Get the free NOTICE OF DEBT FORGIVENESS

Show details

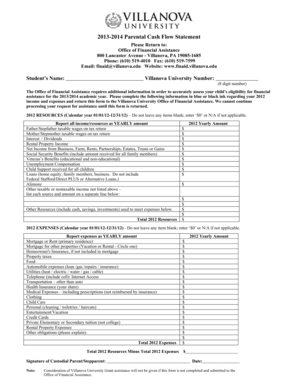

This document notifies a former tenant of their accumulated debt that will be forgiven and informs them about income tax implications related to the forgiven amount.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign notice of debt forgiveness

Edit your notice of debt forgiveness form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your notice of debt forgiveness form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing notice of debt forgiveness online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit notice of debt forgiveness. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out notice of debt forgiveness

How to fill out NOTICE OF DEBT FORGIVENESS

01

Obtain the NOTICE OF DEBT FORGIVENESS form from the appropriate authority.

02

Fill in the debtor's full name and address in the designated fields.

03

Indicate the amount of debt being forgiven.

04

Provide details about the original loan or debt agreement.

05

Include the date of debt forgiveness and any relevant account numbers.

06

Sign and date the document in the signature section.

07

Keep a copy for your records and send the original to the appropriate entity.

Who needs NOTICE OF DEBT FORGIVENESS?

01

Individuals or businesses that have had their debts forgiven.

02

Lenders who wish to officially document the forgiveness of debt.

03

Accounting professionals handling financial records involving forgiven debts.

Fill

form

: Try Risk Free

People Also Ask about

What is the forgiveness of debt?

Debt relief or debt cancellation is the partial or total forgiveness of debt, or the slowing or stopping of debt growth, owed by individuals, corporations, or nations. From antiquity through the 19th century, it refers to domestic debts, in particular agricultural debts and freeing of debt slaves.

What happens if I get a debt relief order?

A debt relief order is a way of writing off your debts if your finances do not get better after 12 months. During this time, you will not pay back what you owe. Interest and charges will stop being added to your debts. You do not have to deal with the people you owe money to.

Is doing debt relief a good idea?

If you're one of the millions of Americans struggling to repay high-interest debt, a debt relief plan may be an option to help you get your finances on track. But it's not a quick fix. It's a long-term solution designed to help you get out of debt over a period of time — typically several years.

How to ask for a debt to be forgiven?

3 things to say when asking for credit card debt forgiveness "I want to take responsibility for this debt and find a realistic solution." "I have a specific amount I can pay as a lump sum settlement." "I need this agreement in writing before making any payment." "I'll pay whatever I have to."

How do I write a letter for forgiveness of debt?

Unfortunately, my circumstances are unlikely to improve in the foreseeable future and I have no assets to sell to help clear my debt. I am therefore asking you to consider writing off my debt as I can see no way of ever repaying it. If you are unable to agree to this, please explain your reasons.

What happens if you ignore debt recovery?

They could file a judgment against you and if you don't show up in court they can get a default judgment that can allow them to start garnishing your wages or place a lien on your house. They eventually give up and sell your debt to another debt collector who will start all over again trying to collect the debt.

What is debt relief and how does it work?

How does debt relief work? Debt relief companies can reduce the amount of debt you owe by negotiating with creditors on your behalf. During the process, the company will typically advise you to stop making payments to your creditors and instead put that money in a special savings account.

What is a debt relief notice?

A Debt Relief Notice (DRN) is one of 3 debt resolution arrangements for people who cannot afford to pay their personal debts. These arrangements offer different solutions to people in different situations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is NOTICE OF DEBT FORGIVENESS?

The NOTICE OF DEBT FORGIVENESS is a formal document that notifies an individual or entity that a debt owed to a lender or institution has been forgiven, meaning that the borrower is no longer required to repay the amount.

Who is required to file NOTICE OF DEBT FORGIVENESS?

Lenders or institutions that forgive debt of $600 or more are typically required to file a NOTICE OF DEBT FORGIVENESS with the IRS and provide a copy to the borrower.

How to fill out NOTICE OF DEBT FORGIVENESS?

To fill out a NOTICE OF DEBT FORGIVENESS, one must provide information such as the borrower's name and address, the lender's name and address, the amount of the debt forgiven, and the date on which the forgiveness occurred.

What is the purpose of NOTICE OF DEBT FORGIVENESS?

The purpose of the NOTICE OF DEBT FORGIVENESS is to inform the IRS and the borrower about the debt cancellation, which may have tax implications for the borrower since forgiven debt may be considered taxable income.

What information must be reported on NOTICE OF DEBT FORGIVENESS?

Information that must be reported on a NOTICE OF DEBT FORGIVENESS includes the borrower’s identifying details, the amount of debt forgiven, the date of forgiveness, and any relevant loan numbers.

Fill out your notice of debt forgiveness online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Notice Of Debt Forgiveness is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.