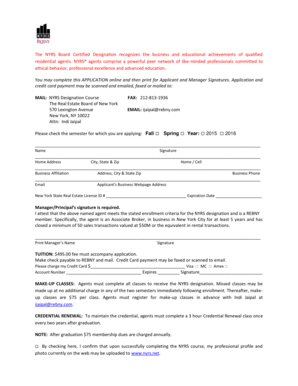

Get the free TAIFOOK MPF RETIREMENT FUND

Show details

This document serves as a third addendum to the explanatory memorandum for the Taifook MPF Retirement Fund, detailing changes in names of the fund and its funds, as well as changes in the investment

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign taifook mpf retirement fund

Edit your taifook mpf retirement fund form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your taifook mpf retirement fund form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit taifook mpf retirement fund online

Follow the steps down below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit taifook mpf retirement fund. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out taifook mpf retirement fund

How to fill out TAIFOOK MPF RETIREMENT FUND

01

Gather personal identification documents (e.g., HK ID card or passport).

02

Contact Taifook's customer service or visit their website to obtain the application form.

03

Fill out the application form with your personal details, including name, address, and contact information.

04

Select your preferred investment options as outlined in the form.

05

Provide details of your employment and income.

06

Review the filled-out form for accuracy and completeness.

07

Submit the application form either online or by mailing it to Taifook's designated address.

08

Await confirmation of your application and contributions from Taifook.

Who needs TAIFOOK MPF RETIREMENT FUND?

01

Employees in Hong Kong contributing to Mandatory Provident Fund (MPF).

02

Self-employed individuals looking for retirement savings options.

03

Individuals seeking a structured investment plan for retirement.

04

People interested in long-term financial security in their retirement years.

Fill

form

: Try Risk Free

People Also Ask about

How do I claim my MPF when I leave Hong Kong?

How To Withdraw Your MPF Before the Age of 65 1 Prove that you are leaving on a long-term basis, with no intention to return for employment or residency. 2 Notify the Mandatory Provident Fund Schemes Authority. 3 Submit tax returns. 4 Directly contact MPFA to speed up the process.

Can I withdraw my MPF from outside Hong Kong?

You must provide proof that you have left or are about to leave Hong Kong permanently with no intention to return or resettle as a permanent resident. You may be eligible to withdraw your accrued benefits early if you have a terminal illness that is likely to reduce your life expectancy to 12 months or less.

How many times can I withdraw my MPF?

Withdrawal options If taken out in part, you can decide when and how much, but note that if you take out benefits more than four times a year, your MPF scheme trustee can charge extra. However you withdraw benefits, you should think carefully about how to use the money and manage it.

Is MPF withdrawal taxable in Hong Kong?

Upon withdrawal of MPF by scheme members, the sum derived from mandatory contributions is not taxable. Generally, when employees withdraw their MPF derived from voluntary contributions, only the voluntary contributions made by their employers may be taxable (depending on the circumstances and timing of the withdrawal).

How long does it take to withdraw MPF in Hong Kong?

How Do I Withdraw My Mandatory Provident Fund From HSBC? AspectDetails Methods Withdraw online with account details or in person at an HSBC branch with ID documents. Processing Time Online takes up to 10 business days; in-person varies by branch. Fees Fees may apply based on account type and withdrawal amount.1 more row • Jan 15, 2025

Is MPF enough for retirement?

And while MPF is an important part of your retirement income, on its own it is not enough to cover your entire post-retirement expenses or your future retirement needs.

How can I check my MPF in Hong Kong?

You can check your account balances through any of the following channels: Logon to HSBC Internet Banking (Personal Customers) Logon to HSBC HK Mobile Banking app. Call the HSBC MPF Member Hotline on +852 3128 0128 (Please refer to the section 'HSBC MPF Member Hotline' in Member Service Guide for the user's guide)

Can I withdraw my MPF from abroad?

You must provide proof that you have left or are about to leave Hong Kong permanently with no intention to return or resettle as a permanent resident. You may be eligible to withdraw your accrued benefits early if you have a terminal illness that is likely to reduce your life expectancy to 12 months or less.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is TAIFOOK MPF RETIREMENT FUND?

TAIFOOK MPF RETIREMENT FUND is a Mandatory Provident Fund scheme that provides retirement benefits to employees and self-employed persons in Hong Kong, allowing them to save systematically for their retirement.

Who is required to file TAIFOOK MPF RETIREMENT FUND?

Employers and employees who are covered under the MPF legislation in Hong Kong are required to file the TAIFOOK MPF RETIREMENT FUND. This includes all employees aged 18 or over and under 65 who are employed for more than 60 days.

How to fill out TAIFOOK MPF RETIREMENT FUND?

To fill out the TAIFOOK MPF RETIREMENT FUND, one must provide personal information such as name, Hong Kong ID number, employment details, and contributions. Forms can typically be completed online or via paper format based on the specific requirements of the fund manager.

What is the purpose of TAIFOOK MPF RETIREMENT FUND?

The purpose of TAIFOOK MPF RETIREMENT FUND is to ensure that employees in Hong Kong have a financial safety net during retirement by mandating pension contributions throughout their working life.

What information must be reported on TAIFOOK MPF RETIREMENT FUND?

The information that must be reported includes the employee's personal identification details, contribution amounts, employer details, and any changes to employment status or personal circumstances that may affect the MPF contributions.

Fill out your taifook mpf retirement fund online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Taifook Mpf Retirement Fund is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.