Get the free APPLICATION FOR PROPERTY TAX ABATEMENT EXEMPTION

Show details

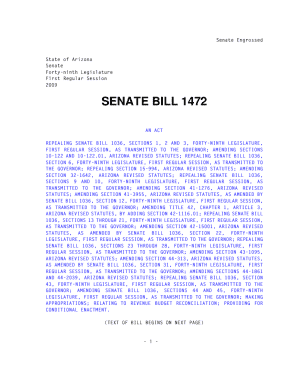

This document serves as an application for tax abatement exemption on property owned as of January 1 of the year, requiring annual submission and supporting documentation.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for property tax

Edit your application for property tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for property tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing application for property tax online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit application for property tax. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for property tax

How to fill out APPLICATION FOR PROPERTY TAX ABATEMENT EXEMPTION

01

Gather necessary documents such as property deeds, financial statements, and proof of income.

02

Obtain the APPLICATION FOR PROPERTY TAX ABATEMENT EXEMPTION form from your local tax assessor's office or their website.

03

Fill out personal information including your name, address, and property details on the form.

04

Provide any required financial information, such as household income, expenses, and assets.

05

Attach required supporting documents that corroborate your eligibility for the exemption.

06

Review the application for accuracy and completeness before submission.

07

Submit the application according to your local jurisdiction's guidelines, either in person or electronically.

08

Follow up with the tax assessor’s office to confirm receipt and inquire about the review process.

Who needs APPLICATION FOR PROPERTY TAX ABATEMENT EXEMPTION?

01

Property owners who meet specific income or eligibility criteria that may qualify for a reduction in their property taxes.

02

Individuals or entities that reside in locations offering tax abatement exemptions for certain types of properties.

03

Owners of properties that may be used for specific purposes, such as non-profit organizations, veterans, or senior citizens.

Fill

form

: Try Risk Free

People Also Ask about

What is the property tax exemption in Philadelphia?

If you own your primary residence, you are eligible for the Homestead Exemption on your Real Estate Tax. The Homestead Exemption reduces the taxable portion of your property's assessed value. With this exemption, the property's assessed value is reduced by $100,000.

How do I become exempt from property taxes in NJ?

Eligibility Active wartime service in the United States Armed Forces. Filing of an application for exemption with the local tax assessor. Honorable discharge. Legal or domiciliary New Jersey residence. New Jersey citizenship. Principal or permanent residence in the claimed dwelling. Property ownership.

Who qualifies for property tax exemption in Massachusetts?

Massachusetts laws Includes clauses for real estate tax exemptions for blind persons, qualifying senior citizens, qualifying surviving spouses, minor children and elderly persons, qualifying veterans, and religious and charitable organizations.

What is a tax abatement in NJ?

An abatement is a contract between the city and a developer (and then subsequent homeowners in the case of an abated condo building) that results in the building's occupants paying a "PILOT" (payment in lieu of tax) instead of regular tax.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is APPLICATION FOR PROPERTY TAX ABATEMENT EXEMPTION?

APPLICATION FOR PROPERTY TAX ABATEMENT EXEMPTION is a formal request submitted by property owners to receive a reduction in property taxes, usually granted for specific reasons like improvements or hardships.

Who is required to file APPLICATION FOR PROPERTY TAX ABATEMENT EXEMPTION?

Property owners who believe they qualify for a tax reduction, based on specific criteria such as income levels, property improvements, or designated exemptions, are required to file this application.

How to fill out APPLICATION FOR PROPERTY TAX ABATEMENT EXEMPTION?

To fill out the application, property owners should provide personal information, property details, applicable financial information, and any documentation that supports their eligibility for the exemption.

What is the purpose of APPLICATION FOR PROPERTY TAX ABATEMENT EXEMPTION?

The purpose of the application is to allow eligible property owners to request and secure a reduction in their property tax obligations, helping to alleviate financial burdens.

What information must be reported on APPLICATION FOR PROPERTY TAX ABATEMENT EXEMPTION?

The application must typically report information such as the property owner's name, property address, account number, reasons for abatement, financial statements, and any other documentation required by the local tax authority.

Fill out your application for property tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Property Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.