Get the free State of Texas Tax Refund for Employers of TANF or Medicaid Clients

Show details

This document outlines eligibility criteria for Texas employers to receive state tax refunds for hiring TANF or Medicaid clients, including the application process and associated tax credits.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign state of texas tax

Edit your state of texas tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your state of texas tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit state of texas tax online

Follow the guidelines below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit state of texas tax. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

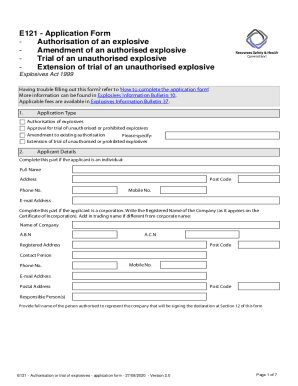

How to fill out state of texas tax

How to fill out State of Texas Tax Refund for Employers of TANF or Medicaid Clients

01

Gather the necessary documentation, including employee information and TANF or Medicaid client details.

02

Obtain the State of Texas Tax Refund application form from the Texas Comptroller's website or your local tax office.

03

Fill out the identification section with your employer details and federal EIN.

04

Complete the employee information section for each qualifying TANF or Medicaid client.

05

Enter the amounts for wages paid to the eligible employees during the tax year.

06

Review the guidelines to ensure all required information and supporting documents are included.

07

Sign and date the application form.

08

Submit the completed application to the appropriate state office via mail or electronically, as instructed.

Who needs State of Texas Tax Refund for Employers of TANF or Medicaid Clients?

01

Employers who have hired employees that are TANF or Medicaid recipients and seek tax refunds for wages paid to them.

Fill

form

: Try Risk Free

People Also Ask about

Do I get a state tax refund in Texas?

After filing your federal tax return, you are probably wondering if you are getting Texas tax refund. Well, because Texas doesn't levy individual income tax, you will not get a Texas state tax refund. Read on for more information on checking for your state tax refund in other states.

What assets are protected from Medicaid in Texas?

There are also many assets that are exempt (non-countable). Exemptions include personal belongings, household furnishings, an automobile, and irrevocable burial trusts. In TX, IRAs / 401Ks are exempt if they are in “payout” status. This means that the owner is withdrawing the Required Minimum Distribution (RMD).

How does Texas Medicaid verify income?

The person must provide proof of employment. Consider any of the following as proof of employment: Tax payment verification under the Federal Insurance Contribution Act (FICA); or. Tax payment verification under the Self-Employment Contribution Act (SECA); or.

How far back does Medicaid look at assets in Texas?

The state will look back for five years to determine if you have transferred assets (including transfers made by your spouse). Thus, you need to begin planning for Medicaid long before you may require long-term care.

Who can garnish tax refunds in Texas?

Federal tax refunds can be garnished by the IRS, the Department of Education, or other federal agencies to pay outstanding debts such as back taxes, defaulted student loans, or child support payments. However, certain government benefits like Supplemental Security Income (SSI) are exempt from tax refund garnishment.

Can Medicaid take my tax refund in Texas?

Pursuant to an amendment to the Internal Revenue Code in 2013, which extended a previous 2010 temporary law, 26 U.S. Code § 6409 provides that federal income tax refunds do not count as income for Medicaid purposes, which means a refund cannot cause a Medicaid recipient to be over Medicaid's monthly income limit.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is State of Texas Tax Refund for Employers of TANF or Medicaid Clients?

The State of Texas Tax Refund for Employers of TANF or Medicaid Clients is a financial incentive program designed to provide tax refunds to employers who hire individuals receiving Temporary Assistance for Needy Families (TANF) or Medicaid benefits. This program aims to encourage employment and support individuals transitioning into the workforce.

Who is required to file State of Texas Tax Refund for Employers of TANF or Medicaid Clients?

Employers who hire individuals that are currently receiving TANF or Medicaid benefits and want to apply for the tax refund must file for the State of Texas Tax Refund. Eligibility is typically based on the hiring of qualified employees who meet the specified benefit requirements.

How to fill out State of Texas Tax Refund for Employers of TANF or Medicaid Clients?

To fill out the State of Texas Tax Refund application, employers need to gather information about their eligible employees, including their TANF or Medicaid status. The application form usually requires details such as the employee's name, the date of hire, and any other relevant employment data. Employers should carefully follow the instructions provided on the application form and submit it to the appropriate Texas state agency.

What is the purpose of State of Texas Tax Refund for Employers of TANF or Medicaid Clients?

The purpose of the State of Texas Tax Refund for Employers of TANF or Medicaid Clients is to incentivize employers to hire individuals from low-income backgrounds or those needing assistance, thereby promoting workforce participation and economic stability for vulnerable populations.

What information must be reported on State of Texas Tax Refund for Employers of TANF or Medicaid Clients?

Employers must report specific information that includes the employee's name, Social Security number, income level, the nature of employment, confirmation of TANF or Medicaid benefit status, and any pertinent dates related to the employee's hiring and employment.

Fill out your state of texas tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

State Of Texas Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.