Get the free Income Statement for the Financial Year 2012-13 (Assessment Year ...

Show details

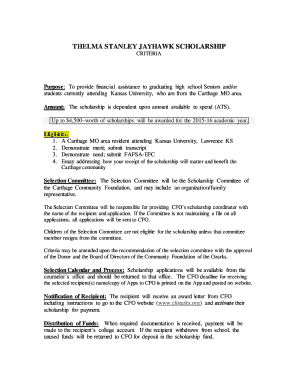

Center of Excellence Govt. College, Anjali Income Statement for the Financial Year 201213 (Assessment Year 201314) Name Designation PAN 1 Gross Salary for the year (including arrears) 2 Exempted incomes

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign income statement for form

Edit your income statement for form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your income statement for form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing income statement for form online

To use the professional PDF editor, follow these steps below:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit income statement for form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out income statement for form

How to Fill Out an Income Statement for Form:

01

Gather all necessary financial information: Before starting to fill out the income statement, make sure you have all relevant financial documents and information readily available. This may include your bank statements, sales records, expense receipts, and any other relevant financial records.

02

Identify the different categories: Determine the various categories that need to be included in the income statement. Typically, these categories include revenues, expenses, and net income. It is essential to have a clear understanding of what falls under each category.

03

Calculate Total Revenues: Start by calculating the total revenues of the business. This includes all sources of income, such as sales, services, and any other forms of revenue generated by the business. Add up the values and write the total in the designated section.

04

Deduct Cost of Goods Sold (COGS): If your business involves selling physical products, you will need to calculate the cost of goods sold (COGS). This includes the direct costs associated with the production or acquisition of the products being sold. Subtract the COGS from the total revenues and record the resulting value.

05

Determine Operating Expenses: Identify and list all the operating expenses incurred by your business, such as rent, utilities, salaries, marketing costs, and any other expenses necessary for day-to-day operations. Total all these expenses and write the final amount in the designated section of the income statement.

06

Calculate Operating Income: To calculate the operating income, subtract the total operating expenses from the resulting value after deducting the COGS from total revenues. This will indicate the profitability of your core business operations.

07

Include Non-Operating Income and Expenses: If your business has any non-operating income or expenses, such as interest income or one-time charges, make sure to include them in the income statement. Add or subtract these values accordingly to calculate the net operating income.

08

Deduct Taxes: Determine the amount of taxes owed by your business based on the applicable tax rate. Subtract the tax expenses from the net operating income to calculate the net income.

09

Review and Finalize: Double-check all calculations and ensure that all necessary information has been included in the income statement. Make any necessary adjustments or corrections before finalizing the document.

Who Needs an Income Statement for Form?

An income statement for form may be required by various parties, including:

01

Business Owners: Income statements are vital for business owners as they provide a comprehensive overview of the financial performance of the business. It allows them to assess profitability and make informed decisions about the future of the company.

02

Potential Investors or Lenders: Investors and lenders often require an income statement to evaluate the financial health and sustainability of a business. This statement helps them determine whether they should invest in or lend money to the business.

03

Financial Analysts or Accountants: Professionals in the finance and accounting field may need an income statement while performing financial analysis or providing consultation services to the business. It allows them to assess the financial standing of the company and provide valuable insights.

04

Government Agencies: Tax authorities and other government agencies may request income statements as part of their regular auditing or tax assessment procedures. These statements help them verify the accuracy of reported incomes and expenses.

In summary, filling out an income statement for a form requires gathering financial information, categorizing revenues and expenses, calculating net operating income, and deducting taxes. The income statement is necessary for business owners, potential investors or lenders, financial analysts or accountants, and government agencies.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send income statement for form to be eSigned by others?

When you're ready to share your income statement for form, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Can I create an eSignature for the income statement for form in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your income statement for form and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I edit income statement for form on an Android device?

The pdfFiller app for Android allows you to edit PDF files like income statement for form. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is income statement for form?

The income statement for form is a financial document that shows a company's revenue and expenses over a specific period of time.

Who is required to file income statement for form?

Companies and businesses of all sizes are required to file an income statement for form.

How to fill out income statement for form?

To fill out an income statement for form, you will need to list all sources of income and expenses for the specified period.

What is the purpose of income statement for form?

The purpose of the income statement for form is to provide a snapshot of a company's financial performance.

What information must be reported on income statement for form?

Information such as revenue, expenses, net income, and earnings per share must be reported on an income statement for form.

Fill out your income statement for form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Income Statement For Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.