Get the free New Loan and Insurance Information

Show details

This document is a form for collecting new loan and insurance information, including details about the lender and insurance company, and requires signatures for submission.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign new loan and insurance

Edit your new loan and insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your new loan and insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit new loan and insurance online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit new loan and insurance. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

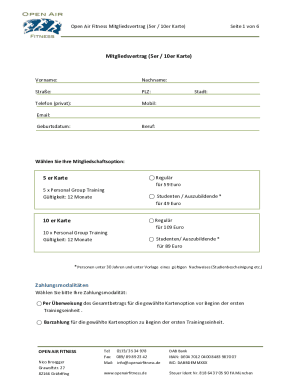

How to fill out new loan and insurance

How to fill out New Loan and Insurance Information

01

Gather all necessary documents related to your loan and insurance.

02

Locate the New Loan and Insurance Information form.

03

Fill in your personal details, including your name, address, and contact information.

04

Input the loan amount you are applying for, along with the terms of the loan.

05

Provide details of your existing insurance coverage, if applicable.

06

Include the insurance company name, policy number, and any relevant coverage details.

07

Review all information for accuracy.

08

Sign and date the form once completed.

09

Submit the form according to the provided instructions.

Who needs New Loan and Insurance Information?

01

Individuals applying for a new loan.

02

Borrowers who are required to update their insurance information.

03

Anyone involved in refinancing an existing loan.

04

Financial institutions processing loan applications.

05

Insurance providers needing updated client information.

Fill

form

: Try Risk Free

People Also Ask about

Is it good to have loan insurance?

Yes. It is good to take home loan insurance as it safeguards loan repayments in the event of impairment, loss of income, critical illness, or death of the borrower. Your family will not have the burden of honouring EMIs and the lender gets the assurance of loan recovery in case of unforeseen events.

Is loan insurance good?

Yes. It is good to take home loan insurance as it safeguards loan repayments in the event of impairment, loss of income, critical illness, or death of the borrower. Your family will not have the burden of honouring EMIs and the lender gets the assurance of loan recovery in case of unforeseen events.

What is a insurance loan?

A policy loan allows you to borrow money from your insurance company using the cash value of your policy as collateral, offering benefits such as easy access to funds, flexibility, and no impact on coverage.

How to take a loan against insurance?

What are the documents required to apply for a Loan Against Life Insurance Policy online? Original policy documents. Address proof and ID proof. Income proof. 'Deed of Assignment' to assign the policy to the lender.

What is an insurance loan?

A policy loan, issued by an insurance company, uses the cash value of a life insurance policy as collateral. Also called a "life insurance loan," it often has lower interest rates than a personal loan and you can use the money for any purpose.

What is meant by loan insurance?

Loan insurance is financial protection that covers borrowers against sudden life events like death, disability, or loss of employment. If the borrower is unable to repay the loan due to such events, the policy pays the outstanding balance, and therefore, the family is not responsible for the burden of loan repayment.

What are the details of any loan?

If the loan is approved, you and the lender will both need to sign a loan contract that outlines the details of your loan agreement, including loan amount, interest rate, payment amount, and terms. Get funding.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is New Loan and Insurance Information?

New Loan and Insurance Information refers to the details related to new loans taken and the insurance policies associated with them, typically required for financial reporting or compliance purposes.

Who is required to file New Loan and Insurance Information?

Individuals or entities that have taken out new loans or have associated insurance policies, often required by financial institutions or regulatory bodies, must file New Loan and Insurance Information.

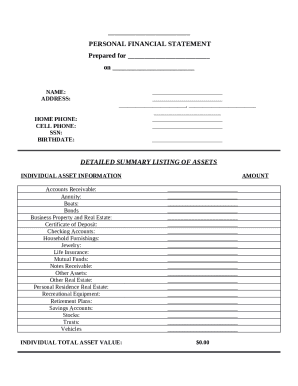

How to fill out New Loan and Insurance Information?

To fill out New Loan and Insurance Information, gather all relevant loan and insurance documents, and provide detailed information such as loan amounts, interest rates, insurance coverage, and policy numbers in the form designated by the reporting entity.

What is the purpose of New Loan and Insurance Information?

The purpose of New Loan and Insurance Information is to maintain accurate records for risk assessment, to ensure compliance with regulations, and to provide lenders and regulators with essential data regarding financial commitments.

What information must be reported on New Loan and Insurance Information?

Information that must be reported includes the loan amount, loan type, interest rate, term of the loan, insurance coverage details, policy number, and any associated parties involved in the loan or insurance agreement.

Fill out your new loan and insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

New Loan And Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.