Get the free Papua New Guinea Taxation

Show details

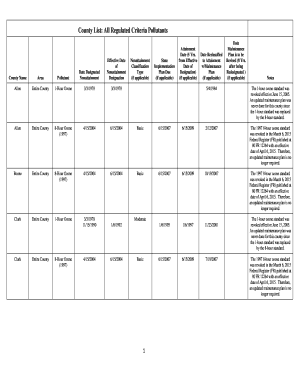

Papua New Guinea Taxation

Review

Issues Paper No. 9

Goods and Services Tax (GST×Prepared by

the Taxation Review Committee

14 September 2015×This page intentionally left blank×Consultation Process

The

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign papua new guinea taxation

Edit your papua new guinea taxation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your papua new guinea taxation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit papua new guinea taxation online

To use the professional PDF editor, follow these steps below:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit papua new guinea taxation. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out papua new guinea taxation

To fill out papua new guinea taxation, follow these steps:

01

Gather necessary documents: Collect all relevant financial records, including income statements, receipts, and expense documentation.

02

Determine your tax obligations: Understand the different types of taxes applicable in Papua New Guinea, such as income tax, goods and services tax (GST), and payroll tax. Identify the specific obligations that apply to your situation.

03

Complete the appropriate tax forms: Obtain the required tax forms from the Papua New Guinea Internal Revenue Commission (IRC) website or their office. Fill out the forms accurately and provide all necessary information.

04

Report your income: Include all sources of income, such as employment wages, business income, rental income, and investment returns. Ensure accurate reporting to avoid discrepancies.

05

Deduct eligible expenses and allowances: Identify allowable deductions, such as work-related expenses, education expenses, and charitable donations. Keep appropriate documentation to support your claims.

06

Calculate your tax liability: Use the prescribed tax rates and formulas to determine the amount of tax payable. Take advantage of any available tax credits or concessions.

07

Make timely payments: Pay the determined tax amount by the due date specified by the IRC. Use the accepted payment methods, such as direct debit, online banking, or in-person payments.

08

Keep records: Maintain copies of all filed tax returns, supporting documents, and correspondence with the IRC. These records may be required for future reference or audits.

Who needs Papua New Guinea taxation?

01

Individual taxpayers: All residents of Papua New Guinea who earn taxable income, including employees, business owners, and investors, are required to fulfill their tax obligations.

02

Corporations and businesses: Companies operating in Papua New Guinea, whether domestic or foreign, must comply with the tax laws and regulations. They need to report their income, expenses, and other relevant financial information.

03

Non-profit organizations: Non-governmental organizations, charities, and non-profit entities are also subject to taxation in Papua New Guinea. They must meet specific criteria to qualify for tax exemptions or concessional treatment.

04

Employers: Employers have responsibilities such as deducting and remitting payroll taxes on behalf of their employees and providing the necessary tax documentation.

05

Importers and exporters: Individuals or businesses involved in international trade, import, or export activities must adhere to customs and taxation requirements associated with cross-border transactions.

It is important for individuals and entities to understand and comply with Papua New Guinea taxation to avoid potential penalties or legal consequences. Seeking professional advice or assistance from tax experts can be beneficial in navigating the complexities of the tax system.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is papua new guinea taxation?

Papua New Guinea taxation refers to the system of taxes imposed by the government of Papua New Guinea on individuals and businesses based on their income and activities.

Who is required to file papua new guinea taxation?

Individuals and businesses in Papua New Guinea are required to file taxation returns if they meet certain income or activity thresholds set by the tax authorities.

How to fill out papua new guinea taxation?

To fill out Papua New Guinea taxation forms, individuals and businesses need to accurately report their income, expenses, deductions, and other relevant financial information as per the instructions provided by the tax authorities.

What is the purpose of papua new guinea taxation?

The purpose of Papua New Guinea taxation is to generate revenue for the government to fund public services and infrastructure projects, as well as to regulate economic activities and promote social welfare.

What information must be reported on papua new guinea taxation?

Information such as income from all sources, expenses, deductions, assets, liabilities, and any other financial details required by the tax authorities must be reported on Papua New Guinea taxation forms.

How do I modify my papua new guinea taxation in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your papua new guinea taxation along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I get papua new guinea taxation?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the papua new guinea taxation in seconds. Open it immediately and begin modifying it with powerful editing options.

Can I sign the papua new guinea taxation electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

Fill out your papua new guinea taxation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Papua New Guinea Taxation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.