Get the free Business Checks and Forms from a company you can Trust

Show details

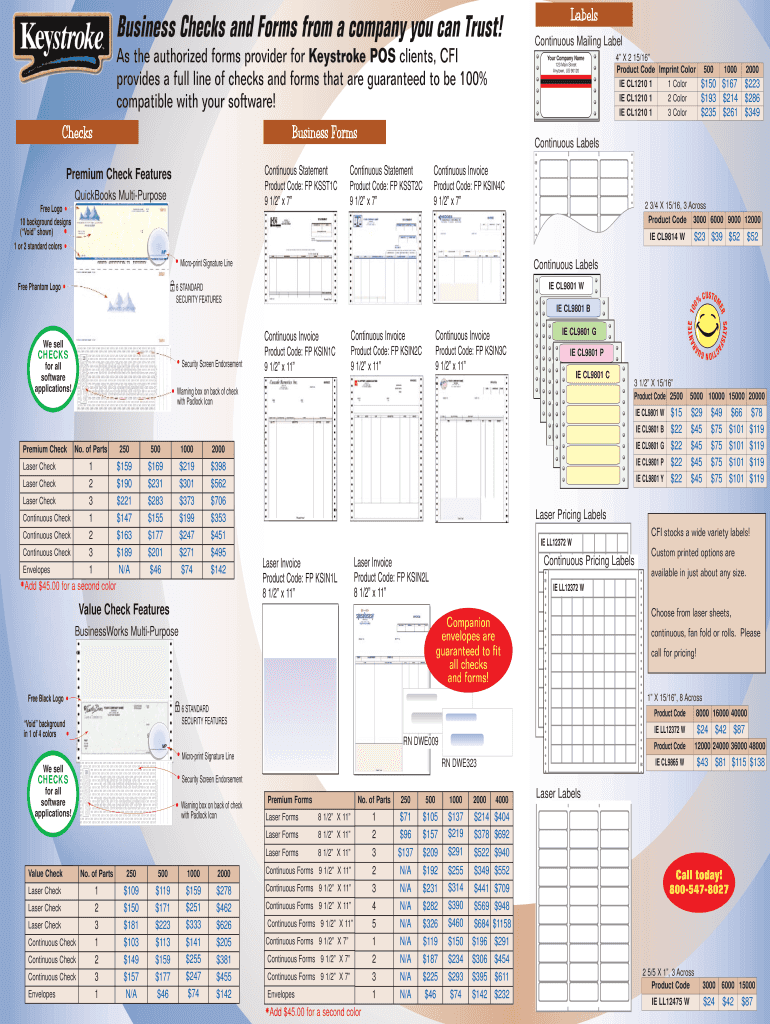

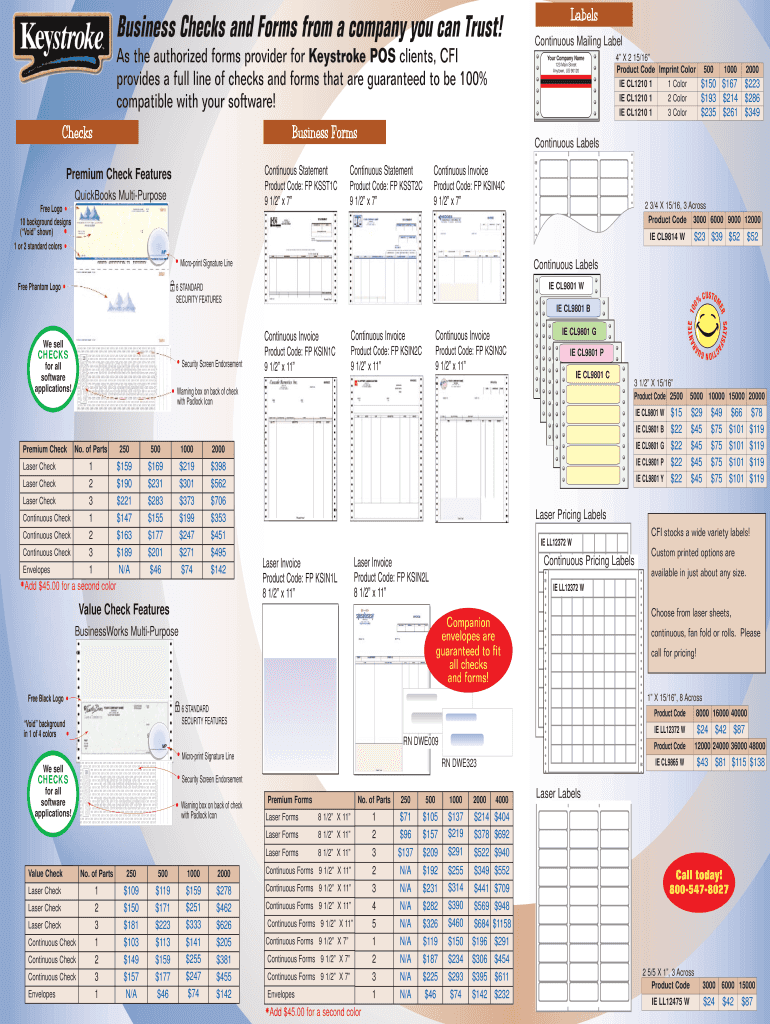

Business Checks and Forms from a company you can Trust! As the authorized forms' provider for Keystroke POS clients, CFI provides a full line of checks and forms that are guaranteed to be 100% compatible

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business checks and forms

Edit your business checks and forms form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business checks and forms form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit business checks and forms online

To use the services of a skilled PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit business checks and forms. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business checks and forms

How to fill out business checks and forms?

01

Start by gathering all the necessary information and materials. This typically includes the business's name, address, and contact information, as well as the recipient's details, such as their name and address. Ensure that you have the correct forms and checkbook available.

02

Begin by filling out the date on the business check and form. This is important for record-keeping and helps to track transactions accurately. Write the date using the day, month, and year format.

03

In the "Pay to the Order Of" field, write the name of the recipient or the company/person to whom the check is being issued. Make sure the name is accurate and matches the information provided.

04

Fill out the numerical amount of the payment in the designated field. Write the exact amount using both numbers and words to avoid any confusion. For example, if the payment amount is $100, write "100.00" in the numerical field and "One hundred dollars" in the words field.

05

Fill out the memo line if necessary. The memo line is an optional field where you can specify the purpose of the payment or any additional information you want to include. For example, if the payment is for invoice number XYZ, you can write "Payment for invoice XYZ" in the memo line.

06

The signature line is crucial as it authorizes the payment. Make sure to sign the check using the authorized person's signature, typically from the business's bank account.

07

Verify all the information entered on the check and form for accuracy. Double-check the recipient's name, payment amount, and any other details to ensure everything is correct before proceeding.

Who needs business checks and forms?

01

Business owners: Business checks and forms are primarily needed by business owners to make payments to suppliers, vendors, or other parties. They provide a formal and professional way to handle financial transactions and maintain proper documentation.

02

Accounting departments: Accounting departments within businesses also require business checks and forms. They use these to process payments, track expenses, and maintain accurate financial records for tax purposes and internal auditing.

03

Non-profit organizations: Non-profit organizations often need business checks and forms to handle their financial transactions. These can include payments to employees, suppliers, or donations received from contributors. The checks and forms help maintain transparency and accountability within the organization.

04

Independent contractors: Independent contractors or freelancers who run their own businesses may also use business checks and forms. They use these to receive payments from clients for their services rendered. It allows them to present a professional image and ensures smooth payment processing.

05

Small businesses: Small businesses, including sole proprietors and partnerships, make use of business checks and forms to manage their financial transactions. These records help them keep track of expenses, income, and payments made, which is vital for accurate financial management and reporting.

In conclusion, filling out business checks and forms involves gathering the necessary information and materials, accurately entering the details on the check and form, and verifying the information before processing the payment. Business checks and forms are essential for business owners, accounting departments, non-profit organizations, independent contractors, and small businesses to handle financial transactions, maintain records, and manage their finances effectively.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify business checks and forms without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your business checks and forms into a dynamic fillable form that you can manage and eSign from any internet-connected device.

Can I sign the business checks and forms electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your business checks and forms in minutes.

How do I fill out the business checks and forms form on my smartphone?

Use the pdfFiller mobile app to complete and sign business checks and forms on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

What is business checks and forms?

Business checks and forms are documents used by businesses to track financial transactions and report income and expenses to the relevant authorities.

Who is required to file business checks and forms?

All businesses, including self-employed individuals, partnerships, corporations, and limited liability companies, are required to file business checks and forms.

How to fill out business checks and forms?

Business checks and forms can be filled out manually or electronically, depending on the requirements of the relevant authority. It is important to accurately report all income and expenses.

What is the purpose of business checks and forms?

The purpose of business checks and forms is to accurately report income, expenses, and financial transactions to the relevant authorities for tax and regulatory purposes.

What information must be reported on business checks and forms?

Business checks and forms typically require information such as business income, expenses, deductions, and relevant financial transactions. Specific requirements may vary depending on the type of business and the relevant tax laws.

Fill out your business checks and forms online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Checks And Forms is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.