Get the free 555 per Mile

Show details

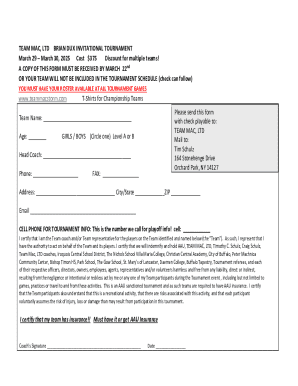

DOA ANA COUNTY HEAD START TRANSPORTATION×MILEAGE Name Date of Travel Starting Odometer Reading Total Mileage .555 per Mile Total Reimbursement Ending Odometer Reading Total Mileage Month Yr Destination

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 555 per mile

Edit your 555 per mile form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 555 per mile form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 555 per mile online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 555 per mile. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 555 per mile

How to fill out 555 per mile?

01

Gather all necessary information: Before filling out the form 555 per mile, make sure you have all the required details. This may include the starting and ending mileage, the purpose of the travel, and any additional expenses incurred during the journey.

02

Record the starting mileage: Begin by noting down the starting mileage of your vehicle. This is typically the odometer reading at the beginning of your trip. Ensure the accuracy of this measurement as it will be crucial for calculating the mileage.

03

Record the ending mileage: Once your trip is complete, record the ending mileage of your vehicle. This can also be obtained from the odometer. Make sure to accurately note down this information as well.

04

Calculate the total mileage: Determine the total distance traveled by subtracting the starting mileage from the ending mileage. This will give you the total mileage for the journey.

05

Calculate the mileage rate: Check the specific mileage rate provided by the organization or individual requesting the form 555 per mile. This rate may vary depending on factors such as the purpose of the travel or the vehicle being used.

06

Multiply the total mileage by the mileage rate: Multiply the total mileage calculated in step 4 by the mileage rate determined in step 5. The result will be the amount of reimbursement or payment owed for the traveled distance.

Who needs 555 per mile?

01

Employees on business trips: Many organizations require their employees to track their mileage when traveling for work purposes. This is especially common for employees who use their own personal vehicles for business travel. The form 555 per mile is typically used to report the mileage and request reimbursement.

02

Independent contractors: Individuals working as independent contractors, such as freelancers or consultants, often need to document their mileage for tax or reimbursement purposes. The form 555 per mile serves as a record of the distance traveled and the corresponding expenses.

03

Non-profit organizations: Non-profit organizations often rely on volunteers to carry out their missions. In some cases, volunteers may be eligible for mileage reimbursement when using their own vehicles for organization-related activities. The form 555 per mile is used to track and calculate the reimbursable mileage.

In conclusion, filling out the form 555 per mile requires accurately recording the starting and ending mileage, calculating the total mileage, and multiplying it by the mileage rate. This form is commonly used by employees, independent contractors, and volunteers who need to track their mileage for reimbursement or record-keeping purposes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the 555 per mile in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your 555 per mile in minutes.

How do I edit 555 per mile on an iOS device?

You certainly can. You can quickly edit, distribute, and sign 555 per mile on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

How do I complete 555 per mile on an Android device?

Complete your 555 per mile and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is 555 per mile?

555 per mile is a form used to report mileage for tax purposes.

Who is required to file 555 per mile?

Individuals who use their vehicle for business purposes may be required to file 555 per mile.

How to fill out 555 per mile?

To fill out 555 per mile, you need to record the starting and ending mileage of your vehicle for the specified period.

What is the purpose of 555 per mile?

The purpose of 555 per mile is to calculate deductible expenses related to the use of a vehicle for business purposes.

What information must be reported on 555 per mile?

On 555 per mile, you must report the starting and ending mileage, purpose of the trip, date, and total mileage.

Fill out your 555 per mile online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

555 Per Mile is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.