Get the free 2011 new jersey ebf 1 income tax get

Show details

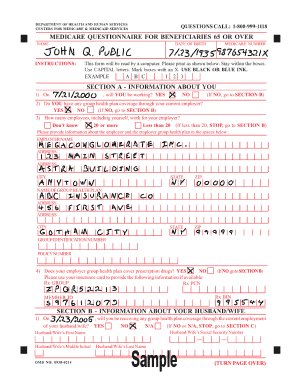

DME MAC Jurisdiction C Medicare Secondary Payer (MAP) Questionnaire Patient Name: Date: ICN: Part I 1. Are you receiving Black Lung (BL) Benefits? Yes No 2. Are the services to be paid by a government

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2011 new jersey ebf

Edit your 2011 new jersey ebf form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2011 new jersey ebf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2011 new jersey ebf online

To use the services of a skilled PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit 2011 new jersey ebf. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2011 new jersey ebf

01

To fill out the 2011 New Jersey EBF form, you should gather all the necessary information and documents. This includes your personal and financial information, such as your name, address, Social Security number, and income details.

02

Next, carefully read the instructions provided with the form. Familiarize yourself with the different sections and requirements of the EBF form.

03

Begin filling out the form by entering your personal information in the designated fields. Make sure to double-check and ensure the accuracy of the information provided.

04

Continue filling out the form by providing details about your income, including wages, tips, interest, dividends, and any other sources of income. You may be required to attach additional documents to support your income information.

05

If you have any deductions or credits that you are eligible for, make sure to include them in the appropriate sections of the form. This could include expenses related to education, healthcare, or any other eligible deductions.

06

Review the completed form for any errors or omissions. It is crucial to ensure that all the information is accurate and complete before submitting the form.

07

Sign and date the form in the designated areas. If you are filing jointly with your spouse, they will also need to sign the form.

Who needs the 2011 New Jersey EBF form?

01

Individuals who were residents of New Jersey during the tax year 2011 and had income that meets the filing requirements set by the state may need to fill out the 2011 New Jersey EBF form.

02

This form is specifically required for individuals who earned income in New Jersey and need to report their income, deductions, credits, and other relevant information for the 2011 tax year.

03

It is important to note that the requirement to fill out the 2011 New Jersey EBF form may vary based on factors such as income level, filing status, and residency status. It is advised to consult the instructions or seek professional tax advice to determine if you need to file this particular form.

Instructions and Help about 2011 new jersey ebf

Fill

form

: Try Risk Free

People Also Ask about

What is a nj927 form?

Employers not classified as weekly payers must report and remit withholding tax on a monthly or quarterly basis, using the Employer's Quarterly Report, Form NJ-927, regardless of the amount of tax due.

Who has to file NJ 927?

Each calendar quarter, all employers, other than domestic employers, subject to the provisions of the Unemployment Compensation Law are required to file the “Employer's Quarterly Report” (Form NJ-927) and “Employer Report of Wages Paid” (Form WR-30).

How do I get my NJ state tax transcript?

Individuals To get a copy or transcript of your tax return, complete Form DCC-1 and send it to: You also can get a copy of your NJ-1040, NJ-1040NR or NJ-1041 at a Division of Taxation Regional Information Center. Otherwise, you can get a copy of a previously filed tax return by completing Form DCC-1 and sending it to:

What is a NJ 927 form?

Employers not classified as weekly payers must report and remit withholding tax on a monthly or quarterly basis, using the Employer's Quarterly Report, Form NJ-927, regardless of the amount of tax due.

What is form NJ 600?

NJ-600 Employer Notice of Adjustment of New Jersey Gross Income Tax.

Where can I get a NJ state income tax form?

State Tax Forms To order State of New Jersey tax forms, call the Division's Customer Service Center (609-292-6400) to request income tax forms and instructions. To obtain State of New Jersey tax forms in person, make an appointment to visit a Division of Taxation Regional Office.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my 2011 new jersey ebf in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your 2011 new jersey ebf and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

Where do I find 2011 new jersey ebf?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the 2011 new jersey ebf. Open it immediately and start altering it with sophisticated capabilities.

How do I execute 2011 new jersey ebf online?

With pdfFiller, you may easily complete and sign 2011 new jersey ebf online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

What is new jersey ebf 1?

The New Jersey EBF-1 form is the Employer Benefit Funds quarterly report that must be filed by employers who are required to contribute to the New Jersey Employer Benefit Funds.

Who is required to file new jersey ebf 1?

Employers who are required to contribute to the New Jersey Employer Benefit Funds are required to file the EBF-1 form.

How to fill out new jersey ebf 1?

To fill out the New Jersey EBF-1 form, employers need to provide information about their company, such as their name, address, and tax identification number. They also need to report the total wages paid and the contribution amount to the Employer Benefit Funds.

What is the purpose of new jersey ebf 1?

The purpose of the New Jersey EBF-1 form is to collect information from employers who are required to contribute to the Employer Benefit Funds. This information is used to ensure compliance with the funding obligations and to calculate the amount due.

What information must be reported on new jersey ebf 1?

The New Jersey EBF-1 form requires employers to report information such as their company details, total wages paid during the reporting period, and the amount contributed to the Employer Benefit Funds.

Fill out your 2011 new jersey ebf online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2011 New Jersey Ebf is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.