Get the free ACCOUNT DOCUMENTATION CHECKLIST

Show details

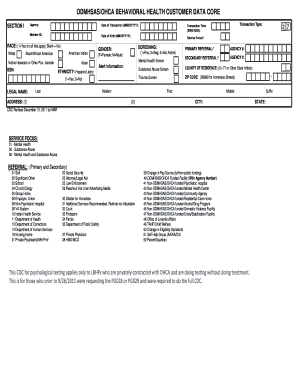

This document provides a checklist of required documentation for different types of accounts, including Sole Proprietorship, Campaign, LLC, Corporation, Partnership, and more, to ensure compliance

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign account documentation checklist

Edit your account documentation checklist form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your account documentation checklist form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing account documentation checklist online

To use our professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit account documentation checklist. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out account documentation checklist

How to fill out ACCOUNT DOCUMENTATION CHECKLIST

01

Gather all necessary personal information, including your name, address, and contact details.

02

Prepare your identification documents, such as a government-issued ID or passport.

03

Collect proof of residency, like utility bills or bank statements with your current address.

04

Complete the ACCOUNT DOCUMENTATION CHECKLIST form by filling in each section accurately.

05

Review all information entered in the checklist for completeness and accuracy.

06

Sign and date the checklist where required before submission.

Who needs ACCOUNT DOCUMENTATION CHECKLIST?

01

Individuals opening a new bank account.

02

Small business owners establishing business accounts.

03

Anyone applying for loans or mortgages that require financial documentation.

04

Prospective clients needing verification for legal or financial services.

Fill

form

: Try Risk Free

People Also Ask about

Which pieces of documentation do you need to open the account?

your photo on it, such as a driver's license, U.S. passport, or military identification. If you do not have a U.S. or state government issued form of identification, some banks and credit unions accept foreign passports and consular IDs, such as the Matricula Consular card.

What documentation do I need for a bank account?

To open a bank account, you typically need to provide a valid government-issued ID, your Social Security number or taxpayer ID, and proof of address such as a utility bill or lease. Some banks may also ask for an initial deposit.

What documents are needed for a bank account?

Documents Required for Opening Saving Account Valid Passport. Aadhaar. Valid Permanent Driving License. Voter ID Card. NREGA Job Card. Letter from the National Population Register.

What documentation do you need to get a bank account?

Banks typically require the adult to present a government-issued photo ID and provide contact information, such as mailing address and phone number. Any minors will need to provide a valid Social Security number and other information, depending on their age at the time of account opening.

What is a checklist account?

A Checklist Account provides several advantages: Automated backup for all your checklists and templates to the cloud. Seamless synchronization across your devices. Easy data sharing with colleagues, friends, and family (with your permission)

What documents do you need to have a bank account?

ID and verification. Personal Details. Address Details. Contact Details. Income & Expenditure Details. Overdraft requests (optional) Packaged Accounts (accounts where you pay a monthly fee and receive insurance benefits) Switching.

What are the 7 steps to open a bank account?

Here's a step-by-step guide to the current account opening process: Step 1- Choose a Bank: Step 2- Visit the Bank: Step 3- Fill out an Application Form: Step 4- Provide Required Documents: Step 5- Initial Deposit: Step 6- Account Activation: Business Type: Business Documents:

Can a foreigner get a bank account in Brazil?

A frequently asked question is whether non-residents can open a bank account in Brazil using a foreign address. The answer is yes — certain banks offer account options that accept proof of address from outside Brazil.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ACCOUNT DOCUMENTATION CHECKLIST?

The ACCOUNT DOCUMENTATION CHECKLIST is a structured list of documents and information required for verifying and maintaining financial accounts, ensuring compliance with relevant regulations.

Who is required to file ACCOUNT DOCUMENTATION CHECKLIST?

Individuals and entities engaged in financial or business activities that require documentation for account verification are typically required to file the ACCOUNT DOCUMENTATION CHECKLIST.

How to fill out ACCOUNT DOCUMENTATION CHECKLIST?

To fill out the ACCOUNT DOCUMENTATION CHECKLIST, one must gather the necessary documents, ensure all required fields are completed accurately, and submit the checklist to the relevant regulatory authority or institution.

What is the purpose of ACCOUNT DOCUMENTATION CHECKLIST?

The purpose of the ACCOUNT DOCUMENTATION CHECKLIST is to ensure that all necessary information and documents are provided for compliance, risk assessment, and auditing processes.

What information must be reported on ACCOUNT DOCUMENTATION CHECKLIST?

The ACCOUNT DOCUMENTATION CHECKLIST must typically include personal identification information, proof of address, financial statements, tax documents, and any other relevant business or financial records.

Fill out your account documentation checklist online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Account Documentation Checklist is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.