Get the free Understanding Short Sales

Show details

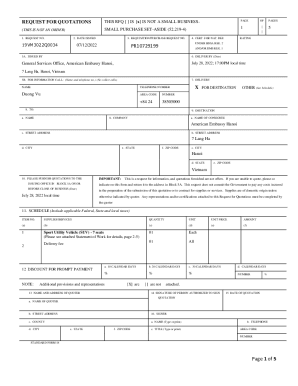

This document explains the concept of short sales, detailing the definitions, requirements, and implications for sellers and buyers involved in a property transaction where the sale price is less

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign understanding short sales

Edit your understanding short sales form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your understanding short sales form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing understanding short sales online

To use our professional PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit understanding short sales. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out understanding short sales

How to fill out Understanding Short Sales

01

Gather necessary financial documents, including income statements, bank statements, and tax returns.

02

Contact your lender to inform them of your intent to pursue a short sale.

03

Obtain a real estate agent experienced in short sales to assist you.

04

Assess the market value of your property to determine the right listing price.

05

Prepare a hardship letter explaining your financial situation and why you can no longer afford the mortgage.

06

Fill out the short sale application provided by your lender, including all required information.

07

Provide all requested documentation to your lender promptly to avoid delays.

08

Wait for the lender's approval, which may require negotiations with potential buyers.

09

Ensure that all agreements and terms are documented in writing.

Who needs Understanding Short Sales?

01

Homeowners facing financial hardship and unable to keep up with mortgage payments.

02

Individuals looking to sell their property for less than the amount owed on the mortgage.

03

Real estate agents specializing in short sales to assist clients in navigating the process.

04

Lenders seeking to mitigate losses by allowing short sales instead of foreclosures.

Fill

form

: Try Risk Free

People Also Ask about

What is the 10% rule for short selling?

The “10% rule” for short selling refers to a restriction that prevents traders from shorting a stock if its price has dropped more than 10% from the previous day's closing price. This rule aims to prevent excessive short selling and market manipulation during significant price declines.

What is the 10 rule for short selling?

The rule is triggered when a stock price falls at least 10% in one day. At that point, short selling is permitted if the price is above the current best bid.

What happens if I short a stock and it goes to $0?

For instance, say you sell 100 shares of stock short at a price of $10 per share. Your proceeds from the sale will be $1,000. If the stock goes to zero, you'll get to keep the full $1,000. However, if the stock soars to $100 per share, you'll have to spend $10,000 to buy the 100 shares back.

How do you understand short selling?

Short selling a stock is when a trader borrows shares from a broker and immediately sells them with the expectation that the price will fall shortly after. If it does, the trader can buy the shares back at the lower price, return them to the broker, and keep the difference, minus any loan interest, as profit.

What is the 7% rule in stocks?

Understanding the 7% Rule in Stocks According to this rule, if a stock falls 7–8% below your purchase price, you should sell it immediately — no exceptions.

What is the rule for short sales?

Short Sale Restriction (SSR), also known as the uptick rule, is an automatically imposed SEC limitation for short sellers once a stock drops 10% or more from the previous day's close. Once triggered, traders can no longer short the stock on a downtick.

How to understand short selling?

Short selling is selling an asset you do not own, so basically to open the position you sell and to close it you buy. This is in contrast to a long position where you just buy to open and sell to close. In order to sell something you do not own you need to borrow it from someone who does own it.

What do you mean by short sales?

A short sale occurs when you sell stock you do not own. Investors who sell short believe the price of the stock will fall. If the price drops, you can buy the stock at the lower price and make a profit. If the price of the stock rises and you buy it back later at the higher price, you will incur a loss.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Understanding Short Sales?

Understanding Short Sales refers to the process of selling a property for less than the amount owed on the mortgage, often used as a strategy to avoid foreclosure.

Who is required to file Understanding Short Sales?

Typically, homeowners who are facing financial hardship and wish to sell their property for less than the mortgage balance need to file for a short sale.

How to fill out Understanding Short Sales?

To fill out Understanding Short Sales, homeowners must complete a short sale application, provide financial documentation, and submit it to their lender for review.

What is the purpose of Understanding Short Sales?

The purpose of Understanding Short Sales is to provide a solution for homeowners to sell their homes and relieve themselves of mortgage debt when they cannot afford to continue making payments.

What information must be reported on Understanding Short Sales?

Information required typically includes the property address, details of the mortgage, seller's financial information, and a hardship letter explaining why the sale is necessary.

Fill out your understanding short sales online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Understanding Short Sales is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.