Get the free Life Insurance Beneficiary Nomination Ordinary

Show details

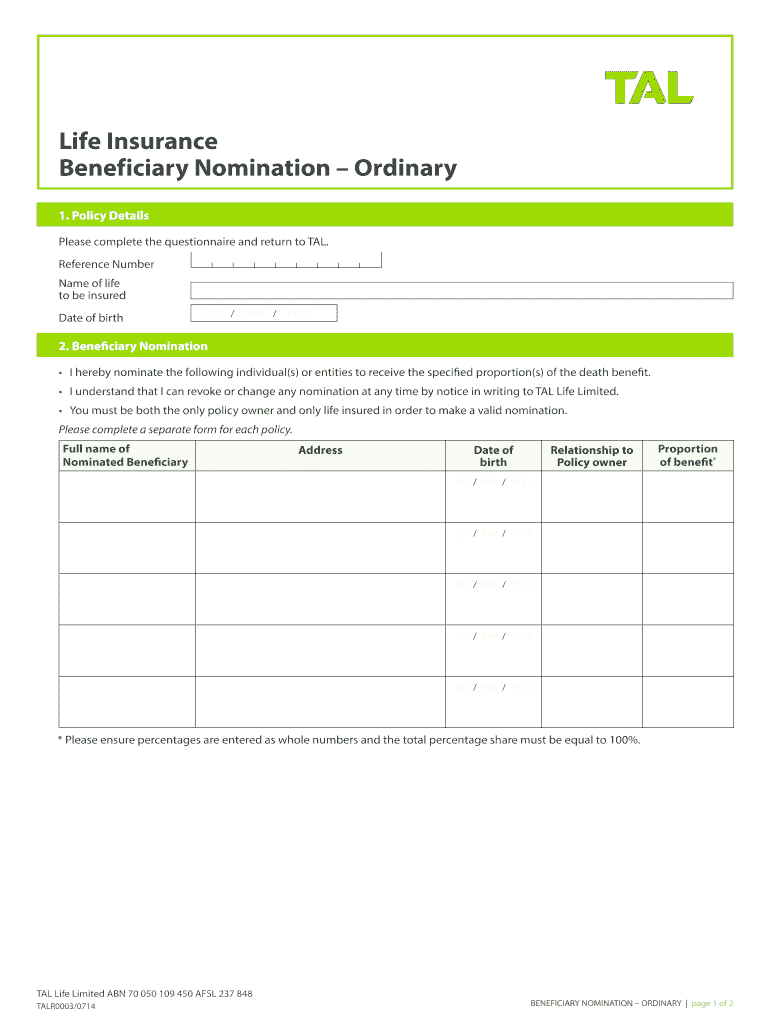

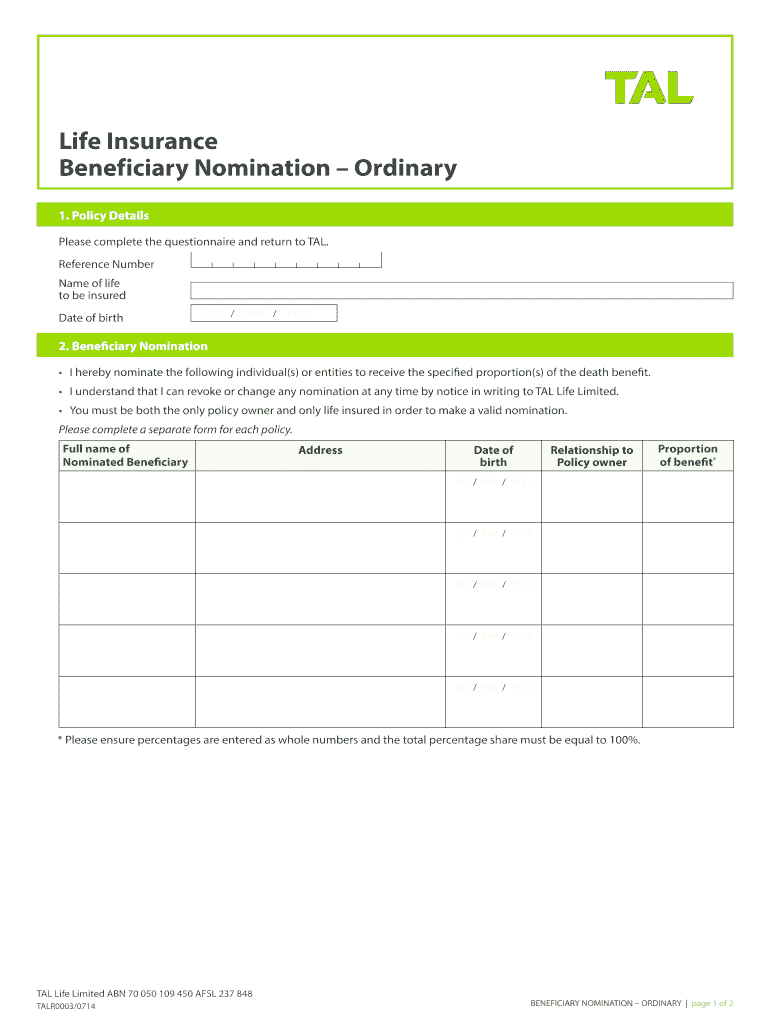

Life Insurance Beneficiary Nomination Ordinary 1. Policy Details Please complete the questionnaire and return to TAIL. Reference Number Name of life to be insured Date of birth DD / MM / YYY 2. Beneficiary

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign life insurance beneficiary nomination

Edit your life insurance beneficiary nomination form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your life insurance beneficiary nomination form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit life insurance beneficiary nomination online

To use the services of a skilled PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit life insurance beneficiary nomination. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out life insurance beneficiary nomination

How to Fill Out a Life Insurance Beneficiary Nomination:

01

Gather the necessary information: Before filling out the beneficiary nomination form, it's important to collect the required information. This includes the full legal names, dates of birth, and contact information of the intended beneficiaries.

02

Understand the options: Familiarize yourself with the different beneficiary designation options available. Common options include primary beneficiaries, contingent beneficiaries, and their respective percentages of the benefit payout.

03

Consult with legal and financial professionals: If you have complex financial or legal situations, it's always a good idea to seek guidance from professionals who can provide personalized advice tailored to your specific situation.

04

Obtain the beneficiary nomination form: Contact your life insurance provider or obtain the form from their website. It may also be available through your employer if the life insurance policy is offered as a workplace benefit.

05

Fill out the form accurately: Complete the beneficiary nomination form using the information you gathered in step 1. Pay close attention to details and double-check for accuracy. Errors in beneficiary designations can lead to complications in the future, so it's essential to be thorough.

06

Name primary and contingent beneficiaries: Designate the primary beneficiaries, who will receive the life insurance benefit upon your passing. It's also recommended to name contingent beneficiaries, who will receive the benefit if your primary beneficiaries predecease you or are unable to claim the benefit.

07

Specify the percentage allocation: Indicate the percentage of the benefit each designated beneficiary should receive. For example, you may wish to split the benefit equally among multiple beneficiaries or allocate specific percentages based on your personal preferences.

08

Review and sign the form: Carefully review the completed form for accuracy and clarity. Once you are satisfied, date and sign the beneficiary nomination form. Some forms may require witness signatures or notarization, so be sure to follow the instructions provided.

Who Needs Life Insurance Beneficiary Nomination?

Life insurance beneficiary nomination is necessary for anyone who owns a life insurance policy and wants to control how the policy benefits are distributed after their passing. It allows policyholders to ensure that their loved ones or chosen individuals receive financial support in the event of their death. Having a designated beneficiary is especially crucial for individuals who have dependents, such as spouses, children, or other family members who rely on their financial support. By nominating beneficiaries, you can provide financial security and peace of mind for your loved ones during a challenging time.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit life insurance beneficiary nomination online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your life insurance beneficiary nomination to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I make edits in life insurance beneficiary nomination without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing life insurance beneficiary nomination and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

Can I create an electronic signature for the life insurance beneficiary nomination in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your life insurance beneficiary nomination in seconds.

What is life insurance beneficiary nomination?

Life insurance beneficiary nomination is the designation of a person or entity to receive the proceeds of a life insurance policy upon the death of the insured.

Who is required to file life insurance beneficiary nomination?

The policyholder or the insured individual is required to file a life insurance beneficiary nomination.

How to fill out life insurance beneficiary nomination?

To fill out a life insurance beneficiary nomination, the policyholder or insured will need to complete the designated form provided by the insurance company and provide the necessary information of the chosen beneficiary.

What is the purpose of life insurance beneficiary nomination?

The purpose of life insurance beneficiary nomination is to ensure that the policy proceeds are distributed according to the wishes of the policyholder or insured individual upon their death.

What information must be reported on life insurance beneficiary nomination?

The information required on a life insurance beneficiary nomination typically includes the full name, contact details, and relationship to the insured of the designated beneficiary.

Fill out your life insurance beneficiary nomination online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Life Insurance Beneficiary Nomination is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.