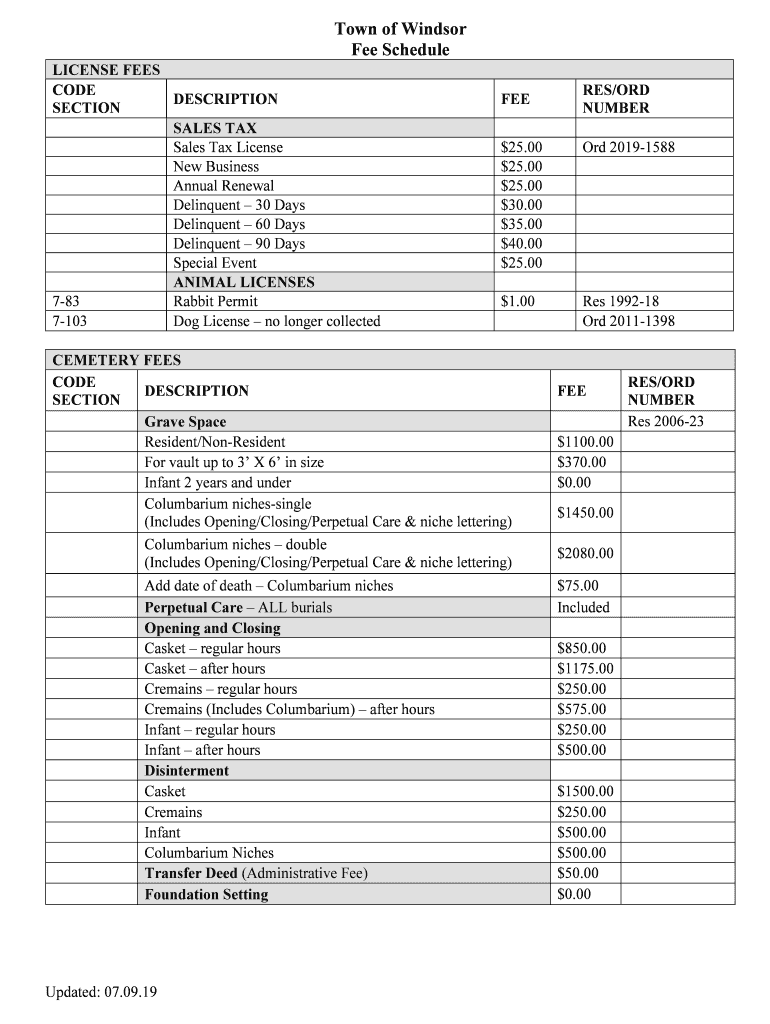

Town of Windsor Fee ScheduleLICENSE FEES CODE DESCRIPTION SECTION SALES TAX License New Business Annual Renewal Delinquent 30 Days Delinquent 60 Days Delinquent 90 Days Special Event ANIMAL LICENSES

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax collectorcity of shelton

Edit your tax collectorcity of shelton form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax collectorcity of shelton form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax collectorcity of shelton online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit tax collectorcity of shelton. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax collectorcity of shelton

How to fill out tax collectorcity of shelton?

01

Gather all necessary documents: Before starting the process of filling out the tax collectorcity of shelton forms, ensure that you have all the required documents handy. These may include your identification documents, income statements, property information, and any other relevant financial records.

02

Understand the form: Familiarize yourself with the tax collectorcity of shelton form you are required to fill out. Read the instructions carefully to ensure that you understand the sections and any specific requirements or guidelines.

03

Provide accurate information: Make sure to provide accurate and up-to-date information in each section of the form. This may include details about your income, deductions, assets, or any other relevant information that is required by the tax collectorcity of shelton.

04

Double-check for errors: Once you have completed filling out the form, take the time to double-check for any errors or omissions. Mistakes could cause delays in processing your tax information or even result in penalties. Review all the details you have provided to ensure accuracy.

05

Submit the form: After confirming that all the information on the tax collectorcity of shelton form is accurate, submit it according to the instructions provided. This may involve mailing the form to the designated address or submitting it online, depending on the specific requirements of the tax collectorcity of shelton.

Who needs tax collectorcity of shelton?

01

Residents of Shelton, Connecticut: The tax collectorcity of shelton is primarily for residents of Shelton, Connecticut. It is required for individuals who earn income or own property within the city's jurisdiction.

02

Property owners: If you own property in Shelton, you will need to utilize the services of the tax collectorcity of shelton. This includes paying property taxes and any other relevant fees or assessments related to homeownership within the city.

03

Individuals with taxable income: If you have taxable income, either from employment, investments, or other sources, you may need to interact with the tax collectorcity of shelton. This could involve filing income tax returns, making tax payments, or addressing any tax-related inquiries or issues.

04

Business entities: Business entities operating within Shelton may also need to engage with the tax collectorcity of shelton. This may include registering a business, obtaining necessary licenses or permits, and fulfilling any tax obligations associated with running a business in the city.

05

Residents seeking tax information or assistance: The tax collectorcity of shelton can also provide assistance and information to residents who have questions about tax-related matters. If you need clarification on tax laws or have concerns about your tax obligations, contacting the tax collectorcity of shelton can be helpful.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is tax collectorcity of shelton?

The Tax Collector in the City of Shelton is responsible for collecting taxes from residents and businesses.

Who is required to file tax collectorcity of shelton?

All residents and businesses in the City of Shelton are required to file taxes with the Tax Collector.

How to fill out tax collectorcity of shelton?

To fill out taxes with the Tax Collector in the City of Shelton, individuals and businesses can download forms online or visit the Tax Collector's office.

What is the purpose of tax collectorcity of shelton?

The purpose of the Tax Collector in the City of Shelton is to collect taxes in order to fund public services and infrastructure projects.

What information must be reported on tax collectorcity of shelton?

Taxpayers must report their income, expenses, and any deductions on their tax forms for the City of Shelton.

Can I sign the tax collectorcity of shelton electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your tax collectorcity of shelton in seconds.

How do I fill out the tax collectorcity of shelton form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign tax collectorcity of shelton and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How do I edit tax collectorcity of shelton on an Android device?

With the pdfFiller Android app, you can edit, sign, and share tax collectorcity of shelton on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

Fill out your tax collectorcity of shelton online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Collectorcity Of Shelton is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.