Get the free COMMITMENT FOR TITLE INSURANCE Issued by TITLE RESOURCES

Show details

COMMITMENT FOR TITLE INSURANCE Issued by TITLE RESOURCES GUARANTY COMPANY We, Title Resources Guaranty Company, will issue our title insurance policy or policies (the Policy) to You (the proposed

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign commitment for title insurance

Edit your commitment for title insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your commitment for title insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

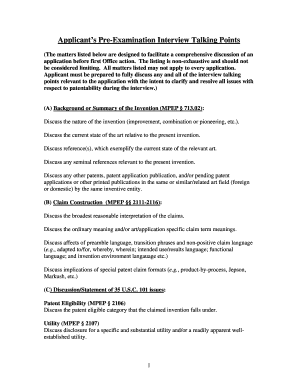

Editing commitment for title insurance online

To use the professional PDF editor, follow these steps:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit commitment for title insurance. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out commitment for title insurance

How to fill out a commitment for title insurance:

01

Obtain the commitment form: The first step is to acquire the commitment form from the title insurance company or agent. This form is typically provided when you are in the process of purchasing real estate.

02

Verify the accuracy of the information: Review the commitment form thoroughly to ensure that all the information is accurate and matches the details of the property and transaction. This includes the names of the property owners, legal description of the property, and any outstanding liens or encumbrances.

03

Provide necessary documents: Gather and attach any necessary documents as requested in the commitment form. This may include copies of deeds, mortgages, survey reports, and other relevant paperwork. Make sure to submit all the required documents to complete the commitment form accurately.

04

Fill in the required information: Complete the commitment form by filling in the necessary information. This often includes your name, contact details, the property address, and any additional details requested by the title insurance company.

05

Disclose any known issues: If you are aware of any title defects or concerns regarding the property, it is important to disclose them in the commitment form. This ensures transparency and allows the title insurance company to assess the risk associated with issuing the policy.

06

Double-check the form: Before submitting the commitment form, review it once again to ensure that all the information is accurate, complete, and legible. Any errors or omissions could cause delays in the title insurance process.

Who needs commitment for title insurance?

01

Homebuyers: When purchasing a home, it is essential for homebuyers to obtain a commitment for title insurance. This protects them from potential legal and financial risks associated with any title defects or claims that may arise after the purchase.

02

Lenders: Lenders typically require title insurance to protect their investment in the property. A commitment for title insurance assures the lender that their mortgage or lien will have priority over any other claims or encumbrances on the property.

03

Real estate investors: Investors involved in the acquisition or sale of multiple properties often need commitment for title insurance. This helps safeguard their investments and ensures a smooth transaction process by identifying any potential issues before closing the deal.

04

Refinancing homeowners: Homeowners who are refinancing their mortgages may also be required to obtain a commitment for title insurance. This is done to protect the new lender's interest in the property and to confirm the property's ownership status.

In summary, anyone involved in a real estate transaction, including homebuyers, lenders, real estate investors, and refinancing homeowners, may need a commitment for title insurance to protect themselves from potential title-related issues and claims.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the commitment for title insurance electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your commitment for title insurance.

How do I fill out the commitment for title insurance form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign commitment for title insurance and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How do I edit commitment for title insurance on an Android device?

With the pdfFiller Android app, you can edit, sign, and share commitment for title insurance on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is commitment for title insurance?

Title insurance commitment is a document that outlines the conditions under which a title insurance policy will be issued.

Who is required to file commitment for title insurance?

Typically, it is the responsibility of the title insurance company to file the commitment for title insurance.

How to fill out commitment for title insurance?

To fill out a commitment for title insurance, you will need to provide the necessary information about the property and other relevant details.

What is the purpose of commitment for title insurance?

The purpose of commitment for title insurance is to outline the conditions that need to be met before a title insurance policy can be issued.

What information must be reported on commitment for title insurance?

Information such as property details, title defects, liens, and any other relevant information must be reported on commitment for title insurance.

Fill out your commitment for title insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Commitment For Title Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.