Get the free Authorization for Use of Tax Return Information

Show details

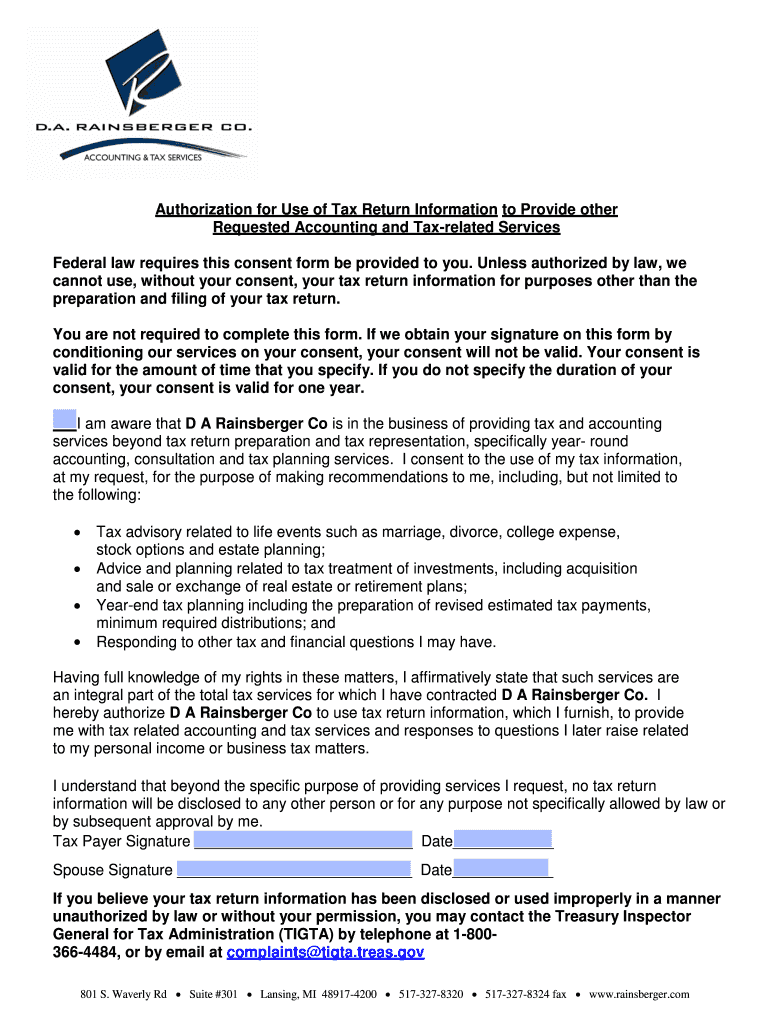

This document serves as a consent form required by federal law which allows for the use of tax return information for additional accounting and tax-related services beyond tax return preparation.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign authorization for use of

Edit your authorization for use of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your authorization for use of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing authorization for use of online

To use the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit authorization for use of. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out authorization for use of

How to fill out Authorization for Use of Tax Return Information

01

Obtain the Authorization for Use of Tax Return Information form.

02

Fill out the taxpayer's name and Social Security Number at the top of the form.

03

Provide the name of the individual or organization that will receive the tax return information.

04

Specify the tax years for which authorization is being granted.

05

Include any additional information as required on the form.

06

Sign and date the form to validate the authorization.

07

Submit the completed form to the designated individual or organization.

Who needs Authorization for Use of Tax Return Information?

01

Taxpayers who want to authorize a third party to access their tax return information.

02

Financial institutions that need to verify a borrower's tax information for loan applications.

03

Tax professionals assisting clients with their tax-related matters.

Fill

form

: Try Risk Free

People Also Ask about

What is a consent disclosure?

"Informed consent" means simply that the person consenting to the disclosure is aware of the confidentiality of the records, the reason the agency is seeking the information, and what use the agency will make of the information. It also includes an understanding of whether the information may be redisclosed.

What does 3rd party authorization mean?

You can grant a third party authorization to help you with federal tax matters. The third party can be a family member or friend, a tax professional, attorney or business, depending on the authorization.

What is the difference between 2848 and 8821?

Use: Form 2848, Power of Attorney and Declaration of Representative PDF when you want to authorize an individual to represent you before the IRS, or. Form 8821, Tax Information Authorization PDF, when you want to name an individual to inspect confidential tax return information related to the bond issuance.

What is an example of consent to disclose returns and return information?

I/we hereby consent to the disclosure of tax return information described in the Global Carry Forward terms above and allow the tax return preparer to enter a PIN in the tax preparation software on my behalf to verify that I/we consent to the terms of this disclosure.

What is an example of an informed consent and confidentiality statement?

Example: All information taken from the study will be coded to protect each subject's name. No names or other identifying information will be used when discussing or reporting data. The investigator(s) will safely keep all files and data collected in a secured locked cabinet in the principal investigators office.

What is an e-file authorization?

IRS e-file Signature Authorization">Form 8879, IRS e-file Signature Authorization, authorizes an ERO to enter the taxpayers' PINs on Individual Income Tax Returns and IRS e-file Authorization for Application of Extension of Time to File">Form 8878, IRS e-file Authorization for Application of Extension of Time to File,

What is an example of an information return?

Examples of information returns include Forms W-2 and 1099. All individuals, partnerships, estates, trusts and corporations making reportable transactions need to file information returns. Apart from filing information returns, these entities also need to provide income recipients with statements.

What is a 7216?

The § 7216 regulations permit tax return preparers to use a list of client names, addresses, email addresses, phone numbers and each client's income tax form number to provide clients general educational information, including general educational information related to the Affordable Care Act.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Authorization for Use of Tax Return Information?

Authorization for Use of Tax Return Information is a form that allows individuals or entities to authorize a third party to access their tax return information for specific purposes.

Who is required to file Authorization for Use of Tax Return Information?

Individuals who want to grant permission for a third party, such as a tax professional or financial institution, to access their tax return information are required to file this authorization.

How to fill out Authorization for Use of Tax Return Information?

To fill out the Authorization for Use of Tax Return Information, complete the form by providing the taxpayer's personal details, specifying the third party's information, and detailing the purpose of the authorization before signing.

What is the purpose of Authorization for Use of Tax Return Information?

The purpose is to legally permit a designated third party to obtain tax return information from the IRS, which can be necessary for various financial processes or legal matters.

What information must be reported on Authorization for Use of Tax Return Information?

The form must report the taxpayer's name, address, Social Security number, the name and address of the authorized third party, and the specific tax years for which access is granted, along with the purpose of the authorization.

Fill out your authorization for use of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Authorization For Use Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.