Get the free FATCA Non Individual Form 161115cdr

Show details

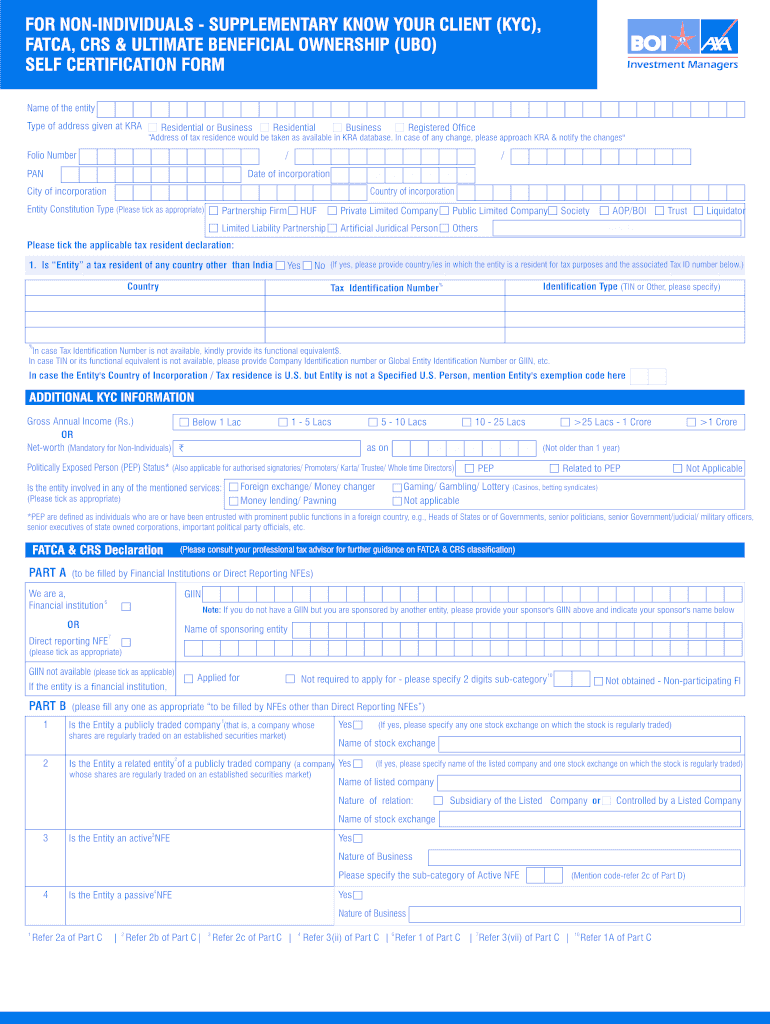

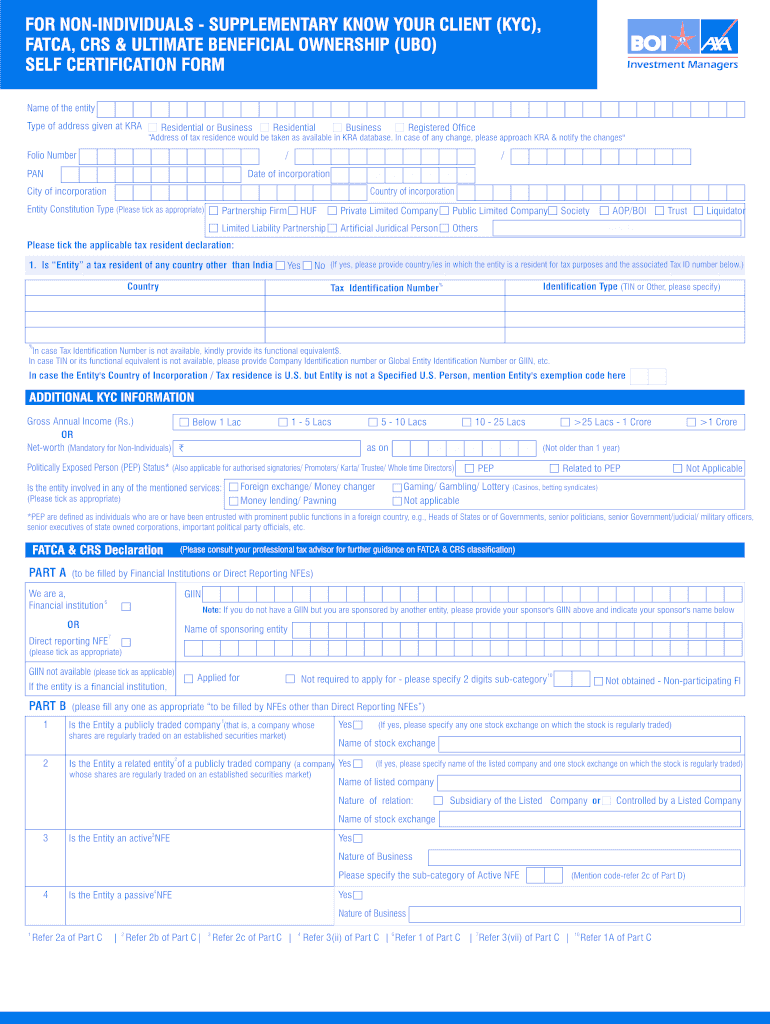

FOR INDIVIDUALS SUPPLEMENTARY KNOW YOUR CLIENT (KYC×, FATWA, CRS & ULTIMATE BENEFICIAL OWNERSHIP (HBO) SELF CERTIFICATION FORM Name of the entity Type of address given at ERA Residential or Business

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fatca non individual form

Edit your fatca non individual form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fatca non individual form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fatca non individual form online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit fatca non individual form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fatca non individual form

How to fill out FATCA non-individual form:

01

Start by gathering all the necessary information. You will need to provide details about the non-individual entity, such as its name, address, and taxpayer identification number.

02

Determine the entity's classification. Different FATCA forms are used for different types of entities, such as foreign financial institutions (FFIs), non-financial foreign entities (NFFEs), or sponsored FFIs. Make sure you are using the correct form for your entity.

03

Fill out Part I of the form, which includes general information about the entity. This section will require you to provide the entity's EIN or GIIN, country of organization, and the reason for submitting the form.

04

Move on to Part II, where you will need to provide details about the responsible officer or principal officer of the entity. This information includes their name, contact information, and their authority to act on behalf of the entity.

05

Complete Part III, which is specific to the entity's FATCA status. This section will require you to choose the appropriate certification category, such as active NFFE, sponsored FFI, or registered deemed-compliant FFI. Provide all the necessary details and documentation to support your chosen category.

06

If the entity has any substantial U.S. owners who are not already disclosed through the FATCA reporting of a participating FFI or U.S. financial institution, fill out Part IV. You will need to provide the name, address, and taxpayer identification number of each substantial U.S. owner.

07

Finally, review the completed form to ensure accuracy and completeness. Make sure all the required fields have been filled out properly and all supporting documentation is attached as necessary.

Who needs FATCA non-individual form?

The FATCA non-individual form is required for non-individual entities that are subject to FATCA reporting. This includes foreign financial institutions (FFIs) and non-financial foreign entities (NFFEs). Any entity that falls under these categories and has U.S. reportable accounts or substantial U.S. owners will need to fill out the FATCA non-individual form. It is important for these entities to comply with FATCA regulations to ensure they are not subjected to penalties or other legal consequences.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send fatca non individual form for eSignature?

When you're ready to share your fatca non individual form, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Can I create an electronic signature for the fatca non individual form in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your fatca non individual form in minutes.

How can I edit fatca non individual form on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing fatca non individual form.

What is fatca non individual form?

The FATCA non-individual form is a form used by entities, such as corporations, partnerships, and trusts, to report their foreign financial accounts to the IRS.

Who is required to file fatca non individual form?

Entities with foreign financial accounts exceeding certain thresholds are required to file FATCA non-individual forms.

How to fill out fatca non individual form?

The FATCA non-individual form must be filled out with detailed information about the foreign financial accounts held by the entity, including the account number, financial institution, and maximum value of the account.

What is the purpose of fatca non individual form?

The purpose of the FATCA non-individual form is to help the IRS identify and track foreign financial accounts held by entities to prevent tax evasion.

What information must be reported on fatca non individual form?

The FATCA non-individual form requires information such as account numbers, financial institution names, account values, and other details about foreign financial accounts.

Fill out your fatca non individual form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fatca Non Individual Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.