Get the free Memorandum of Liability Coverage - California JPIA

Show details

Memorandum of Liability Coverage Issued to the Agency Effective July 1, 2014, July 1, 2015, Administered by the California Joint Powers Insurance Authority Effective July 1, 2014, July 1, 2015, as

We are not affiliated with any brand or entity on this form

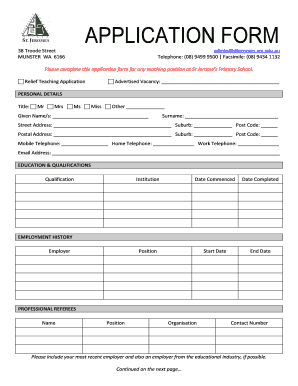

Get, Create, Make and Sign memorandum of liability coverage

Edit your memorandum of liability coverage form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your memorandum of liability coverage form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit memorandum of liability coverage online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit memorandum of liability coverage. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out memorandum of liability coverage

How to fill out a memorandum of liability coverage:

01

Begin by filling out the heading of the memorandum, which includes the name of the insurance company, policy number, and effective date of coverage.

02

Provide the insured party's details, such as their name, address, and contact information.

03

Indicate the type of liability coverage being provided, whether it is for general liability, professional liability, or another specific type.

04

Specify the limits of liability, which refers to the maximum amount the insurance company will pay in the event of a covered claim.

05

Outline any exclusions or limitations to the coverage, such as specific activities or types of claims that are not covered.

06

Include any additional insured parties, if applicable, by providing their names and contact information.

07

Describe the scope of coverage, including the scope of services or products being covered and any additional endorsements or extensions to the coverage.

08

Provide signatures from both the insured party and the insurance company, acknowledging their agreement to the terms and conditions.

09

Keep a copy of the completed memorandum for your records and send a copy to the insurance company.

Who needs a memorandum of liability coverage:

01

Businesses and organizations that engage in activities that pose potential risks or liabilities.

02

Professionals in fields such as medicine, law, accounting, or architecture, who may be held liable for errors or omissions in their work.

03

Contractors, construction companies, and tradespeople who may cause property damage or bodily injury while performing their services.

04

Event organizers or venues that host gatherings where accidents or injuries could occur.

05

Landlords or property owners who require liability coverage for their premises.

06

Manufacturers or distributors of products that have the potential to cause harm or damage.

07

Non-profit organizations that interact with the public or provide services to individuals.

08

Individuals seeking personal liability coverage for activities such as operating a rental property or participating in high-risk hobbies.

Note: It is essential to consult with an insurance professional or legal expert to determine the specific requirements and coverage needed for each situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete memorandum of liability coverage online?

With pdfFiller, you may easily complete and sign memorandum of liability coverage online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I edit memorandum of liability coverage online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your memorandum of liability coverage to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I edit memorandum of liability coverage straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing memorandum of liability coverage, you need to install and log in to the app.

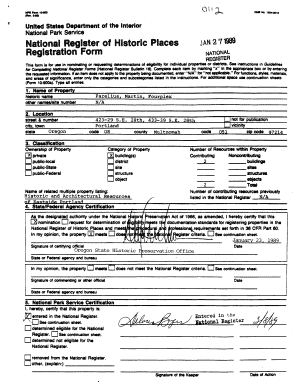

What is memorandum of liability coverage?

The memorandum of liability coverage is a document that outlines the details of an insurance policy that provides coverage for liability claims.

Who is required to file memorandum of liability coverage?

Businesses and individuals who are required to carry liability insurance are required to file a memorandum of liability coverage.

How to fill out memorandum of liability coverage?

The memorandum of liability coverage can be filled out by providing all the required information about the insurance policy and submitting it to the appropriate authority.

What is the purpose of memorandum of liability coverage?

The purpose of the memorandum of liability coverage is to ensure that businesses and individuals have the appropriate insurance coverage to protect against liability claims.

What information must be reported on memorandum of liability coverage?

The memorandum of liability coverage must include details about the insurance policy, such as the coverage limits, policy number, insurance company, and effective dates.

Fill out your memorandum of liability coverage online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Memorandum Of Liability Coverage is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.