Get the free Tax Deferral Affidavit for 65 or Over or Disabled Homeowner

Show details

This affidavit allows eligible homeowners aged 65 or over or disabled individuals to defer the collection of property taxes on their residence homestead as per Texas Property Tax Code Section 33.06.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax deferral affidavit for

Edit your tax deferral affidavit for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax deferral affidavit for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax deferral affidavit for online

To use our professional PDF editor, follow these steps:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit tax deferral affidavit for. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax deferral affidavit for

How to fill out Tax Deferral Affidavit for 65 or Over or Disabled Homeowner

01

Obtain the Tax Deferral Affidavit form from your local tax office or online.

02

Fill in your personal information including name, address, and date of birth.

03

Indicate if you are 65 years or older or if you are disabled.

04

Provide any required documentation such as proof of age or disability.

05

Review the form for accuracy and completeness.

06

Sign and date the affidavit.

07

Submit the completed affidavit to your local tax office by the deadline.

Who needs Tax Deferral Affidavit for 65 or Over or Disabled Homeowner?

01

Homeowners who are aged 65 or older.

02

Homeowners who are disabled, regardless of age.

03

Those seeking to defer property taxes due to financial hardship.

Fill

form

: Try Risk Free

People Also Ask about

Is property tax deferral a good idea in Texas?

While property tax deferment can be a helpful tool for homeowners in certain situations, it's not for everyone. Some key considerations include: Interest continues to accrue at 8% annually. You may not qualify if the home isn't your primary residence.

What is the new tax law for the elderly in Texas?

Seniors' homestead exemption now goes all the way up to $200,000. This session, we also spent $50 billion on property tax relief. This is truly unprecedented – no state in American history has devoted such a large percentage of their budget to tax relief.” Watch the Governor's full bill signing ceremony here.

What does deferral mean on local property tax?

In certain circumstances, you can delay paying some or all of your Local Property Tax (LPT) until a later date. This is known as a deferral. You may qualify for a deferral if: Your income is below a certain amount. You are the personal representative of a deceased person who was liable for LPT.

What is the over 65 property tax deferral in Texas?

If you qualify for the Age 65 or Older or Disability exemptions, you may defer or postpone paying property taxes on your home for as long as you live in it. This deferral does not cancel your taxes. Your property taxes accrue five percent interest annually until the deferral is removed.

How much do property taxes go down when you turn 65 in Texas?

Every Texas homeowner can apply for a general homestead exemption, which reduces the taxable value of their primary residence. Seniors age 65 and older qualify for additional exemptions that can further reduce their property tax bill. The general homestead exemption reduces the taxable value of a home by $25,000.

What is the property tax deferral for seniors in BC?

The Property Tax Deferment Program is a low-interest provincial loan program designed to help qualified BC home owners pay their annual property taxes. You cannot defer: Any property taxes owing from previous years, penalties, or interest. Your Empty Homes Tax (Vacancy Tax) through this program.

Are seniors entitled to defer property taxes in Texas?

An individual is entitled to defer collection of a tax on their homestead property if they are 65 years of age or older or disabled (as defined by Section 11.13(m) of the Texas Property Tax Code). The individual must own the property and occupy the property as a residence homestead.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Tax Deferral Affidavit for 65 or Over or Disabled Homeowner?

The Tax Deferral Affidavit for 65 or Over or Disabled Homeowner is a legal document that allows eligible homeowners who are 65 years of age or older, or who are disabled, to postpone property tax payments on their primary residence. This deferral means that taxes owed will not need to be paid until the homeowner sells the property or passes away.

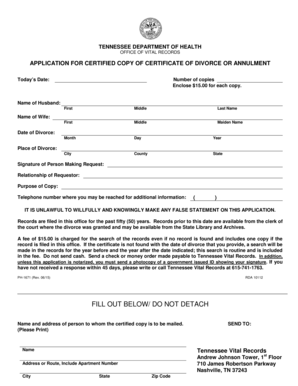

Who is required to file Tax Deferral Affidavit for 65 or Over or Disabled Homeowner?

Homeowners who are 65 years or older, or those who are disabled, and who own their primary residence are required to file the Tax Deferral Affidavit to qualify for the property tax deferral program.

How to fill out Tax Deferral Affidavit for 65 or Over or Disabled Homeowner?

To fill out the Tax Deferral Affidavit, the homeowner should provide personal identification details, confirm age or disability status, provide property information, and sign the affidavit. It may require submission of supporting documents verifying age or disability.

What is the purpose of Tax Deferral Affidavit for 65 or Over or Disabled Homeowner?

The purpose of the Tax Deferral Affidavit is to assist eligible homeowners by allowing them to defer payment of property taxes, thereby easing the financial burden during retirement or due to disabilities. This helps ensure they can continue to live in their homes without the stress of immediate tax payments.

What information must be reported on Tax Deferral Affidavit for 65 or Over or Disabled Homeowner?

The affidavit typically requires the following information: homeowner's name, address of the property, date of birth or proof of disability, details of any liens on the property, and acknowledgment of terms related to the deferral. Specific requirements may vary by jurisdiction.

Fill out your tax deferral affidavit for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Deferral Affidavit For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.