Get the free Chapter 13 Plan - Southern District of Mississippi - United States ... - mssb uscourts

Show details

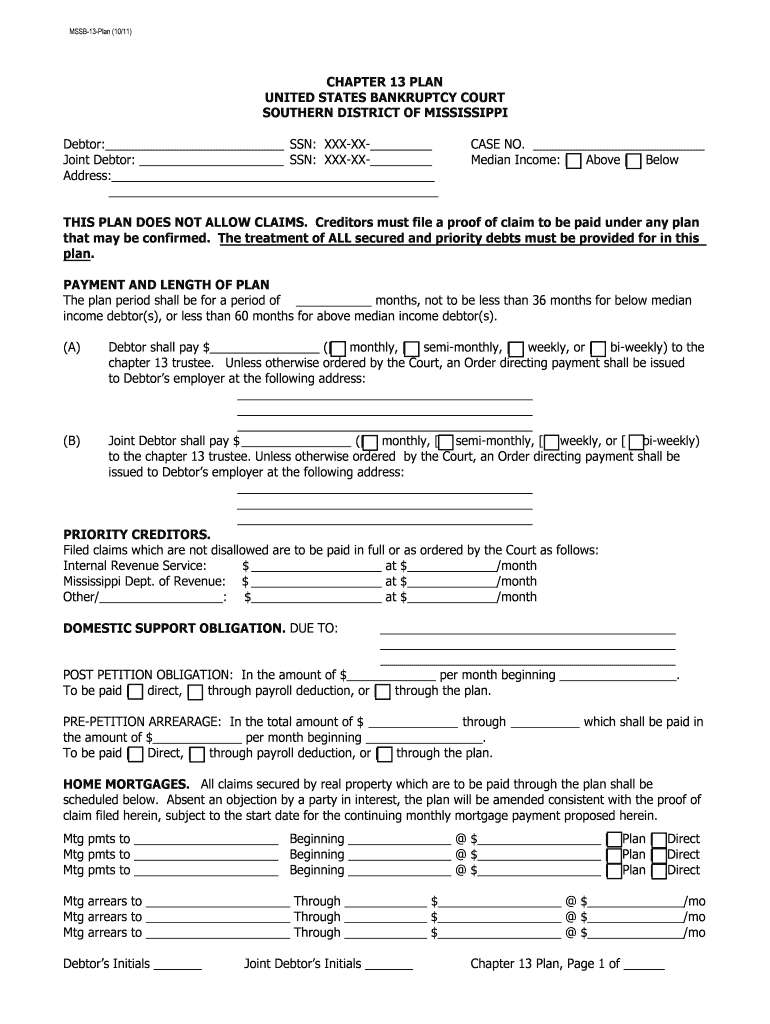

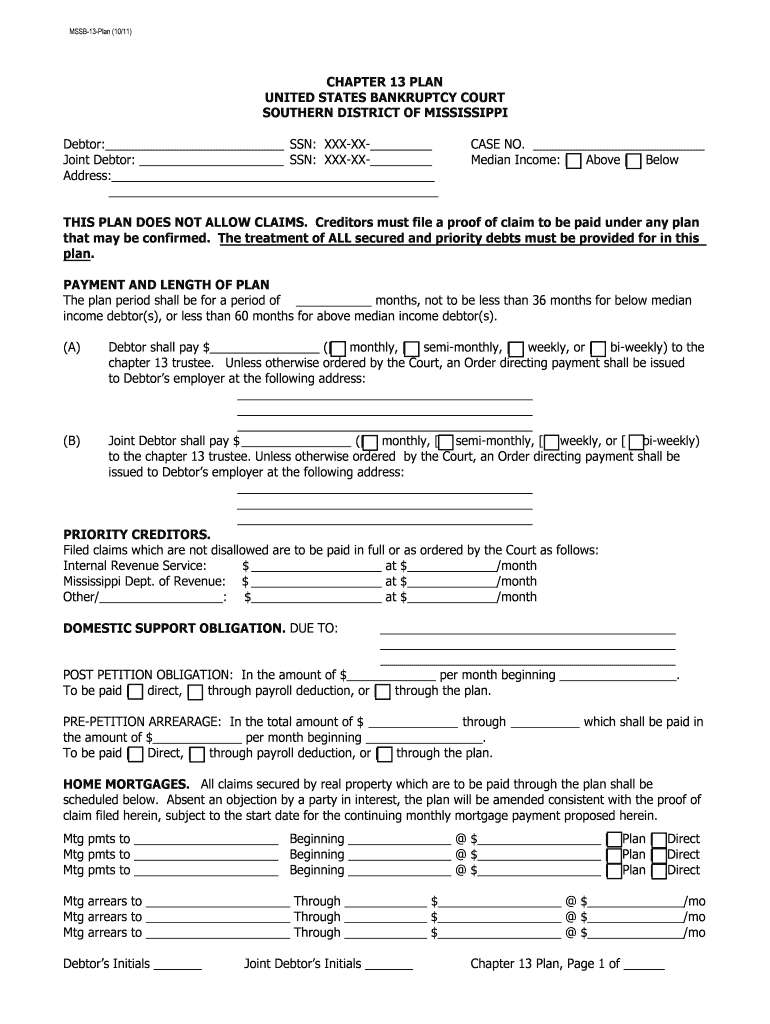

MSSB13Plan (10×11) CHAPTER 13 PLAN UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT OF MISSISSIPPI Debtor: SSN: XXXIX Joint Debtor: SSN: XXXIX Address: CASE NO. Median Income: Above Below THIS PLAN

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign chapter 13 plan

Edit your chapter 13 plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your chapter 13 plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing chapter 13 plan online

Follow the steps below to use a professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit chapter 13 plan. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out chapter 13 plan

How to fill out a chapter 13 plan:

01

Gather all necessary financial information: Before filling out a chapter 13 plan, you need to gather all your financial information. This includes details of your income, expenses, debts, assets, and any other relevant financial documents.

02

Consult with a bankruptcy attorney: It is highly recommended to consult with a bankruptcy attorney who specializes in chapter 13 cases. They will guide you through the entire process and help you understand the specific requirements and regulations applicable to your situation.

03

Complete the required forms: You will need to complete several forms to file a chapter 13 plan, such as the official bankruptcy forms and schedules. These forms require you to provide detailed information about your financial situation, creditors, income, expenses, and proposed repayment plan.

04

Develop a repayment plan: The main purpose of a chapter 13 plan is to propose a repayment plan to your creditors. This plan should outline how you intend to repay your debts over the next three to five years. Your plan should consider your income, necessary expenses, and the amount you can reasonably afford to pay each month.

05

Submit the plan to the court: Once you have completed the required forms and developed your repayment plan, you need to submit them to the bankruptcy court. Along with the plan, you may also need to provide additional supporting documents, such as proof of income and tax returns.

06

Attend the confirmation hearing: After submitting your chapter 13 plan, a confirmation hearing will be scheduled. During this hearing, the bankruptcy trustee and your creditors have the opportunity to review and object to your proposed plan. You, along with your attorney, will need to attend this hearing to address any concerns or objections.

07

Make the agreed-upon payments: If the court approves your chapter 13 plan, you will be required to make regular monthly payments to the bankruptcy trustee. These payments will be used to repay your creditors according to the terms outlined in your plan. It is crucial to make these payments on time to stay in compliance with your repayment plan.

08

Complete the plan successfully: The chapter 13 plan typically lasts for three to five years. During this time, you must make all the required payments and meet your obligations under the plan. Once you have successfully completed the plan, any remaining eligible debts may be discharged.

Who needs a chapter 13 plan?

01

Individuals with a regular income: Chapter 13 bankruptcy is primarily designed for individuals with a regular income who are unable to fully repay their debts but have the means to make partial payments over time.

02

Those facing foreclosure or repossession: Chapter 13 can help individuals prevent foreclosure or repossession by providing them with an opportunity to catch up on missed mortgage or car loan payments through the repayment plan.

03

Debtors with non-exempt property: Chapter 13 allows debtors to keep their non-exempt property, such as a home or a valuable asset, by proposing a feasible repayment plan that satisfies their creditors.

04

Individuals who do not qualify for chapter 7: If you do not meet the eligibility requirements for chapter 7 bankruptcy, such as the means test, chapter 13 may be a viable option.

It is important to note that every financial situation is unique, and the decision to pursue a chapter 13 plan should be made after careful consideration and consultation with a bankruptcy attorney.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send chapter 13 plan for eSignature?

Once your chapter 13 plan is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Where do I find chapter 13 plan?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific chapter 13 plan and other forms. Find the template you want and tweak it with powerful editing tools.

Can I create an electronic signature for signing my chapter 13 plan in Gmail?

Create your eSignature using pdfFiller and then eSign your chapter 13 plan immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

What is chapter 13 plan?

Chapter 13 plan is a repayment plan approved by the bankruptcy court that allows individuals with regular income to pay off their debts over a period of three to five years.

Who is required to file chapter 13 plan?

Individuals with regular income who have unsecured debts less than $394,725 and secured debts less than $1,184,200 are required to file a chapter 13 plan.

How to fill out chapter 13 plan?

To fill out a chapter 13 plan, you must gather information about your income, expenses, assets, debts, and proposed repayment plan. This information will then be submitted to the bankruptcy court for approval.

What is the purpose of chapter 13 plan?

The purpose of chapter 13 plan is to provide individuals with a structured way to repay their debts while keeping their assets and avoiding liquidation.

What information must be reported on chapter 13 plan?

Information such as income, expenses, assets, debts, proposed repayment plan, and any other relevant financial details must be reported on a chapter 13 plan.

Fill out your chapter 13 plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Chapter 13 Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.