Get the free SPECIAL PROPERTY TRANSFER TAX RETURN

Show details

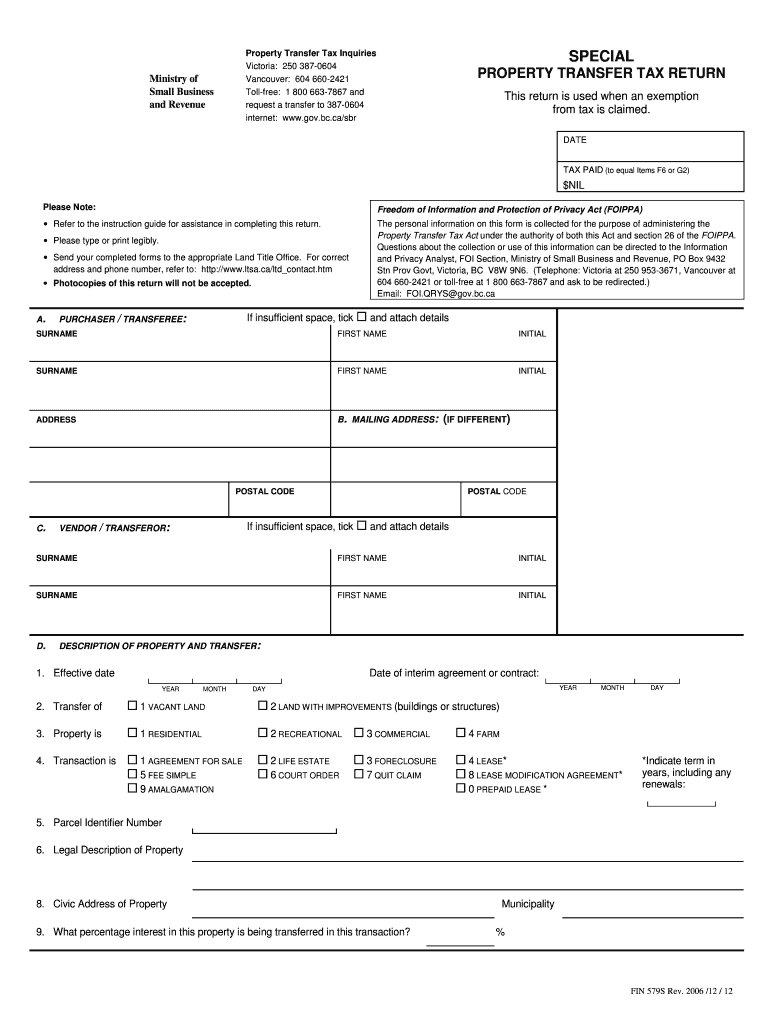

This return is used to claim an exemption from the Property Transfer Tax and to provide necessary details related to the property transfer, including information about the purchaser, vendor, and transaction

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign special property transfer tax

Edit your special property transfer tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your special property transfer tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit special property transfer tax online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit special property transfer tax. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out special property transfer tax

How to fill out SPECIAL PROPERTY TRANSFER TAX RETURN

01

Obtain the SPECIAL PROPERTY TRANSFER TAX RETURN form from your local tax office or online.

02

Fill in the property owner's details including name, address, and contact information.

03

Provide the property description, including the legal description and address of the property being transferred.

04

Indicate the type of transfer (sale, gift, or other transfer) and provide the date of transfer.

05

List the purchase price or fair market value of the property.

06

Complete any additional sections regarding exemptions or special circumstances if applicable.

07

Sign and date the form to certify the information is correct.

08

Submit the completed form to the appropriate tax authority by the specified deadline.

Who needs SPECIAL PROPERTY TRANSFER TAX RETURN?

01

Individuals or entities that are transferring property ownership in a jurisdiction that requires a Special Property Transfer Tax Return.

02

Property sellers, buyers, or individuals gifting property.

03

Real estate agents or attorneys facilitating property transfers.

Fill

form

: Try Risk Free

People Also Ask about

Do you pay GST and PTT on new homes in BC?

In the vast majority of situations, Goods and Services Tax & Property Transfer Tax are payable on newly constructed properties and presale condos in British Columbia.

Who has to pay foreign buyers tax in BC?

In British Columbia, if the property is within specified area, a foreign national must pay an additional foreign buyer property tax on the individual's proportionate share of a residential property's fair market value.

What are the new property transfer tax rules in BC?

Effective January 1, 2025, subject to legislative approval, a new 20% tax will be applied to income derived from the sale of BC properties that are zoned for residential use or contain a “housing unit”. The Flipping Tax is in addition to the Federal government's 50% capital gains counterpart introduced in 2022.

Who has to pay property transfer tax in BC?

When you purchase or gain an interest in property that is registered at the Land Title Office, you or your legal professional must file a property transfer tax return and you must pay property transfer tax, unless you qualify for an exemption.

How much is the PPT in BC?

How Is It Calculated? The amount of the Property Transfer Tax is 1% on the first $200,000.00 of the property's fair market value, 2% on the amount between $200,000 and $2,000,000, and 3% on the amount between $2,000,000 and $3,000,000, and 5% of the remaining fair market value.

Who pays property transfer tax in Spain?

Who pays transfer tax? The buyer in all cases.

Who qualifies for property tax exemption in Massachusetts?

Massachusetts laws Includes clauses for real estate tax exemptions for blind persons, qualifying senior citizens, qualifying surviving spouses, minor children and elderly persons, qualifying veterans, and religious and charitable organizations.

Who pays PTT in BC?

On the purchase of any property in British Columbia, the purchaser must pay Property Transfer Tax (PTT) on the transaction.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is SPECIAL PROPERTY TRANSFER TAX RETURN?

SPECIAL PROPERTY TRANSFER TAX RETURN is a legal document filed to report the transfer of property ownership and to determine the associated taxes owed on that transfer.

Who is required to file SPECIAL PROPERTY TRANSFER TAX RETURN?

The seller or transferor of the property is typically required to file a SPECIAL PROPERTY TRANSFER TAX RETURN, although in some jurisdictions, the buyer may also be responsible.

How to fill out SPECIAL PROPERTY TRANSFER TAX RETURN?

To fill out the SPECIAL PROPERTY TRANSFER TAX RETURN, you must provide details about the property being transferred, the parties involved in the transaction, the sale price, and any exemptions or deductions applicable.

What is the purpose of SPECIAL PROPERTY TRANSFER TAX RETURN?

The purpose of the SPECIAL PROPERTY TRANSFER TAX RETURN is to assess the tax liability related to the transfer of property ownership, ensuring compliance with local tax regulations.

What information must be reported on SPECIAL PROPERTY TRANSFER TAX RETURN?

The information that must be reported includes the property address, names of the parties involved, sale price, date of transfer, and any relevant exemptions or tax credits.

Fill out your special property transfer tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Special Property Transfer Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.