Get the free Application for Private School Property Tax Exemption

Show details

Este formulario es utilizado para solicitar exenciones de impuestos sobre propiedad en virtud del Código de Impuestos §11.21 para propiedades poseídas el 1 de enero de este año o adquiridas durante

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for private school

Edit your application for private school form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for private school form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit application for private school online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit application for private school. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

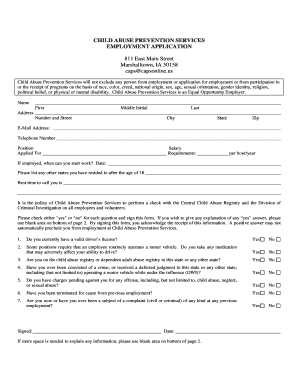

How to fill out application for private school

How to fill out Application for Private School Property Tax Exemption

01

Obtain the Application for Private School Property Tax Exemption form from your local tax office or website.

02

Read the instructions carefully to understand the eligibility criteria and required documentation.

03

Fill out the applicant's information, including the name of the private school, address, and contact details.

04

Provide details about the property being claimed for exemption, including its location, size, and type of property.

05

Explain the educational purposes of the property and how it is used for the school's operations.

06

Attach any required documents, such as proof of nonprofit status, financial statements, or property deeds.

07

Review the completed application for accuracy and completeness.

08

Submit the application to the appropriate local tax authority by the specified deadline.

Who needs Application for Private School Property Tax Exemption?

01

Private schools seeking to reduce their tax liabilities for properties used in educational operations.

02

Non-profit educational institutions that meet the criteria for property tax exemption.

03

Owners of private school properties who wish to apply for tax relief.

Fill

form

: Try Risk Free

People Also Ask about

What is 100% property tax exemption in California?

This bill would exempt from taxation, property owned by, and that constitutes the principal place of residence of, a veteran, the veterans spouse, or the veteran and the veterans spouse jointly, if the veteran is 100% disabled.

How do you qualify for property tax exemption in California?

To obtain the exemption for a property, you must be its owner or co-owner (or a purchaser named in a contract of sale), and you must live in the property as your principal place of residence. You must also file the appropriate exemption claim form with the Assessor.

How do I become exempt from property taxes in California?

The home must have been the principal place of residence of the owner on the lien date, January 1st. To claim the exemption, the homeowner must make a one-time filing with the county assessor where the property is located.

What is the school property tax exemption in Texas?

Tax Code Section 11.13(b) requires school districts to provide a $100,000 exemption on a residence homestead and Tax Code Section 11.13(n) allows any taxing unit to adopt a local option residence homestead exemption of up to 20 percent of a property's appraised value.

Who is exempt from school taxes in Georgia?

To qualify for school tax exemption, your property must be owner-occupied and you must be 62 years of age by January 1 of the qualifying year. You must provide proof of age (copy of drivers license, birth certificate, Georgia state identification card, etc.).

What is the property tax loophole in California?

19 would narrow California's property tax inheritance loophole, which offers Californians who inherit certain properties a significant tax break by allowing them to pay property taxes based on the property's value when it was originally purchased rather than its value upon inheritance.

At what age do you stop paying property taxes in California?

If you are blind, disabled, or at least 62 years of age and meet certain income restrictions, you may defer the payment of property taxes on your house, condominium or mobile home. Under this program, taxes would be paid by the State and the deferred payment would create a lien on the property.

Who qualifies for property tax exemption in Massachusetts?

Massachusetts laws Includes clauses for real estate tax exemptions for blind persons, qualifying senior citizens, qualifying surviving spouses, minor children and elderly persons, qualifying veterans, and religious and charitable organizations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Application for Private School Property Tax Exemption?

The Application for Private School Property Tax Exemption is a form that private schools submit to request exemption from property taxes, based on their status as educational institutions.

Who is required to file Application for Private School Property Tax Exemption?

Private schools that own property and wish to be exempt from property taxes must file this application.

How to fill out Application for Private School Property Tax Exemption?

To fill out the application, a private school must provide information about its ownership, use of the property, financial status, and educational mission, along with any required documentation.

What is the purpose of Application for Private School Property Tax Exemption?

The purpose of this application is to determine whether the private school qualifies for a property tax exemption, thereby supporting its mission to provide education.

What information must be reported on Application for Private School Property Tax Exemption?

The application must report information including the school's name, address, type of ownership, property description, enrollment numbers, and financial statements.

Fill out your application for private school online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Private School is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.