Get the free Loan and Insurance Information Sheet

Show details

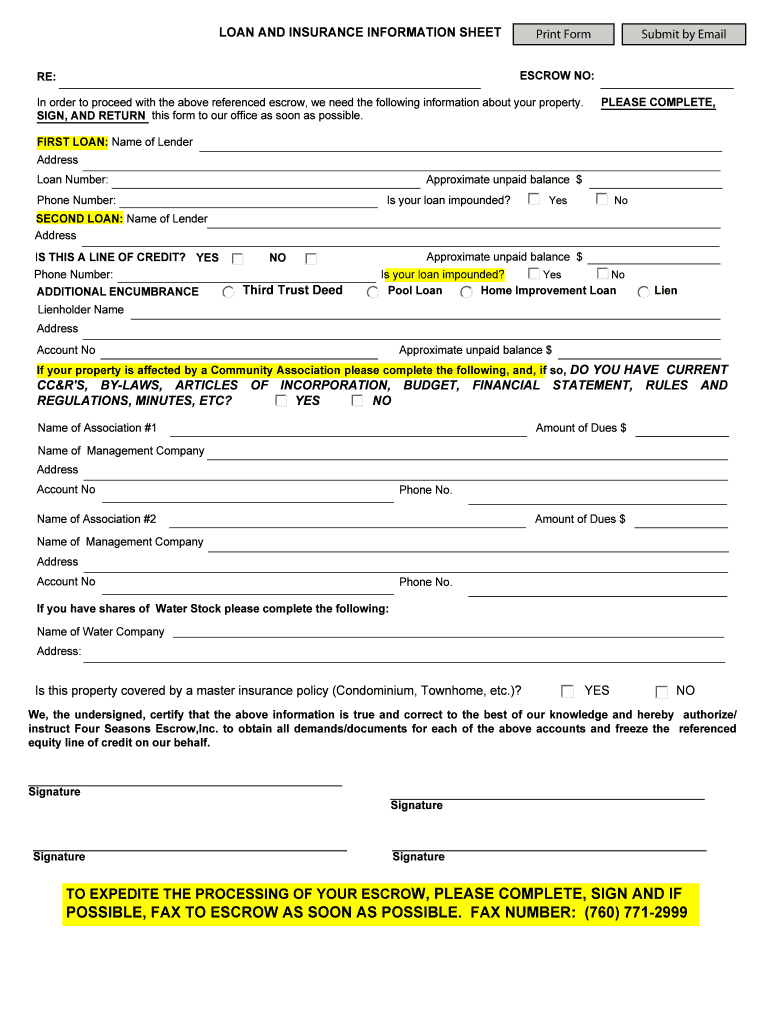

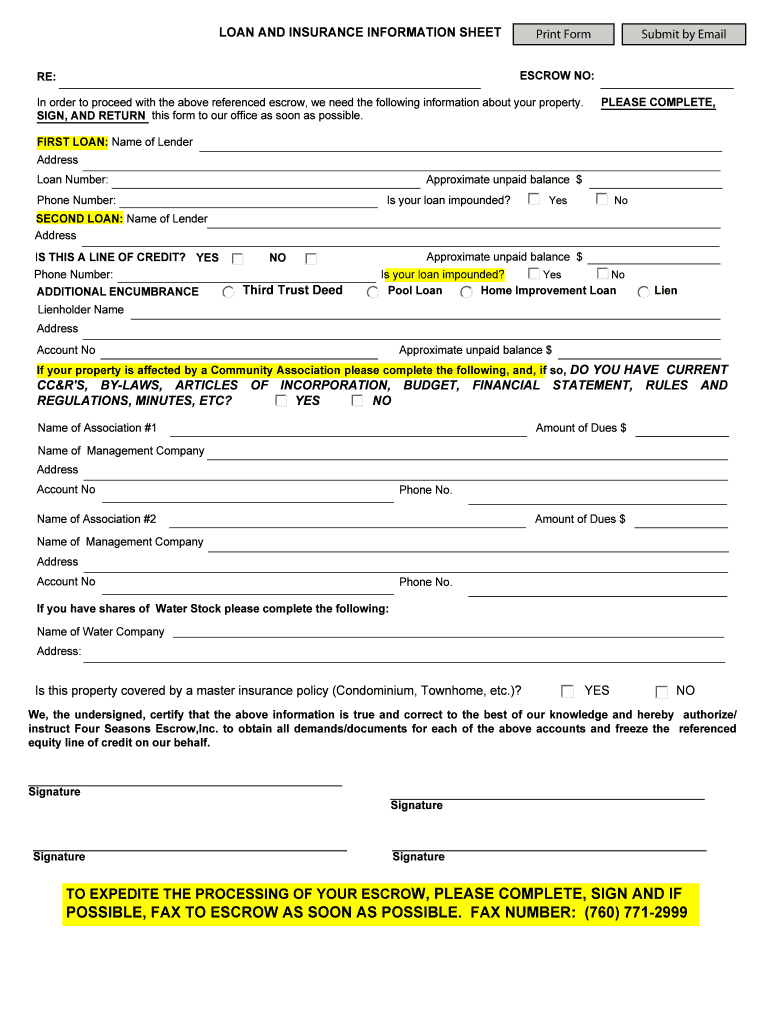

This document is used to collect necessary loan and insurance information related to a property in order to proceed with an escrow process.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign loan and insurance information

Edit your loan and insurance information form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your loan and insurance information form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit loan and insurance information online

Follow the steps below to benefit from a competent PDF editor:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit loan and insurance information. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out loan and insurance information

How to fill out Loan and Insurance Information Sheet

01

Obtain the Loan and Insurance Information Sheet from your lender or insurance provider.

02

Fill in your personal details at the top of the sheet, including your name, address, and contact information.

03

Provide the loan details such as the loan amount, interest rate, and term of the loan.

04

Input information about the type of insurance required, including coverage amounts and policy numbers.

05

Include any additional notes or special requirements that may be relevant to the loan or insurance.

06

Review all information for accuracy and ensure all fields are completed.

07

Sign and date the form where indicated.

Who needs Loan and Insurance Information Sheet?

01

Individuals applying for a loan who need to provide insurance details.

02

Homeowners seeking a mortgage who must disclose insurance information.

03

Borrowers who are required to get insurance coverage for a specific loan.

04

Real estate agents and brokers who assist clients in securing loans and insurance.

Fill

form

: Try Risk Free

People Also Ask about

What is a insurance loan?

A policy loan, issued by an insurance company, uses the cash value of a life insurance policy as collateral. Also called a "life insurance loan," it often has lower interest rates than a personal loan and you can use the money for any purpose. 1 You don't need to repay this loan before you die.

What information is included in a loan application?

Employment and income information Employment Status. Work phone number. Employer name. Gross monthly income amount and source(s) of income (all sources you want considered for your loan) Monthly mortgage or rent payment amount.

Is a line of credit insured?

Line of Credit protection insurance* is a safety net for the unexpected and helps to protect you from defaulting on your payments if your ability to earn income is impacted by illness, disability or death. Enrolment is easy with no health questions or medical underwriting required up to $50,000 of coverage.

What are the 5 elements of a loan?

The Underwriting Process of a Loan Application One of the first things all lenders learn and use to make loan decisions are the “Five C's of Credit": Character, Conditions, Capital, Capacity, and Collateral.

What is included in a loan document?

This document is an explanation of your loan in plain language, which includes your loan amount, interest rates, monthly payment, escrow account and your closing costs and other associated fees.

What are the six pieces of a loan application?

To receive a Loan Estimate, you need to submit only six key pieces of information: Your name. Your income. Your Social Security number (so the lender can check your credit) The address of the home you plan to purchase or refinance. An estimate of the home's value. The loan amount you want to borrow.

What is the loan insurance for?

Key Takeaways Loan protection insurance covers debt payments on certain covered loans if the insured loses their ability to pay due to a covered event. Such an event may be disability or illness, unemployment, or another hazard, depending on the particular policy.

What details are needed for a loan?

You'll typically be asked to provide your personal details and information on your personal or household finances. Personal details. Your finances. Proof of identity. Proof of address. Bank statements. Payslips. Benefit documents. Existing loan and credit card statements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Loan and Insurance Information Sheet?

The Loan and Insurance Information Sheet is a document used to provide detailed information about loans and insurance policies held by an individual or an entity. It typically includes various financial details, terms, and conditions of the loans and insurance agreements.

Who is required to file Loan and Insurance Information Sheet?

Individuals or businesses applying for loans, requesting insurance coverage, or participating in financial assessments may be required to file the Loan and Insurance Information Sheet. This may include lenders, borrowers, and insurance policyholders.

How to fill out Loan and Insurance Information Sheet?

To fill out the Loan and Insurance Information Sheet, one must provide accurate and complete information regarding the loans and insurance policies, including names of lenders or insurers, policy numbers, loan amounts, payment terms, and any relevant dates. It is essential to follow the instructions provided with the sheet to ensure proper submission.

What is the purpose of Loan and Insurance Information Sheet?

The purpose of the Loan and Insurance Information Sheet is to consolidate and present crucial financial information in one document. It aids lenders and insurers in assessing risk, verifying financial stability, and making informed decisions regarding loan approvals and insurance coverage.

What information must be reported on Loan and Insurance Information Sheet?

The information that must be reported on the Loan and Insurance Information Sheet typically includes borrower or policyholder details, loan amounts, interest rates, repayment terms, types of insurance coverage, premium amounts, policy limits, and any relevant endorsements or riders.

Fill out your loan and insurance information online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Loan And Insurance Information is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.