Get the free Returning to the PST and GST

Show details

Este documento proporciona información sobre el retorno del Impuesto sobre Ventas Provincial (PST) y el Impuesto sobre Bienes y Servicios (GST) en Columbia Británica, explicando cómo se aplican

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign returning to form pst

Edit your returning to form pst form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your returning to form pst form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing returning to form pst online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit returning to form pst. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out returning to form pst

How to fill out Returning to the PST and GST

01

Gather all relevant sales records and documentation for the reporting period.

02

Identify the total sales amounts subject to PST and GST.

03

Calculate the total PST collected during the reporting period based on applicable rates.

04

Calculate the total GST collected during the reporting period based on applicable rates.

05

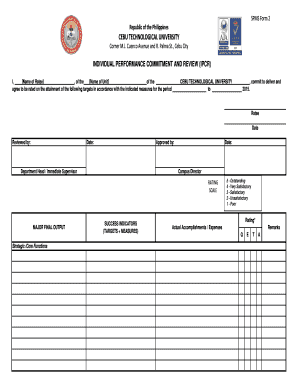

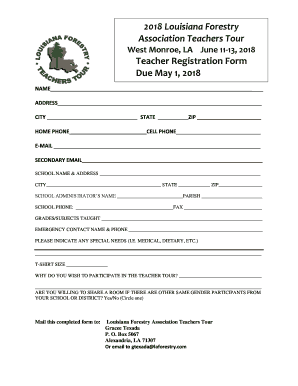

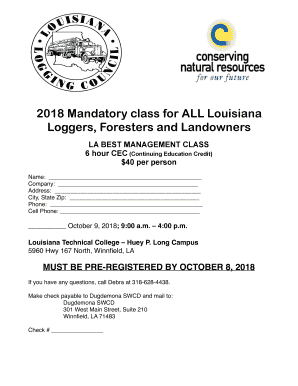

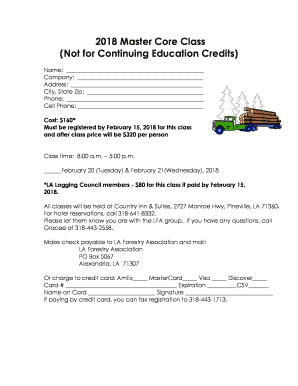

Complete the required form for PST and GST returns, ensuring all fields are accurately filled out.

06

Include any allowable deductions, such as exempt sales.

07

Review your calculations and ensure all information is correct.

08

Submit the completed return form to the appropriate tax authority by the deadline.

09

Keep copies of your return and any supporting documents for your records.

Who needs Returning to the PST and GST?

01

Businesses that sell goods or services subject to Provincial Sales Tax (PST) and Goods and Services Tax (GST).

02

Self-employed individuals who engage in taxable sales.

03

Companies operating in provinces that assess PST and GST.

04

Entities that are registered for both PST and GST for compliance purposes.

Fill

form

: Try Risk Free

People Also Ask about

What is GST return in English?

A GST return is a document containing details of all income/sales and/or expenses/purchases that a GST-registered taxpayer (every GSTIN) is required to file with the tax administrative authorities. This is used by tax authorities to calculate net tax liability.

What is a GST return?

Filing a GST/HST return also refers to claiming the GST/HST you pay on services or supplies that you need to run your business. Those purchases could be eligible for a credit, up to a certain limit. This credit is commonly called a 'write-off' or 'business expense'.

What is GST and PST in Canada?

The Canadian sales taxes include the Provincial Sales Tax (PST), the Quebec Sales Tax (QST), the Goods and Services Tax (GST), and the Harmonized Sales Tax (HST) which is a combination of the provincial sales tax portion and the GST in some provinces.

Can I claim back GST when I leave Canada?

Yes, tourists can get a tax refund when leaving Canada through the Visitor Rebate Program. This program allows non-residents to claim refunds on the Goods and Services Tax (GST) and the Harmonized Sales Tax (HST) paid on eligible goods and services purchased in Canada.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Returning to the PST and GST?

Returning to the PST (Provincial Sales Tax) and GST (Goods and Services Tax) refers to the process where businesses report their collected sales tax and remit the owed amount to the relevant tax authority.

Who is required to file Returning to the PST and GST?

Businesses that collect PST and GST on taxable goods and services sold within the province or country are required to file returns.

How to fill out Returning to the PST and GST?

To fill out the return, businesses need to provide details of their total sales, the amount of PST and GST collected, and any exemptions or adjustments before calculating the total amount owed.

What is the purpose of Returning to the PST and GST?

The purpose is to ensure accurate reporting and remittance of sales tax collected by businesses, which is used to fund public services and infrastructure.

What information must be reported on Returning to the PST and GST?

Businesses must report total sales, taxable sales, exempt sales, the amount of PST and GST collected, and any applicable deductions or refunds.

Fill out your returning to form pst online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Returning To Form Pst is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.