Get the free SIP Performance of Select Schemes

Show details

The document provides details on the performance of various equity mutual fund schemes under the Systematic Investment Plan (SIP) as of March 31, 2015, including investment amounts, returns, benchmarks,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sip performance of select

Edit your sip performance of select form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sip performance of select form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sip performance of select online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit sip performance of select. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

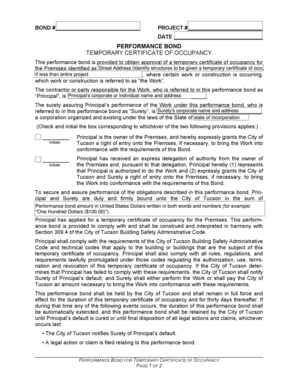

How to fill out sip performance of select

How to fill out SIP Performance of Select Schemes

01

Gather the relevant financial documents and information needed for the SIP Performance of Select Schemes.

02

Identify the specific schemes you want to assess and gather their performance data.

03

Fill in the basic details such as scheme name, investment amount, and investment date in the required fields.

04

Record the performance metrics such as annual returns, investment duration, and comparison benchmarks.

05

Double-check all entered data for accuracy and completeness.

06

Submit or save the filled document as per the guidelines provided.

Who needs SIP Performance of Select Schemes?

01

Investors looking to evaluate the performance of their investment schemes.

02

Financial advisors who assist clients in managing their investment portfolios.

03

Fund managers monitoring the performance of different schemes.

04

Regulatory bodies analyzing the performance of mutual funds for compliance.

Fill

form

: Try Risk Free

People Also Ask about

How to calculate SIP performance?

How to Use a Systematic Investment Plan Calculator Enter Your Monthly SIP Amount: Enter the value of the fixed money you desire to invest each month. Enter the Expected Annual Return: Based on historical trends, equity funds have the potential to deliver higher returns over the long term. Choose the Investment Tenure:

Is 15% return possible from SIP?

If you can continue investing consistently for 15 years and ensure your portfolio can manage a return of 15%, an SIP calculator will show you how, using the simple compounding method, your investment will exponentially grow to ₹1,01,52,946.

What is the 70 20 10 rule in SIP?

The 70:20:10 rule helps safeguard SIPs by allocating 70% to low-risk, 20% to medium-risk, and 10% to high-risk investments, ensuring stability, balanced growth, and high returns while managing market fluctuations.

What is meant by SIP?

SIP stands for Systematic Investment Plan. It is a disciplined way of investing a fixed amount regularly into mutual funds, helping you grow wealth over time by leveraging the power of compounding and rupee cost averaging.

How to check SIP performance?

Consolidated Account Statement (CAS) CAS is one of the best ways to track SIP investments. CAS gives a consolidated view of all the mutual fund schemes you hold across different fund houses in the form of a single statement. This information will cover unit holdings, balance, and transaction history for each.

What is the 7 5 3 1 rule in SIP?

Breaking down the 7-5-3-1 rule The 7-5-3-1 rule in mutual fund investing is essentially a behavioural framework designed for SIP investors in equity mutual funds. It encompasses four major aspects: time horizon, diversification, emotional discipline, and contribution escalation.

What is SIP performance?

SIPs offer a disciplined approach to investing, enabling individuals to contribute regularly to their preferred mutual funds while benefiting from market fluctuations and the power of compounding.

Which SIP gives 40% return?

LIC MF Small Cap Fund delivered 40.03% XIRR on SIP investments made on January 1, 2024. The other 258 equity mutual funds active in the mentioned period gave SIP returns ranging between -0.98% and 39.84% in 2024.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is SIP Performance of Select Schemes?

SIP Performance of Select Schemes refers to the evaluation metrics that assess the returns generated by systematic investment plans (SIPs) in various mutual fund schemes over a specific time frame.

Who is required to file SIP Performance of Select Schemes?

Mutual fund houses and asset management companies are required to file SIP Performance of Select Schemes to provide transparency and help investors make informed decisions.

How to fill out SIP Performance of Select Schemes?

To fill out SIP Performance of Select Schemes, one must enter details such as the scheme name, the amount invested, the period of investment, and the resulting returns, ensuring that the data is accurate and complies with regulatory standards.

What is the purpose of SIP Performance of Select Schemes?

The purpose of SIP Performance of Select Schemes is to provide investors with a clear understanding of how their investments are performing, enabling them to assess the effectiveness of their chosen schemes.

What information must be reported on SIP Performance of Select Schemes?

The information that must be reported includes the scheme name, investment amount, duration of the SIP, total returns, annualized return rate, and any applicable fees or charges.

Fill out your sip performance of select online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sip Performance Of Select is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.